B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bond issued by the State of Pennsylvania provides a 4.25% yield.What yield on a Synthetic Chemical Company bond would cause the two bonds to provide the same after-tax rate of return to an investor in the 35.00% tax bracket?

A) 7.19%

B) 8.11%

C) 6.54%

D) 7.98%

E) 5.43%

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The value of any asset is the present value of the cash flows the asset is expected to provide.The cash flows a business is able to provide to its investors is its free cash flow.This is the reason that FCF is so important in finance.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Nantell Corporation just purchased an expensive piece of equipment.Assume that the firm planned to depreciate the equipment over 5 years on a straight-line basis,but Congress then passed a provision that requires the company to depreciate the equipment on a straight-line basis over 7 years.Other things held constant,which of the following will occur as a result of this Congressional action? Assume that the company uses the same depreciation method for tax and stockholder reporting purposes.

A) Nantell's taxable income will be lower.

B) Nantell's operating income (EBIT) will increase.

C) Nantell's cash position will improve (increase) .

D) Nantell's reported net income for the year will be lower.

E) Nantell's tax liability for the year will be lower.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The amount shown on the December 31,2019 balance sheet as "retained earnings" is equal to the firm's net income for 2019 minus any dividends it paid

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The balance sheet for a given year is designed to give us an idea of what happened to the firm during that year.

B) The balance sheet for a given year tells us how much money the company earned during that year.

C) The difference between the total assets reported on the balance sheet and the liabilities reported on this statement tells us the current market value of the stockholders' equity,assuming the statements are prepared in accordance with generally accepted accounting principles (GAAP) .

D) If a company's statements were prepared in accordance with generally accepted accounting principles (GAAP) ,the market value of the stock equals the book value of the stock as reported on the balance sheet.

E) The assets section of a typical company's balance sheet begins with cash,then lists the assets in the order in which they will probably be converted to cash,with the longest-lived assets listed last.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

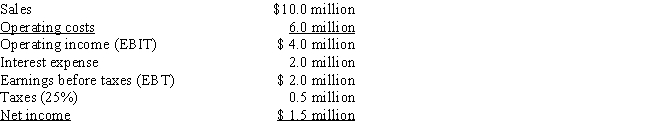

Scranton Shipyards has $8.5 million in total invested operating capital,and its WACC is 10%.Scranton has the following income statement: What is Scranton's EVA? Answer options are provided in whole dollar.

A) $1,937,500

B) $1,860,000

C) $2,150,000

D) $1,472,500

E) $2,956,500

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

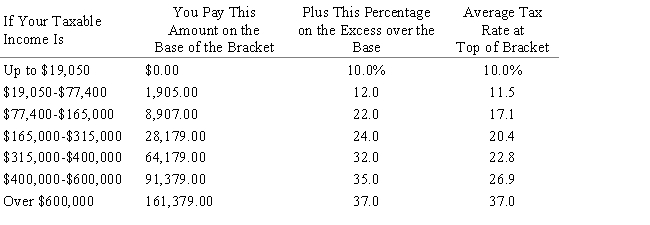

Alan and Sara Winthrop are a married couple who file a joint income tax return.They have two children,and they have legitimate itemized deductions totaling $25,750.Their total income from wages is $357,600.Assume the following tax table is applicable: Married Couples Filing Joint Returns

What is their federal tax liability?

A) $49,048.50

B) $54,707.25

C) $52,820.50

D) $57,851.50

E) $69,571.00

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

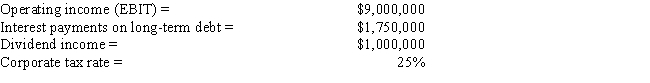

Lintner Beverage Corp.reported the following information from their financial statements: Assume a 50% dividend exclusion for tax on dividends.What is the firm's total tax liability?

A) $2,412,980

B) $2,361,640

C) $3,106,070

D) $2,156,280

E) $1,937,500

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

An increase in accounts payable represents an increase in net cash provided by operating activities,an effect similar to taking out a new bank loan.However,these two items show up in different sections of the statement of cash flows to reflect the difference between operating and financing activities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Interest paid by a corporation is a tax deduction for the paying corporation,but dividends paid are not deductible.This treatment,other things held constant,tends to encourage the use of debt financing by corporations.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

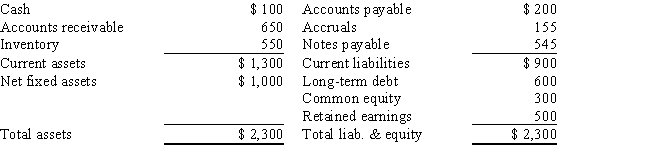

Wu Systems has the following balance sheet.Assume that all current assets are used in operations.How much net operating working capital does the firm have?

A) $945

B) $860

C) $983

D) $1,021

E) $1,143

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Maureen Smith is a single individual.She claims a standard deduction of $12,000.Her salary for the year was $134,750.What is her taxable income?

A) $105,698

B) $122,750

C) $129,324

D) $121,863

E) $120,620

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The current cash flow from existing assets is highly relevant to investors.However,since the value of the firm depends primarily upon its growth opportunities,accounting net income projections from those opportunities are the only relevant future flows with which investors are concerned.

B) Two metrics that are used to measure a company's financial performance are net income and free cash flow.Accountants tend to emphasize net income as calculated in accordance with generally accepted accounting principles.Finance people generally put at least as much weight on free cash flows as they do on net income.

C) To estimate the net cash provided by operations,depreciation must be subtracted from net income because depreciation is a non-cash charge that has been added to revenue.

D) Interest paid by a corporation is a tax deduction for the paying corporation,but dividends paid are not deductible.This treatment,other things held constant,tends to discourage the use of debt financing by corporations.

E) If Congress changed depreciation allowances so that companies had to report higher depreciation levels for tax purposes in 2019,companies would have lower free cash flows in 2019.

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Assume that two firms are both following generally accepted accounting principles.Both firms commenced operations two years ago with $1 million of identical fixed assets,and neither firm sold any of those assets or purchased any new fixed assets.The two firms would be required to report the same amount of net fixed assets on their balance sheets as those statements are presented to investors.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

EBIT,often referred to as operating income,stands for "earnings before interest and taxes."

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Free cash flow (FCF)is,essentially,the cash flow that is available for interest and dividends after the company has made the investments in current and fixed assets that are necessary to sustain ongoing operations.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

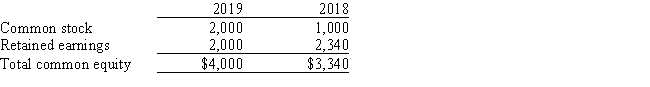

Below is the common equity section (in millions) of Timeless Technology's last two year-end balance sheets:

The firm has never paid a dividend to its common stockholders.Which of the following statements is CORRECT?

The firm has never paid a dividend to its common stockholders.Which of the following statements is CORRECT?

A) The company's net income in 2019 was higher than in 2018.

B) The firm issued common stock in 2019.

C) The market price of the firm's stock doubled in 2019.

D) The firm had positive net income in both 2018 and 2019,but its net income in 2019 was lower than it was in 2018.

E) The company has more equity than debt on its balance sheet.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 121 - 138 of 138

Related Exams