A) $80,033

B) $84,479

C) $77,365

D) $88,925

E) $72,919

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Griffey Communications recently realized $120,000 in operating income.The company had interest income of $25,000 and realized $70,000 in dividend income.The company's interest expense was $40,000.Its corporate tax rate is 25%.Griffey is a small company,so it is not subject to the interest expense deduction limitation. Assume a 50% dividend exclusion for tax on dividends.

A) $37,000

B) $35,950

C) $35,000

D) $32,000

E) $40,400

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Net operating working capital is equal to current assets less excess cash minus the difference between current liabilities and notes payable.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Allen Corporation can (1) build a new plant that should generate a before-tax return of 10.00%,or (2) invest the same funds in the preferred stock of Florida Power & Light (FPL) ,which should provide Allen with a before-tax return of 9.00%,all in the form of dividends.Assume that Allen's marginal tax rate is 25.00%,and that 50.00% of dividends received are excluded from taxable income.If the plant project is divisible into small increments,and if the two investments are equally risky,what combination of these two possibilities will maximize Allen's effective return on the money invested? (Round your final answer to two decimal places. )

A) All in FPL preferred stock.

B) 60% in FPL;40% in the project.

C) All in the plant project.

D) 60% in the project;40% in FPL.

E) 50% in each.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things held constant,which of the following actions would increase the amount of cash on a company's balance sheet?

A) The company repurchases common stock.

B) The company pays a dividend.

C) The company issues new common stock.

D) The company gives customers more time to pay their bills.

E) The company purchases a new piece of equipment.

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The time dimension is important in financial statement analysis.The balance sheet shows the firm's financial position at a given point in time,the income statement shows results over a period of time,and the statement of cash flows reflects specific changes in accounts over that period of time.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The annual report contains four basic financial statements: the income statement,the balance sheet,the cash flow statement,and the statement of stockholders' equity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

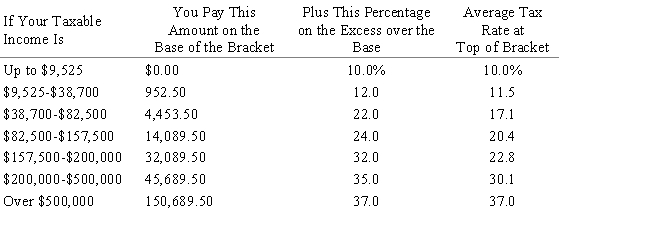

Maureen Smith is a single individual.She claims a standard deduction of $12,000.Her salary for the year was $177,100.Assume the following tax table is applicable. Single Individuals

What is her federal tax liability?

A) $30,536.25

B) $45,210.75

C) $34,521.50

D) $40,054.75

E) $30,140.25

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On 12/31/19,Hite Industries reported retained earnings of $537,500 on its balance sheet,and it reported that it had $135,000 of net income during the year.On its previous balance sheet,at 12/31/18,the company had reported $445,000 of retained earnings.No shares were repurchased during 2019.How much in dividends did the firm pay during 2019?

A) $46,750

B) $44,625

C) $53,125

D) $48,450

E) $42,500

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Moose Industries has a corporate tax rate of 25%.Last year the company realized $14,000,000 in operating income (EBIT) .Its annual interest expense is $1,500,000.What was the company's net income for the year?

A) $6,497,750

B) $9,375,000

C) $8,883,000

D) $9,705,500

E) $10,280,250

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On its 12/31/19 balance sheet,Barnes Inc showed $510 million of retained earnings,and exactly that same amount was shown the previous year.Assuming that no earnings restatements were issued,which of the following statements is CORRECT?

A) If the company lost money in 2019,it must have paid dividends.

B) The company must have had zero net income in 2019.

C) The company must have paid out half of its 2019 earnings as dividends.

D) The company must have paid no dividends in 2019.

E) Dividends could have been paid in 2019,but they would have had to equal the earnings for the year.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Dividends paid reduce the net income that is reported on a company's income statement.

B) If a company uses some of its bank deposits to buy short-term,highly liquid marketable securities,its current assets as shown on the balance sheet will decline.

C) If a company issues new long-term bonds to purchase fixed assets during the current year,its reported current assets and current liabilities at the end of the year will increase.

D) Accounts receivable are reported as a current liability on the balance sheet.

E) If a company pays more in dividends than it generates in net income,its retained earnings as reported on the balance sheet will decline from the previous year's balance.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

If the tax laws were changed so that $0.50 out of every $1.00 of interest paid by a corporation was allowed as a tax-deductible expense,companies would be encouraged to use more debt financing than they presently do,other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The income statement shows the difference between a firm's income and its costs-i.e. ,its profits-during a specified period of time.However,not all reported income comes in the form of cash,and reported costs likewise may not be consistent with cash outlays.Therefore,there may be a substantial difference between a firm's reported profits and its actual cash flow for the same period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation recently purchased some preferred stock that has a before-tax yield of 8.00%.The company has a tax rate of 25%.What is the after-tax return on the preferred stock? Assume a 50% dividend exclusion for tax on dividends.(Round your final answer to two decimal places. )

A) 6.30%

B) 7.00%

C) 7.14%

D) 7.98%

E) 6.02%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your corporation has a marginal tax rate of 25% and has purchased preferred stock in another company.The before-tax dividend yield on the preferred stock is 7.25%.What is the company's after-tax return on the preferred,assuming a 50% dividend exclusion? (Round your final answer to two decimal places. )

A) 6.85%

B) 6.34%

C) 7.93%

D) 6.60%

E) 4.82%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Austin Financial recently announced that its net income increased sharply from the previous year,yet its net cash provided from operations declined.Which of the following could explain this performance?

A) The company's dividend payment to common stockholders declined.

B) The company's expenditures on fixed assets declined.

C) The company's cost of goods sold increased.

D) The company's depreciation expense declined.

E) The company's interest expense increased.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) In the statement of cash flows,a decrease in accounts receivable is subtracted from net income in the operating activities section.

B) Dividends do not show up in the statement of cash flows because dividends are considered to be a financing activity,not an operating activity.

C) In the statement of cash flows,a decrease in accounts payable is subtracted from net income in the operating activities section.

D) In the statement of cash flows,depreciation is subtracted from net income in the operating activities section.

E) In the statement of cash flows,a decrease in inventories is subtracted from net income in the operating activities section.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Granville Co.recently purchased several shares of Kalvaria Electronics' preferred stock.The preferred stock has a before-tax yield of 6.10%.If the company's tax rate is 25%,what is Granville Co.'s after-tax yield on the preferred stock? Assume a 50% dividend exclusion for tax on dividends.(Round your final answer to two decimal places. )

A) 4.96%

B) 5.34%

C) 6.19%

D) 4.80%

E) 5.66%

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Corporations are allowed to exclude 50% of their interest income from corporate taxes.

B) Corporations are allowed to exclude 50% of their dividend income from corporate taxes.

C) Individuals pay taxes on only 30% of the income realized from municipal bonds.

D) Individuals are allowed to exclude 50% of their interest income from their taxes.

E) Individuals are allowed to exclude 50% of their dividend income from their taxes.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 138

Related Exams