A) The corporate valuation model can be used both for companies that pay dividends and those that do not pay dividends.

B) The corporate valuation model discounts free cash flows by the required return on equity.

C) The corporate valuation model can be used to find the value of a division.

D) An important step in applying the corporate valuation model is forecasting the firm's pro forma financial statements.

E) Free cash flows are assumed to grow at a constant rate beyond a specified date in order to find the horizon,or continuing,value.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Misra Inc.forecasts a free cash flow of $80 million in Year 3,i.e. ,at t = 3,and it expects FCF to grow at a constant rate of 5.5% thereafter.If the weighted average cost of capital (WACC) is 10.0% and the cost of equity is 15.0%,then what is the horizon,or continuing,value in millions at t = 3?

A) $1,876

B) $1,763

C) $1,744

D) $2,251

E) $2,063

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Classified stock differentiates various classes of common stock.Using it is one way companies can meet special needs,such as when owners of a start-up firm need additional equity capital but don't want to relinquish voting control.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The preemptive right is important to shareholders because it

A) allows managers to buy additional shares below the current market price.

B) will result in higher dividends per share.

C) is included in every corporate charter.

D) protects the current shareholders against a dilution of their ownership interests.

E) protects bondholders and thus enables the firm to issue debt with a relatively low interest rate.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

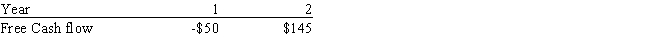

Kale Inc.forecasts the free cash flows (in millions) shown below.Assume the firm has zero non-operating assets.If the weighted average cost of capital is 11.0% and FCF is expected to grow at a rate of 5.0% after Year 2,then what is the firm's total corporate value (in millions) ? Do not round intermediate calculations.

A) $2,260

B) $2,452

C) $2,345

D) $1,876

E) $2,132

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

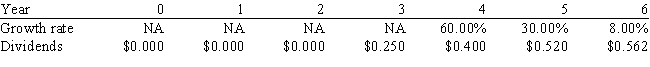

Agarwal Technologies was founded 10 years ago.It has been profitable for the last 5 years,but it has needed all of its earnings to support growth and thus has never paid a dividend.Management has indicated that it plans to pay a $0.25 dividend 3 years from today,then to increase it at a relatively rapid rate for 2 years,and then to increase it at a constant rate of 8.00% thereafter.Management's forecast of the future dividend stream,along with the forecasted growth rates,is shown below.Assuming a required return of 11.00%,what is your estimate of the stock's current value? Use the dividend values provided in the table below for your calculations.Do not round your intermediate calculations.

A) $11.87

B) $11.28

C) $13.65

D) $13.30

E) $12.23

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The expected return on Natter Corporation's stock is 14%.The stock's dividend is expected to grow at a constant rate of 8%,and it currently sells for $50 a share.Which of the following statements is CORRECT?

A) The stock's dividend yield is 7%.

B) The stock's dividend yield is 8%.

C) The current dividend per share is $4.00.

D) The stock price is expected to be $54 a share one year from now.

E) The stock price is expected to be $57 a share one year from now.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Founders' shares,a type of classified stock owned by the firm's founders,generally have more votes per share than the other classes of common stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A stock just paid a dividend of D0 = $1.50.The required rate of return is rs = 9.0%,and the constant growth rate is g = 4.0%.What is the current stock price?

A) $32.14

B) $34.32

C) $27.14

D) $36.19

E) $31.20

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The corporate valuation model can be used only when a company doesn't pay dividends.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For a stock to be in equilibrium-that is,for there to be no long-term pressure for its price to change-the

A) expected future return must be less than the most recent past realized return.

B) past realized return must be equal to the expected return during the same period.

C) required return must equal the realized return in all periods.

D) expected return must be equal to both the required future return and the past realized return.

E) expected future return must be equal to the required return.

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

When a new issue of stock is brought to market,the marginal investor determines the price at which the stock will trade.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in a firm's expected growth rate would cause its required rate of return to

A) increase.

B) decrease.

C) fluctuate less than before.

D) fluctuate more than before.

E) possibly increase,possibly decrease,or possibly remain constant.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The corporate valuation model cannot be used unless a company pays dividends.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

According to the basic DCF stock valuation model,the value an investor should assign to a share of stock is dependent on the length of time he or she plans to hold the stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Isberg Company just paid a dividend of $0.75 per share,and that dividend is expected to grow at a constant rate of 5.50% per year in the future.The company's beta is 1.65,the market risk premium is 5.00%,and the risk-free rate is 4.00%.What is the company's current stock price,P0? Do not round intermediate calculations.

A) $10.08

B) $11.72

C) $13.83

D) $12.66

E) $13.60

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Ramirez Company's last dividend was $1.75.Its dividend growth rate is expected to be constant at 22% for 2 years,after which dividends are expected to grow at a rate of 6% forever.Its required return (rs) is 12%.What is the best estimate of the current stock price? Do not round intermediate calculations.

A) $33.35

B) $44.73

C) $40.67

D) $39.04

E) $44.33

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two constant growth stocks are in equilibrium,have the same price,and have the same required rate of return.Which of the following statements is CORRECT?

A) The two stocks must have the same dividend per share.

B) If one stock has a higher dividend yield,then it must also have a lower dividend growth rate.

C) If one stock has a higher dividend yield,then it must also have a higher dividend growth rate.

D) The two stocks must have the same dividend growth rate.

E) The two stocks must have the same dividend yield.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) A major disadvantage of financing with preferred stock is that preferred stockholders typically have supernormal voting rights.

B) Preferred stock is normally expected to provide steadier,more reliable income to investors than the same firm's common stock.As a result,the expected after-tax yield on the preferred is lower than the after-tax expected return on the common stock.

C) The preemptive right is a provision in all corporate charters that gives preferred stockholders the right to purchase (on a pro rata basis) new issues of preferred stock.

D) One of the disadvantages to a corporation of owning preferred stock is that 50% of the dividends received represent taxable income to the corporate recipient,whereas interest income earned on bonds is tax free.

E) One of the advantages to financing with preferred stock is that 50% of the dividends paid out are tax deductible to the issuer.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) To implement the corporate valuation model,we discount projected free cash flows at the weighted average cost of capital.

B) To implement the corporate valuation model,we discount net operating profit after taxes (NOPAT) at the weighted average cost of capital.

C) To implement the corporate valuation model,we discount projected net income at the weighted average cost of capital.

D) To implement the corporate valuation model,we discount projected free cash flows at the cost of equity capital.

E) The corporate valuation model requires the assumption of a constant growth rate in all years.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 89

Related Exams