A) Small-company stocks,long-term corporate bonds,large-company stocks,long-term government bonds,U.S.Treasury bills.

B) Large-company stocks,small-company stocks,long-term corporate bonds,U.S.Treasury bills,long-term government bonds.

C) Small-company stocks,large-company stocks,long-term corporate bonds,long-term government bonds,U.S.Treasury bills.

D) U.S.Treasury bills,long-term government bonds,long-term corporate bonds,small-company stocks,large-company stocks.

E) Large-company stocks,small-company stocks,long-term corporate bonds,long-term government bonds,U.S.Treasury bills.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements best describes what you should expect if you randomly select stocks and add them to your portfolio?

A) Adding more such stocks will reduce the portfolio's unsystematic,or diversifiable,risk.

B) Adding more such stocks will increase the portfolio's expected rate of return.

C) Adding more such stocks will reduce the portfolio's beta coefficient and thus its systematic risk.

D) Adding more such stocks will have no effect on the portfolio's risk.

E) Adding more such stocks will reduce the portfolio's market risk but not its unsystematic risk.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock X has a beta of 0.6,while Stock Y has a beta of 1.4.Which of the following statements is CORRECT?

A) A portfolio consisting of $50,000 invested in Stock X and $50,000 invested in Stock Y will have a required return that exceeds that of the overall market.

B) Stock Y must have a higher expected return and a higher standard deviation than Stock X.

C) If expected inflation increases but the market risk premium is unchanged,then the required return on both stocks will fall by the same amount.

D) If the market risk premium declines but expected inflation is unchanged,the required return on both stocks will decrease,but the decrease will be greater for Stock Y.

E) If expected inflation declines but the market risk premium is unchanged,then the required return on both stocks will decrease but the decrease will be greater for Stock Y.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

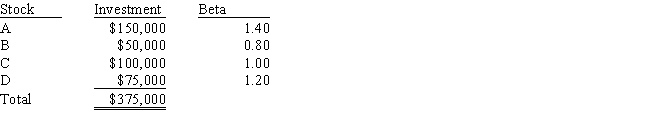

Tom Noel holds the following portfolio: Tom plans to sell Stock A and replace it with Stock E,which has a beta of 0.83.By how much will the portfolio beta change? Do not round your intermediate calculations.

A) -0.228

B) -0.219

C) -0.251

D) -0.205

E) -0.280

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The realized return on a stock portfolio is the weighted average of the expected returns on the stocks in the portfolio.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Assume that two investors each hold a portfolio,and that portfolio is their only asset.Investor A's portfolio has a beta of minus 2.0,while Investor B's portfolio has a beta of plus 2.0.Assuming that the unsystematic risks of the stocks in the two portfolios are the same,then the two investors face the same amount of risk.However,the holders of either portfolio could lower their risks,and by exactly the same amount,by adding some "normal" stocks with beta = 1.0.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

We would almost always find that the beta of a diversified portfolio is less stable over time than the beta of a single security.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the price of money (e.g. ,interest rates and equity capital costs)increases due to an increase in anticipated inflation,the risk-free rate will also increase.If there is no change in investors' risk aversion,then the market risk premium (rM - rRF)will remain constant.Also,if there is no change in stocks' betas,then the required rate of return on each stock as measured by the CAPM will increase by the same amount as the increase in expected inflation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that to cool off the economy and decrease expectations for inflation,the Federal Reserve tightened the money supply,causing an increase in the risk-free rate,rRF.Investors also became concerned that the Fed's actions would lead to a recession,and that led to an increase in the market risk premium, (rM - rRF) .Under these conditions,with other things held constant,which of the following statements is most correct?

A) The required return on all stocks would increase by the same amount.

B) The required return on all stocks would increase,but the increase would be greatest for stocks with betas of less than 1.0.

C) Stocks' required returns would change,but so would expected returns,and the result would be no change in stocks' prices.

