B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

HD Corp. and LD Corp. have identical assets, sales, interest rates paid on their debt, tax rates, and EBIT. However, HD uses more debt than LD. Which of the following statements is correct?

A) HD would have the lower equity multiplier for use in the Du Pont equation.

B) HD would have to pay more in income taxes.

C) HD would have the lower net income as shown on the income statement.

D) HD would have the higher net income as shown on the income statement.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Aziz Industries has sales of $100,000 and accounts receivable of $11,500, and it gives its customers 30 days to pay. The industry average DSO is 27 days, based on a 365-day year. If the company changes its credit and collection policy sufficiently to cause its DSO to fall to the industry average, and if it earns 8.0% on any cash freed up by this change, how would that affect its net income, assuming other things are held constant?

A) $281.41

B) $296.22

C) $311.81

D) $328.22

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

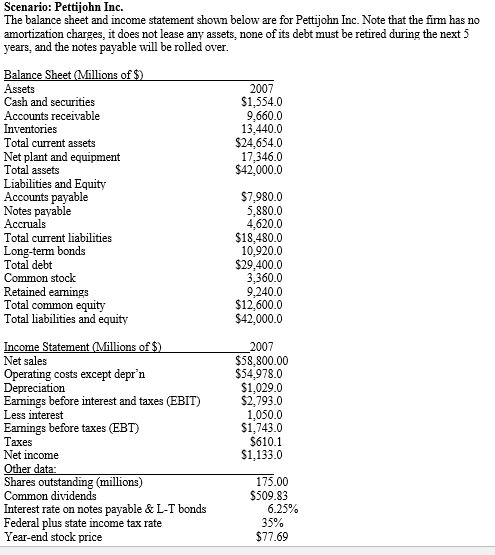

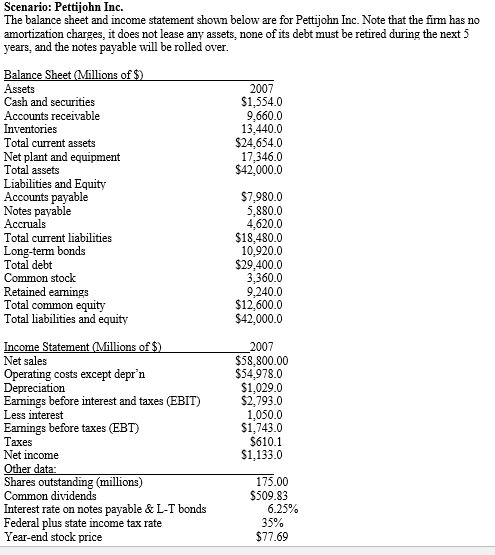

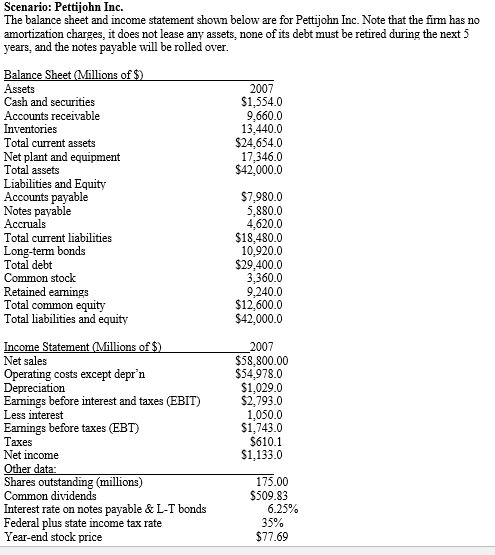

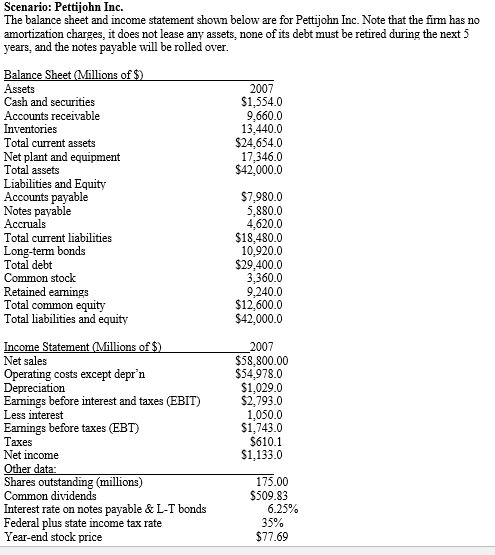

-Refer to Scenario: Pettijohn Inc. What is the firm's EBITDA coverage?

-Refer to Scenario: Pettijohn Inc. What is the firm's EBITDA coverage?

