A) Companies' after-tax operating profits would decline.

B) Companies' physical stocks of fixed assets would increase.

C) Companies' cash flows would increase.

D) Companies' cash positions would decline.

E) Companies' reported net incomes would decline.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The income of certain small corporations that qualify under the Tax Code is completely exempt from corporate income taxes.Thus,the federal government receives no tax revenue from these businesses,even though they report high accounting profits.

B) All businesses,regardless of their legal form of organization,are taxed under the Business Tax Provisions of the Internal Revenue Code.

C) Small corporations that qualify under the Tax Code can elect not to pay corporate taxes,but then each stockholder must report his or her pro rata shares of the firm's income as personal income and pay taxes on that income.

D) Congress recently changed the tax laws to make dividend income received by individuals exempt from income taxes.Prior to the enactment of that law,corporate income was subject to double taxation,whereby the firm was taxed on the corporation's income and stockholders were taxed again on this income when it was paid to them as dividends.

E) All corporations other than non-profits are subject to corporate income taxes,which are 15% for the lowest amounts of income and 38% for the highest income amounts.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company with a 25% tax rate buys preferred stock in another company.The preferred stock has a before-tax yield of 6.00%.Assume a 50% dividend exclusion for tax on dividends.What is the preferred stock's after-tax return? (Round your final answer to two decimal places. )

A) 4.52%

B) 4.36%

C) 5.25%

D) 4.31%

E) 5.85%

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Besset Company's operations provided a negative cash flow,yet the cash shown on its balance sheet increased.Which of the following statements could explain the increase in cash,assuming the company's financial statements were prepared under generally accepted accounting principles (GAAP) ?

A) The company repurchased some of its common stock.

B) The company dramatically increased its capital expenditures.

C) The company retired a large amount of its long-term debt.

D) The company sold some of its fixed assets.

E) The company had high depreciation expenses.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Both interest and dividends paid by a corporation are deductible operating expenses,hence they decrease the firm's taxes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lovell Co.purchased preferred stock in another company.The preferred stock's before-tax yield was 5.60%.The corporate tax rate is 25%.What is the after-tax return on the preferred stock,assuming a 50% dividend exclusion? (Round your final answer to two decimal places. )

A) 4.90%

B) 5.59%

C) 6.03%

D) 4.31%

E) 4.80%

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following items is NOT normally considered a current asset?

A) Accounts receivable.

B) Inventory.

C) Bonds.

D) Cash.

E) Short-term,highly-liquid,marketable securities.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The four most important financial statements provided in the annual report are the balance sheet,income statement,cash budget,and the statement of stockholders' equity.

B) The balance sheet gives us a picture of the firm's financial position at a point in time.

C) The income statement gives us a picture of the firm's financial position at a point in time.

D) The statement of cash flows tells us how much cash the firm must pay out in interest during the year.

E) The statement of cash flows tells us how much cash the firm will require during some future period,generally a month or a year.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2018,Bradshaw Beverages had taxable income of -$800,000.In 2019,its taxable income is $1,250,000.Its corporate tax rate is 25%. Assume that the company takes full advantage of the Tax Code's carry-forward provision..How much did the company pay in taxes during 2019?

A) $392,400

B) $112,500

C) $120,000

D) $108,400

E) $234,000

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) MVA stands for "market value added" and is defined as follows:

MVA = (Shares outstanding) (Stock price) + Book value of common equity.

B) The primary difference between EVA and accounting net income is that when net income is calculated,a deduction is made to account for the cost of common equity,whereas EVA represents net income before deducting the cost of the equity capital the firm uses.

C) MVA gives us an idea about how much value a firm's management has added during the last year.

D) EVA gives us an idea about how much value a firm's management has added over the firm's life.

E) EVA stands for "economic value added" and is defined as follows:

EVA = NOPAT - (Total invested capital) (AT cost of capital %)

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The focal point of the income statement is the cash account because that account cannot be manipulated by "accounting tricks."

B) The reported income of two otherwise identical firms cannot be manipulated by different accounting procedures provided the firms follow generally accepted accounting principles (GAAP) .

C) The reported income of two otherwise identical firms must be identical if the firms are publicly owned,provided they follow procedures that are permitted by the Securities and Exchange Commission (SEC) .

D) If a firm follows generally accepted accounting principles (GAAP) ,then its reported net income will be identical to its reported cash flow.

E) The income statement for a given year is designed to give us an idea of how much the firm earned during that year.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Solarcell Corporation has $20,000 that it plans to invest in marketable securities.It is choosing between AT&T bonds that yield 11.50%,State of Florida municipal bonds that yield 11.00%,and AT&T preferred stock with a dividend yield of 9.00%.Solarcell's corporate tax rate is 25%,and 70.00% of the preferred stock dividends it receives are tax exempt.Assuming that the investments are equally risky and that Solarcell chooses strictly on the basis of after-tax returns,which security should be selected? Answer by giving the after-tax rate of return on the highest yielding security.

