A) 21 days

B) 24 days

C) 19 days

D) 22 days

E) 14 days

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT a situation that might lead a firm to increase its holdings of short-term marketable securities?

A) The firm must make a known future payment,such as paying for a new plant that is under construction.

B) The firm is going from its peak sales season to its slack season,so its receivables and inventories will experience a seasonal decline.

C) The firm is going from its slack season to its peak sales season,so its receivables and inventories will experience seasonal increases.

D) The firm has just sold long-term securities and has not yet invested the proceeds in operating assets.

E) The firm just won a product liability suit one of its customers had brought against it.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

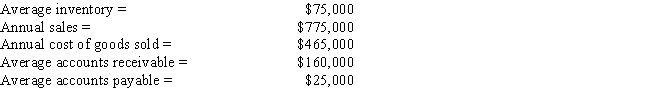

Your consulting firm was recently hired to improve the performance of Shin-Soenen Inc,which is highly profitable but has been experiencing cash shortages due to its high growth rate.As one part of your analysis,you want to determine the firm's cash conversion cycle.Using the following information and a 365-day year,what is the firm's present cash conversion cycle?

A) 128.4 days

B) 121.5 days

C) 87.1 days

D) 114.6 days

E) 88.2 days

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Edwards Enterprises follows a moderate current asset investment policy,but it is now considering a change,perhaps to a restricted or maybe to a relaxed policy.The firm's annual sales are $400,000;its fixed assets are $100,000;its target capital structure calls for 50% debt and 50% equity;its EBIT is $39,000;the interest rate on its debt is 10%;and its tax rate is 40%.With a restricted policy,current assets will be 15% of sales,while under a relaxed policy they will be 25% of sales.What is the difference in the projected ROEs between the restricted and relaxed policies?

A) 4.91%

B) 4.50%

C) 5.85%

D) 4.45%

E) 4.68%

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

An increase in any current asset must be accompanied by an equal increase in some current liability.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following items should a company report directly in its monthly cash budget?

A) Its monthly depreciation expense.

B) Cash proceeds from selling one of its divisions.

C) Accrued interest on zero coupon bonds that it issued.

D) New shares issued in a stock split.

E) New shares issued in a stock dividend.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Setting up a lockbox arrangement is one way for a firm to speed up the collection of payments from its customers.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Inventory management is largely self-contained in the sense that very little coordination among the sales,purchasing,and production personnel is required for successful inventory management.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A firm constructing a new manufacturing plant and financing it with short-term loans,which are scheduled to be converted to first mortgage bonds when the plant is completed,would want to separate the construction loan from its current liabilities associated with working capital when calculating net working capital.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the yield curve is upward sloping,then short-term debt will be cheaper than long-term debt.Thus,if a firm's CFO expects the yield curve to continue to have an upward slope,this would tend to cause the current ratio to be relatively low,other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Uncertainty about the exact lives of assets prevents precise maturity matching in an ex post (i.e. ,after the fact)sense even though it is possible to match maturities on an ex ante (expected)basis.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Edison Inc.has annual sales of $41,610,000,or $114,000 a day on a 365-day basis.The firm's cost of goods sold are 75% of sales.On average,the company has $9,000,000 in inventory and $8,000,000 in accounts receivable.The firm is looking for ways to shorten its cash conversion cycle.Its CFO has proposed new policies that would result in a 20% reduction in both average inventories and accounts receivable.She also anticipates that these policies would reduce sales by 10%,while the payables deferral period would remain unchanged at 35 days.What effect would these policies have on the company's cash conversion cycle? Round to the nearest whole day.

A) -16 days

B) -21 days

C) -17 days

D) -19 days

E) -22 days

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A line of credit can be either a formal or an informal agreement between a borrower and a bank regarding the maximum amount of credit the bank will extend to the borrower during some future period,assuming the borrower maintains its financial strength.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The cash budget and the capital budget are handled separately,and although they are both important,they are developed completely independently of one another.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

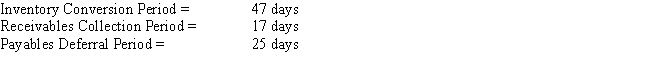

Cass & Company has the following data.What is the firm's cash conversion cycle?

A) 46 days

B) 30 days

C) 45 days

D) 39 days

E) 38 days

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The four primary elements in a firm's credit policy are (1)credit standards, (2)discounts offered, (3)credit period,and (4)collection policy.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Accruals are an expensive but commonly used way to finance working capital.

B) A conservative financing policy is one where the firm finances part of its fixed assets with short-term capital and all of its net working capital with short-term funds.

C) If a company receives trade credit under terms of 2/10,net 30,this implies that the company has 10 days of free trade credit.

D) One cannot tell if a firm has a conservative,aggressive,or moderate current asset financing policy without an examination of its cash budget.

E) If a firm has a relatively aggressive current asset financing policy vis-à-vis other firms in its industry,then its current ratio will probably be relatively high.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statement completions is CORRECT? If the yield curve is upward sloping,then the marketable securities held in a firm's portfolio,assumed to be held for emergencies,should

A) consist mainly of long-term securities because they pay higher rates.

B) consist mainly of short-term securities because they pay higher rates.

C) consist mainly of U.S.Treasury securities to minimize interest rate risk.

D) consist mainly of short-term securities to minimize interest rate risk.

E) be balanced between long- and short-term securities to minimize the adverse effects of either an upward or a downward trend in interest rates.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The facts that (1)no explicit interest is paid on accruals and (2)the firm can vary the level of these accounts at will makes them an attractive source of funding to meet the firm's working capital needs.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your firm's cost of goods sold (COGS) average $2,000,000 per month,and it keeps inventory equal to 50% of its monthly COGS on hand at all times.Using a 365-day year,what is its inventory conversion period?

A) 15.2 days

B) 14.0 days

C) 15.7 days

D) 13.7 days

E) 14.8 days

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 124

Related Exams