Filters

Question type

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 52

Multiple Choice

You must estimate the intrinsic value of Noe Technologies' stock.The end-of-year free cash flow (FCF1) is expected to be $23.50 million,and it is expected to grow at a constant rate of 7.0% a year thereafter.The company's WACC is 10.0%,it has $125.0 million of long-term debt plus preferred stock outstanding,and there are 15.0 million shares of common stock outstanding.Assume the firm has zero non-operating assets.What is the firm's estimated intrinsic value per share of common stock? Do not round intermediate calculations.

A) $33.79

B) $43.89

C) $44.77

D) $52.67

E) $44.33

F) All of the above

G) A) and E)

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Question 53

Multiple Choice

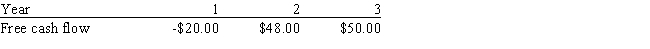

Wall Inc.forecasts that it will have the free cash flows (in millions) shown below.Assume the firm has zero non-operating assets.If the weighted average cost of capital is 14% and the free cash flows are expected to continue growing at the same rate after Year 3 as from Year 2 to Year 3,what is the firm's total corporate value,in millions? Do not round intermediate calculations.

A) $492.77

B) $349.05

C) $394.22

D) $418.86

E) $410.65

F) C) and E)

G) C) and D)

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Question 54

Multiple Choice

A share of common stock just paid a dividend of $1.00.If the expected long-run growth rate for this stock is 5.4%,and if investors' required rate of return is 10.2%,then what is the stock price?

A) $23.93

B) $21.96

C) $24.37

D) $23.50

E) $16.47

F) C) and D)

G) A) and B)

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Question 55

Multiple Choice

Kedia Inc.forecasts a negative free cash flow for the coming year,FCF1 = -$10 million,but it expects positive numbers thereafter,with FCF2 = $38 million.After Year 2,FCF is expected to grow at a constant rate of 4% forever.Assume the firm has zero non-operating assets.If the weighted average cost of capital is 14.0%,what is the firm's total corporate value,in millions? Do not round intermediate calculations.

A) $375.72

B) $308.33

C) $357.83

D) $324.56

E) $340.79

F) B) and C)

G) All of the above

G) All of the above

Correct Answer

verified

Correct Answer

verified

Question 56

Multiple Choice

The Francis Company is expected to pay a dividend of D1 = $1.25 per share at the end of the year,and that dividend is expected to grow at a constant rate of 6.00% per year in the future.The company's beta is 0.85,the market risk premium is 5.50%,and the risk-free rate is 4.00%.What is the company's current stock price? Do not round intermediate calculations.

A) $49.53

B) $54.21

C) $46.73

D) $47.66

E) $51.40

F) None of the above

G) All of the above

G) All of the above

Correct Answer

verified

Correct Answer

verified

Question 57

True/False

A proxy is a document giving one party the authority to act for another party,including the power to vote shares of common stock.Proxies can be important tools relating to control of firms.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 58

Multiple Choice

Church Inc.is presently enjoying relatively high growth because of a surge in the demand for its new product.Management expects earnings and dividends to grow at a rate of 41% for the next 4 years,after which competition will probably reduce the growth rate in earnings and dividends to zero,i.e. ,g = 0.The company's last dividend,D0,was $1.25,its beta is 1.20,the market risk premium is 5.50%,and the risk-free rate is 3.00%.What is the current price of the common stock? Do not round intermediate calculations.

A) $45.43

B) $54.06

C) $48.16

D) $42.70

E) $37.71

F) None of the above

G) C) and D)

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Question 59

Multiple Choice

Reddick Enterprises' stock currently sells for $50.00 per share.The dividend is projected to increase at a constant rate of 5.50% per year.The required rate of return on the stock,rs,is 9.00%.What is the stock's expected price 3 years from today?

A) $71.04

B) $71.63

C) $58.71

D) $68.69

E) $61.65

F) A) and D)

G) B) and E)

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 89 of 89

Related Exams