D) The prices of all stocks would decline,but the decline would be greatest for high-beta stocks.

E) The prices of all stocks would increase,but the increase would be greatest for high-beta stocks.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taggart Inc.'s stock has a 50% chance of producing a 46% return,a 30% chance of producing a 10% return,and a 20% chance of producing a -28% return.What is the firm's expected rate of return? Do not round your intermediate calculations.

A) 20.60%

B) 21.83%

C) 20.40%

D) 18.16%

E) 22.24%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a company's beta doubles,then its required rate of return will also double.

B) Other things held constant,if investors suddenly become convinced that there will be deflation in the economy,then the required returns on all stocks should increase.

C) If a company's beta were cut in half,then its required rate of return would also be halved.

D) If the risk-free rate rises by 0.5% but the market risk premium declines by that same amount,then the required rates of return on stocks with betas less than 1.0 will decline while returns on stocks with betas above 1.0 will increase.

E) If the risk-free rate rises by 0.5% but the market risk premium declines by that same amount,then the required rate of return on an average stock will remain unchanged,but required returns on stocks with betas less than 1.0 will rise.

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

When adding a randomly chosen new stock to an existing portfolio,the higher (or more positive)the degree of correlation between the new stock and stocks already in the portfolio,the less the additional stock will reduce the portfolio's risk.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

One key conclusion of the Capital Asset Pricing Model is that the value of an asset should be measured by considering both the risk and the expected return of the asset,assuming that the asset is held in a well-diversified portfolio.The risk of the asset held in isolation is not relevant under the CAPM.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Portfolio A has only one stock,while Portfolio B consists of all stocks that trade in the market,each held in proportion to its market value.Because of its diversification,Portfolio B will by definition be riskless.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The standard deviation is a better measure of risk than the coefficient of variation if the expected returns of the securities being compared differ significantly.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Any change in its beta is likely to affect the required rate of return on a stock,which implies that a change in beta will likely have an impact on the stock's price,other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) A graph of the SML as applied to individual stocks would show required rates of return on the vertical axis and standard deviations of returns on the horizontal axis.

B) The CAPM has been thoroughly tested,and the theory has been confirmed beyond any reasonable doubt.

C) If two "normal" or "typical" stocks were combined to form a 2-stock portfolio,the portfolio's expected return would be a weighted average of the stocks' expected returns,but the portfolio's standard deviation would probably be greater than the average of the stocks' standard deviations.

D) If investors become more risk averse,then (1) the slope of the SML would increase and (2) the required rate of return on low-beta stocks would increase by more than the required return on high-beta stocks.

E) An increase in expected inflation,combined with a constant real risk-free rate and a constant market risk premium,would lead to identical increases in the required returns on a riskless asset and on an average stock,other things held constant.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If you plotted the returns on a given stock against those of the market,and if you found that the slope of the regression line was negative,the CAPM would indicate that the required rate of return on the stock should be greater than the risk-free rate for a well-diversified investor,assuming that the observed relationship is expected to continue into the future.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stocks A and B each have an expected return of 12%,a beta of 1.2,and a standard deviation of 25%.The returns on the two stocks have a correlation of +0.6.Portfolio P has 50% in Stock A and 50% in Stock B.Which of the following statements is CORRECT?

A) Portfolio P has a beta that is greater than 1.2.

B) Portfolio P has a standard deviation that is greater than 25%.

C) Portfolio P has an expected return that is less than 12%.

D) Portfolio P has a standard deviation that is less than 25%.

E) Portfolio P has a beta that is less than 1.2.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Someone who is risk averse has a general dislike for risk and a preference for certainty.If risk aversion exists in the market,then investors in general are willing to accept somewhat lower returns on less risky securities.Different investors have different degrees of risk aversion,and the end result is that investors with greater risk aversion tend to hold securities with lower risk (and therefore a lower expected return)than investors who have more tolerance for risk.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 147

Related Exams