A) 3.29

B) 3.46

C) 3.64

D) 3.82

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-Refer to Scenario: Pettijohn Inc. What is the firm's current ratio?

-Refer to Scenario: Pettijohn Inc. What is the firm's current ratio?

A) 0.97

B) 1.08

C) 1.20

D) 1.33

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Companies HD and LD have the same sales, tax rate, interest rate on their debt, total assets, and basic earning power. Both companies have positive net incomes. Company HD has a higher debt ratio and, therefore, a higher interest expense. Which of the following statements is correct?

A) Company HD pays less in taxes than Company LD.

B) Company HD has a lower equity multiplier than Company LD.

C) Company HD has a higher ROA than Company LD.

D) Company HD has more net income than Company LD.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Northwest Lumber had a profit margin of 5.25%, a total assets turnover of 1.5, and an equity multiplier of 1.8. What was the firm's ROE?

A) 12.79%

B) 13.47%

C) 14.18%

D) 14.88%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement regarding the Du Pont analysis is correct?

A) Suppose a firm's total assets turnover ratio falls from 1.0 to 0.9, but at the same time its profit margin rises from 9% to 10% and its debt increases from 40% of total assets to 60%. Under these conditions, the ROE will increase.

B) Suppose a firm's total assets turnover ratio falls from 1.0 to 0.9, but at the same time its profit margin rises from 9% to 10% and its debt increases from 40% of total assets to 60%. Without additional information, we cannot tell what will happen to the ROE.

C) The modified Du Pont equation provides information about how operations affect the ROE, but the equation does not include the effects of debt on the ROE.

D) Suppose a firm's total assets turnover ratio falls from 1.0 to 0.9, but at the same time its profit margin rises from 9% to 10%, and its debt increases from 40% of total assets to 60%. Under these conditions, the ROE will decrease.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lindley Corp.'s stock price at the end of last year was $33.50, and its book value per share was $25.00. What was its market/book ratio?

A) 1.34

B) 1.41

C) 1.48

D) 1.55

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-Refer to Scenario: Pettijohn Inc. What is the firm's ROA?

-Refer to Scenario: Pettijohn Inc. What is the firm's ROA?

A) 2.70%

B) 2.97%

C) 3.26%

D) 3.59%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) If a firm has the highest price/earnings ratio of any firm in its industry, then, other things held constant, this suggests that the board of directors should fire the president.

B) If a firm has the highest market/book ratio of any firm in its industry, then, other things held constant, this suggests that the board of directors should fire the president.

C) Other things held constant, the higher a firm's expected future growth rate, the lower its P/E ratio is likely to be.

D) The higher the market/book ratio, then, other things held constant, the higher one would expect to find the Market Value Added (MVA) .

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Beranek Corp. has $410,000 of assets, and it uses no debt-it is financed only with common equity. The new CFO wants to employ enough debt to bring the debt/assets ratio to 40%, using the proceeds from the borrowing to buy back common stock at its book value. How much must the firm borrow to achieve the target debt ratio?

A) $155,800

B) $164,000

C) $172,200

D) $180,810

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pace Corp.'s assets are $625,000, and its total debt outstanding is $185,000. The new CFO wants to employ a debt ratio of 55%. How much debt must the company add or subtract to achieve the target debt ratio?

A) $158,750

B) $166,688

C) $175,022

D) $183,773

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

High current and quick ratios always indicate that a firm is managing its liquidity position well.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Debt management ratios show the extent to which a firm's managers are attempting to magnify returns on owners' capital through the use of financial leverage.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The average collection period tells how many days it takes a business to pay money for trade credits to its suppliers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm wants to strengthen its financial position. Which action would increase its quick ratio?

A) Offer price reductions along with generous credit terms that would (1) enable the firm to sell some of its excess inventory and (2) lead to an increase in accounts receivable.

B) Issue new common stock and use the proceeds to increase inventories.

C) Speed up the collection of receivables and use the cash generated to increase inventories.

D) Use some of its cash to purchase additional inventories.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would indicate an improvement in a company's financial position, other things held constant?

A) The debt ratio increases.

B) The profit margin declines.

C) The EBITDA coverage ratio declines.

D) The current and quick ratios both increase.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

It is appropriate to use the fixed assets turnover ratio to appraise firms' effectiveness in managing their fixed assets if and only if all the firms being compared have the same proportion of fixed assets to total assets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-Refer to Scenario: Pettijohn Inc. What is the firm's BEP?

-Refer to Scenario: Pettijohn Inc. What is the firm's BEP?

A) 6.00%

B) 6.32%

C) 6.65%

D) 6.98%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 110

Related Exams