A) 1,089.5%

B) 1,303.1%

C) 822.5%

D) 982.7%

E) 1,068.1%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

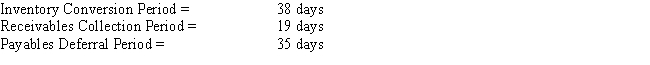

Whittington Inc.has the following data.What is the firm's cash conversion cycle?

A) 28 days

B) 32 days

C) 29 days

D) 25 days

E) 34 days

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The target cash balance is typically (and logically)set so that it does not need to be adjusted for either seasonal patterns or unanticipated random fluctuations.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is most consistent with efficient inventory management? The firm has a

A) below-average inventory turnover ratio.

B) low incidence of production schedule disruptions.

C) below-average total assets turnover ratio.

D) relatively high current ratio.

E) relatively low DSO.

G) A) and E)

Correct Answer

verified

B

Correct Answer

verified

True/False

"Stretching" accounts payable is a widely accepted,entirely ethical,and costless financing technique,which is particularly useful when suppliers' production plants are at full capacity .

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The average accounts receivables balance is a function of both the volume of credit sales and the days sales outstanding.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Romano Inc.has the following data.What is the firm's cash conversion cycle?

A) 26 days

B) 24 days

C) 22 days

D) 19 days

E) 20 days

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Inventory management is largely self-contained in the sense that very little coordination among the sales,purchasing,and production personnel is required for successful inventory management.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Accruals are "spontaneous" funds arising automatically from a firm's operations,but unfortunately,due to law and economic forces,firms have little control over the level of these accounts.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Dimon Products' sales are expected to be $5 million this year,with 90% on credit and 10% for cash.Sales are expected to grow at a stable,steady rate of 10% annually in the future.Dimon's accounts receivable balance will remain constant at the current level,because the 10% cash sales can be used to support the 10% growth rate,other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the yield curve is upward sloping,then short-term debt will be cheaper than long-term debt.Thus,if a firm's CFO expects the yield curve to continue to have an upward slope,this would tend to cause the current ratio to be relatively low,other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An informal line of credit and a revolving credit agreement are similar except that the line of credit creates a legal obligation for the bank and thus is a more reliable source of funds for the borrower than the revolving credit agreement.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT a situation that might lead a firm to increase its holdings of short-term marketable securities?

A) The firm must make a known future payment,such as paying for a new plant that is under construction.

B) The firm is going from its peak sales season to its slack season,so its receivables and inventories will experience a seasonal decline.

C) The firm is going from its slack season to its peak sales season,so its receivables and inventories will experience seasonal increases.

D) The firm has just sold long-term securities and has not yet invested the proceeds in operating assets.

E) The firm just won a product liability suit one of its customers had brought against it.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The four primary elements in a firm's credit policy are (1)credit standards, (2)discounts offered, (3)credit period,and (4)collection policy.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Synchronization of cash flows is an important cash management technique,as proper synchronization can reduce the required cash balance and increase a firm's profitability.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Net operating working capital,defined as operating current assets minus the difference between current liabilities and notes payable,is equal to the current ratio minus the quick ratio.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ingram Office Supplies,Inc. ,buys on terms of 2/15,net 50 days.It does not take discounts,and it typically pays on time,50 days after the invoice date.Net purchases amount to $300,000 per year.On average,what is the dollar amount of costly trade credit (total credit - free credit) the firm receives during the year? (Assume a 365-day year,and note that purchases are net of discounts. ) Do not round intermediate calculations.

A) $29,055

B) $28,767

C) $27,904

D) $32,795

E) $26,466

G) C) and D)

Correct Answer

verified

B

Correct Answer

verified

True/False

The calculated cost of trade credit for a firm that buys on terms of 2/10,net 30,is lower (other things held constant)if the firm plans to pay in 40 days than in 30 days.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Trade credit is provided only to relatively large,strong firms.

B) Commercial paper is a form of short-term financing that is primarily used by large,strong,financially stable companies.

C) Short-term debt is favored by firms because,while it is generally more expensive than long-term debt,it exposes the borrowing firm to less risk than long-term debt.

D) Commercial paper can be issued by virtually any firm so long as it is willing to pay the going interest rate.

E) Commercial paper is typically offered at a long-term maturity of at least five years.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

An increase in any current asset must be accompanied by an equal increase in some current liability.

B) False

Correct Answer

verified

False

Correct Answer

verified

Showing 1 - 20 of 124

Related Exams