A) $15.02

B) $15.84

C) $14.85

D) $16.50

E) $12.54

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ackert Company's last dividend was $3.00.The dividend growth rate is expected to be constant at 1.5% for 2 years,after which dividends are expected to grow at a rate of 8.0% forever.The firm's required return (rs) is 12.0%.What is the best estimate of the current stock price? Do not round intermediate calculations.

A) $88.92

B) $71.71

C) $78.88

D) $80.31

E) $68.84

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Companies can issue different classes of common stock.Which of the following statements concerning stock classes is CORRECT?

A) All common stocks fall into one of three classes: A,B,and C.

B) All common stocks,regardless of class,must have the same voting rights.

C) All firms have several classes of common stock.

D) All common stock,regardless of class,must pay the same dividend.

E) Some class or classes of common stock are entitled to more votes per share than other classes.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

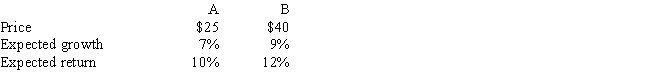

Stocks A and B have the following data.Assuming the stock market is efficient and the stocks are in equilibrium,which of the following statements is CORRECT?

A) The two stocks should have the same expected dividend.

B) The two stocks could not be in equilibrium with the numbers given in the question.

C) A's expected dividend is $0.50.

D) B's expected dividend is $0.75.

E) A's expected dividend is $0.75 and B's expected dividend is $1.20.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Francis Inc.'s stock has a required rate of return of 10.25%,and it sells for $80.00 per share.The dividend is expected to grow at a constant rate of 6.00% per year.What is the expected year-end dividend,D1?

A) $3.40

B) $4.25

C) $3.57

D) $3.23

E) $2.89

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Schnusenberg Corporation just paid a dividend of D0 = $0.75 per share,and that dividend is expected to grow at a constant rate of 6.50% per year in the future.The company's beta is 0.75,the required return on the market is 10.50%,and the risk-free rate is 4.50%.What is the company's current stock price? Do not round intermediate calculations.

A) $27.80

B) $28.76

C) $31.63

D) $31.95

E) $33.23

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The preemptive right gives current stockholders the right to purchase,on a pro rata basis,any new shares issued by the firm.This right helps protect current stockholders against both dilution of control and dilution of value.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a given investor believes that a stock's expected return exceeds its required return,then the investor most likely believes that

A) the stock is experiencing supernormal growth.

B) the stock should be sold.

C) the stock is a good buy.

D) management is probably not trying to maximize the price per share.

E) dividends are not likely to be declared.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

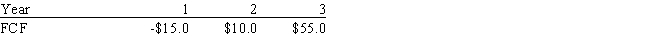

Ryan Enterprises forecasts the free cash flows (in millions) shown below.Assume the firm has zero non-operating assets.The weighted average cost of capital is 13.0%,and the FCFs are expected to continue growing at a 5.0% rate after Year 3.What is the firm's total corporate value (in millions) ? Do not round intermediate calculations.

A) $564.95

B) $660.88

C) $522.31

D) $442.37

E) $532.97

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

If a stock's market price exceeds its intrinsic value as seen by the marginal investor,then the investor will sell the stock until its price has fallen down to the level of the investor's estimate of the intrinsic value.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

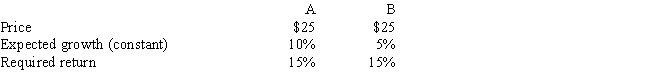

Stocks A and B have the following data.Assuming the stock market is efficient and the stocks are in equilibrium,which of the following statements is CORRECT?

A) Stock A's expected dividend at t = 1 is only half that of Stock B.

B) Stock A has a higher dividend yield than Stock B.

C) Currently the two stocks have the same price,but over time Stock B's price will pass that of A.

D) Since Stock A's growth rate is twice that of Stock B,Stock A's future dividends will always be twice as high as Stock B's.

E) The two stocks should not sell at the same price.If their prices are equal,then a disequilibrium must exist.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a company has two classes of common stock,Class A and Class B,then the stocks may pay different dividends,but under all state charters the two classes must have the same voting rights.

B) The preemptive right gives stockholders the right to approve or disapprove of a merger between their company and some other company.

C) The preemptive right is a provision in the corporate charter that gives common stockholders the right to purchase (on a pro rata basis) new issues of the firm's common stock.

D) The stock valuation model,P0 = D1/(rs - g) ,cannot be used for firms that have negative growth rates.

E) The stock valuation model,P0 = D1/(rs - g) ,can be used only for firms whose growth rates exceed their required returns.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sorenson Corp.'s expected year-end dividend is D1 = $1.90,its required return is rs = 11.00%,its dividend yield is 6.00%,and its growth rate is expected to be constant in the future.What is Sorenson's expected stock price in 7 years,i.e. ,what is ? Do not round intermediate calculations.

A) $37.87

B) $50.35

C) $47.68

D) $38.77

E) $44.56

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The constant growth model takes into consideration the capital gains investors expect to earn on a stock.

B) Two firms with the same expected dividend and growth rate must also have the same stock price.

C) It is appropriate to use the constant growth model to estimate a stock's value even if its growth rate is never expected to become constant.

D) If a stock has a required rate of return rs = 12%,and if its dividend is expected to grow at a constant rate of 5%,then the stock's dividend yield is also 5%.

E) The price of a stock is the present value of all expected future dividends,discounted at the dividend growth rate.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The required returns of Stocks X and Y are rX = 10% and rY = 12%.Which of the following statements is CORRECT?

A) If the market is in equilibrium,and if Stock Y has the lower expected dividend yield,then it must have the higher expected growth rate.

B) If Stock Y and Stock X have the same dividend yield,then Stock Y must have a lower expected capital gains yield than Stock X.

C) If Stock X and Stock Y have the same current dividend and the same expected dividend growth rate,then Stock Y must sell for a higher price.

D) The stocks must sell for the same price.

E) Stock Y must have a higher dividend yield than Stock X.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have been assigned the task of using the corporate,or free cash flow,model to estimate Petry Corporation's intrinsic value.The firm's WACC is 10.00%,its end-of-year free cash flow (FCF1) is expected to be $75.0 million,the FCFs are expected to grow at a constant rate of 5.00% a year in the future,the company has $200 million of long-term debt and preferred stock,and it has 30 million shares of common stock outstanding.Assume the firm has zero non-operating assets.What is the firm's estimated intrinsic value per share of common stock? Do not round intermediate calculations.

A) $34.23

B) $42.90

C) $53.30

D) $42.03

E) $43.33

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a firm's stockholders are given the preemptive right,then they can call for a meeting to vote to replace the management.Without the preemptive right,dissident stockholders must seek a change in management through a proxy fight.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gray Manufacturing is expected to pay a dividend of $1.25 per share at the end of the year (D1 = $1.25) .The stock sells for $22.50 per share,and its required rate of return is 10.5%.The dividend is expected to grow at some constant rate,g,forever.What is the equilibrium expected growth rate?

A) 5.88%

B) 4.25%

C) 4.30%

D) 4.90%

E) 4.94%

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If D0 = $1.75,g (which is constant) = 3.6%,and P0 = $34.00,then what is the stock's expected total return for the coming year?

A) 8.58%

B) 8.93%

C) 7.41%

D) 9.20%

E) 6.97%

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

For a stock to be in equilibrium,two conditions are necessary: (1)The stock's market price must equal its intrinsic value as seen by the marginal investor,and (2)the expected return as seen by the marginal investor must equal his or her required return.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 89

Related Exams