A) An account that pays 8% nominal interest with monthly compounding.

B) An account that pays 8% nominal interest with annual compounding.

C) An account that pays 7% nominal interest with daily (365-day) compounding.

D) An account that pays 7% nominal interest with monthly compounding.

E) An account that pays 8% nominal interest with daily (365-day) compounding.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The present value of a future sum increases as either the discount rate or the number of periods per year increases,other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You plan to invest in bonds that pay 6.0%,compounded annually.If you invest $10,000 today,how many years will it take for your investment to grow to $25,000?

A) 15.88

B) 17.61

C) 16.35

D) 15.73

E) 14.00

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a bank compounds savings accounts quarterly,the effective annual rate will exceed the nominal rate.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A $150,000 loan is to be amortized over 7 years,with annual end-of-year payments.Which of these statements is CORRECT?

A) The annual payments would be larger if the interest rate were lower.

B) If the loan were amortized over 10 years rather than 7 years,and if the interest rate were the same in either case,the first payment would include more dollars of interest under the 7-year amortization plan.

C) The proportion of each payment that represents interest as opposed to repayment of principal would be higher if the interest rate were lower.

D) The proportion of each payment that represents interest versus repayment of principal would be higher if the interest rate were higher.

E) The proportion of interest versus principal repayment would be the same for each of the 7 payments.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Farmers Bank offers to lend you $50,000 at a nominal rate of 5.0%,simple interest,with interest paid quarterly.Merchants Bank offers to lend you the $50,000,but it will charge 6.2%,simple interest,with interest paid at the end of the year.What's the difference in the effective annual rates charged by the two banks?

A) 1.33%

B) 1.09%

C) 0.91%

D) 1.11%

E) 0.83%

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you borrowed $27,000 at a rate of 9.0% and must repay it in 4 equal installments at the end of each of the next 4 years.How large would your payments be?

A) $10,000.86

B) $8,334.05

C) $6,500.56

D) $10,250.89

E) $6,333.88

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a State of California bond will pay $1,000 eight years from now.If the going interest rate on these 8-year bonds is 6.2%,how much is the bond worth today?

A) $537.68

B) $704.54

C) $618.02

D) $673.64

E) $741.63

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the U.S.Treasury offers to sell you a bond for $597.25.No payments will be made until the bond matures 5 years from now,at which time it will be redeemed for $1,000.What interest rate would you earn if you bought this bond at the offer price?

A) 9.01%

B) 9.56%

C) 11.08%

D) 11.94%

E) 10.86%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Midway through the life of an amortized loan,the percentage of the payment that represents interest could be equal to,less than,or greater than to the percentage that represents repayment of principal.The proportions depend on the original life of the loan and the interest rate.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you borrowed $15,000 at a rate of 11.8% and must repay it in 5 equal installments at the end of each of the next 5 years.How much interest would you have to pay in the first year?

A) $1,362.90

B) $1,557.60

C) $1,716.90

D) $1,770.00

E) $1,893.90

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You plan to borrow $45,200 at a 7.5% annual interest rate.The terms require you to amortize the loan with 7 equal end-of-year payments.How much interest would you be paying in Year 2?

A) $2,403.37

B) $2,703.80

C) $2,854.01

D) $3,004.22

E) $3,454.85

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Disregarding risk,if money has time value,it is impossible for the present value of a given sum to exceed its future value.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that you own an annuity that will pay you $15,000 per year for 12 years,with the first payment being made today.You need money today to start a new business,and your uncle offers to give you $156,000 for the annuity.If you sell it,what rate of return would your uncle earn on his investment?

A) 3.31%

B) 2.77%

C) 2.42%

D) 2.72%

E) 2.15%

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Starting to invest early for retirement reduces the benefits of compound interest.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

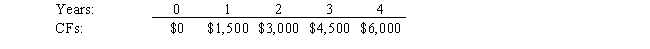

What is the present value of the following cash flow stream at a rate of 10.0%?

A) $11,888

B) $13,473

C) $9,850

D) $11,322

E) $13,586

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your uncle has $415,000 and wants to retire.He expects to live for another 25 years and to earn 7.5% on his invested funds.How much could he withdraw at the end of each of the next 25 years and end up with zero in the account?

A) $29,783.94

B) $45,420.51

C) $40,952.92

D) $37,229.93

E) $45,048.21

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following investments would have the highest future value at the end of 10 years? Assume that the effective annual rate for all investments is the same and is greater than zero.

A) Investment A pays $250 at the beginning of every year for the next 10 years (a total of 10 payments) .

B) Investment B pays $125 at the end of every 6-month period for the next 10 years (a total of 20 payments) .

C) Investment C pays $125 at the beginning of every 6-month period for the next 10 years (a total of 20 payments) .

D) Investment D pays $2,500 at the end of 10 years (just one payment) .

E) Investment E pays $250 at the end of every year for the next 10 years (a total of 10 payments) .

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You want to quit your job and go back to school for a law degree 4 years from now,and you plan to save $2,400 per year,beginning immediately.You will make 4 deposits in an account that pays 5.7% interest.Under these assumptions,how much will you have 4 years from today?

A) $9,501.47

B) $11,711.12

C) $11,490.15

D) $11,048.22

E) $9,390.99

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How much would $100,growing at 5% per year,be worth after 65 years?

A) $1,787.99

B) $2,717.75

C) $2,383.99

D) $2,574.71

E) $2,860.79

G) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 164

Related Exams