A) 8.63%

B) 9.32%

C) 10.52%

D) 7.33%

E) 9.23%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following factors would explain how a company's cash balance could have increased even though the company had a negative cash flow last year?

A) The company sold a new issue of bonds.

B) The company made a large investment in a new plant and equipment.

C) The company paid a large dividend.

D) The company had high depreciation expenses.

E) The company repurchased 20% of its common stock.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Houston Pumps recently reported $172,500 of sales,$140,500 of operating costs other than depreciation,and $9,250 of depreciation.The company had $35,250 of outstanding bonds that carry a 6.75% interest rate,and its federal-plus-state income tax rate was 25%.In order to sustain its operations and thus generate future sales and cash flows,the firm was required to spend $15,250 to buy new fixed assets and to invest $6,850 in net operating working capital.What was the firm's free cash flow?

A) $4,213

B) $1,860

C) $5,354

D) $2,286

E) $1,978

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The statement of cash flows has four main sections,one each for operating,investing,and financing activities,and one that shows a summary of the cash and cash equivalents at the end of the year.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The CFO of Daves Industries plans to have the company issue $300 million of new common stock and use the proceeds to pay off some of the company's outstanding bonds that carry a 7% interest rate.Assume that the company,which does not pay any dividends,takes this action,and that total assets,operating income (EBIT) ,and tax rate all remain constant.Which of the following would occur?

A) The company's taxable income would fall.

B) The company's interest expense would remain constant.

C) The company would have less common equity than before.

D) The company's net income would increase.

E) The company would have to pay less taxes.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Assets other than cash are expected to produce cash over time,but the amount of cash they eventually produce could be higher or lower than the amounts at which the assets are carried on the books.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

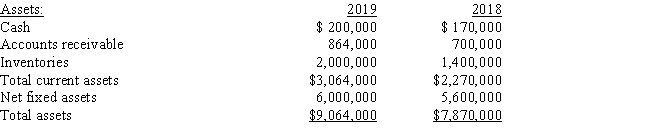

Below are the 2018 and 2019 year-end balance sheets for Tran Enterprises: Liabilities and equity:

The firm has never paid a dividend on its common stock,and it issued $2,400,000 of 10-year,non-callable,long-term debt in 2018.As of the end of 2019,none of the principal on this debt had been repaid.Assume that the company's sales in 2018 and 2019 were the same.Which of the following statements must be CORRECT?

The firm has never paid a dividend on its common stock,and it issued $2,400,000 of 10-year,non-callable,long-term debt in 2018.As of the end of 2019,none of the principal on this debt had been repaid.Assume that the company's sales in 2018 and 2019 were the same.Which of the following statements must be CORRECT?

A) The firm increased its short-term bank debt in 2019.

B) The firm issued long-term debt in 2019.

C) The firm issued new common stock in 2019.

D) The firm repurchased some common stock in 2019.

E) The firm had negative net income in 2018.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

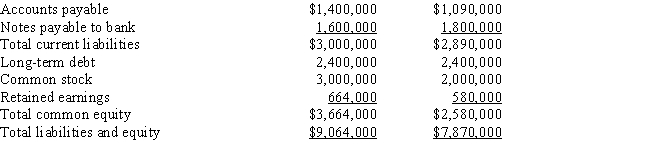

Alan and Sara Winthrop are a married couple who file a joint income tax return.They have two children,and they have legitimate itemized deductions totaling $25,750.Their total income from wages is $169,100.Assume the following tax table is applicable: Married Couples Filing Joint Returns

What is their average tax rate?

A) 16.3%

B) 17.93%

C) 19.21%

D) 17.20%

E) 14.64%

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

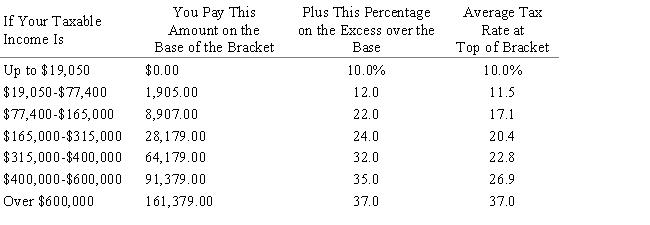

Arvo Corporation is trying to choose between three alternative investments.The three securities that the company is considering are as follows:

The company's tax rate is 25.00%.What is the after-tax return on the best investment alternative? Assume a 50.00% dividend exclusion for tax on dividends.(Round your final answer to 3 decimal places. )

The company's tax rate is 25.00%.What is the after-tax return on the best investment alternative? Assume a 50.00% dividend exclusion for tax on dividends.(Round your final answer to 3 decimal places. )

A) 8.800%

B) 10.296%

C) 9.944%

D) 7.128%

E) 8.888%

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 138

Related Exams