A) 9.14%

B) 6.24%

C) 7.61%

D) 7.23%

E) 8.98%

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements concerning the cash budget is CORRECT?

A) Depreciation expense is not explicitly included,but depreciation's effects are reflected in the estimated tax payments.

B) Cash budgets do not include financial items such as interest and dividend payments.

C) Cash budgets do not include cash inflows from long-term sources such as the issuance of bonds.

D) Changes that affect the DSO do not affect the cash budget.

E) Capital budgeting decisions have no effect on the cash budget until projects go into operation and start producing revenues.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

An informal line of credit and a revolving credit agreement are similar except that the line of credit creates a legal obligation for the bank and thus is a more reliable source of funds for the borrower than the revolving credit agreement.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

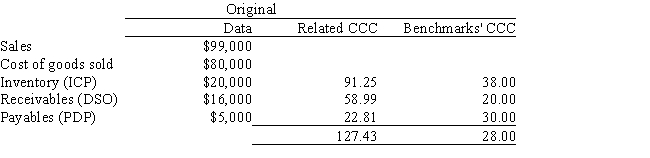

Soenen Inc.had the following data for last year (in millions) .The new CFO believes that the company could improve its working capital management sufficiently to bring its net working capital and cash conversion cycle up to the benchmark companies' level without affecting either sales or the costs of goods sold.Soenen finances its net working capital with a bank loan at an 8% annual interest rate,and it uses a 365-day year.If these changes had been made,by how much would the firm's pre-tax income have increased?

A) $1,467

B) $1,906

C) $1,810

D) $2,058

E) $1,849

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nogueiras Corp's budgeted monthly sales are $10,500,and they are constant from month to month.40% of its customers pay in the first month and take the 2% discount,while the remaining 60% pay in the month following the sale and do not receive a discount.The firm has no bad debts.Purchases for next month's sales are constant at 50% of projected sales for the next month."Other payments",which include wages,rent,and taxes,are 25% of sales for the current month.Construct a cash budget for a typical month and calculate the average cash gain or loss during the month.

A) $2,007

B) $2,236

C) $2,998

D) $2,541

E) $1,931

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

If one of your firm's customers is "stretching" its accounts payable,this may be a nuisance but it does not represent a real financial cost to your firm as long as the customer periodically pays off its entire balance.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

"Stretching" accounts payable is a widely accepted,entirely ethical,and costless financing technique,which is particularly useful when suppliers' production plants are at full capacity .

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The longer its customers normally hold inventory,the longer the credit period supplier firms normally offer.Still,suppliers have some flexibility in the credit terms they offer.If a supplier lengthens the credit period offered,this will shorten the customer's cash conversion cycle but lengthen the supplier firm's own CCC.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

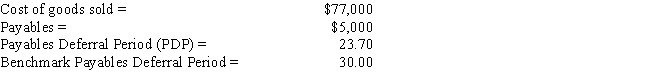

Data on Wentz Inc.for last year are shown below,along with the payables deferral period (PDP) for the firms against which it benchmarks.The firm's new CFO believes that the company could delay payments enough to increase its PDP to the benchmarks' average.If this were done,by how much would payables increase? Use a 365-day year.

A) $1,036

B) $1,382

C) $1,342

D) $1,648

E) $1,329

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Other things held constant,if a firm "stretches" (i.e. ,delays paying)its accounts payable,this will lengthen its cash conversion cycle (CCC).

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a firm takes actions that reduce its days sales outstanding (DSO),then,other things held constant,this will lengthen its cash conversion cycle (CCC)and cause a deterioration in its cash position.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The target cash balance is typically (and logically)set so that it does not need to be adjusted for either seasonal patterns or unanticipated random fluctuations.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Firms generally choose to finance temporary current assets with short-term debt because

A) matching the maturities of assets and liabilities reduces risk under some circumstances,and also because short-term debt is often less expensive than long-term capital.

B) short-term interest rates have traditionally been more stable than long-term interest rates.

C) a firm that borrows heavily on a long-term basis is more apt to be unable to repay the debt than a firm that borrows short term.

D) the yield curve is normally downward sloping.

E) short-term debt has a higher cost than equity capital.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Van Den Borsh Corp.has annual sales of $68,735,000,an average inventory level of $15,012,000,and average accounts receivable of $10,008,000.The firm's cost of goods sold is 85% of sales.The company makes all purchases on credit and has always paid on the 30th day.However,it now plans to take full advantage of trade credit and to pay its suppliers on the 40th day.The CFO also believes that sales can be maintained at the existing level but inventory can be lowered by $1,946,000 and accounts receivable by $1,946,000.What will be the net change in the cash conversion cycle,assuming a 365-day year? Round to the nearest whole day.

A) -34 days

B) -27 days

C) -31 days

D) -25 days

E) -32 days

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If a firm has set up a revolving credit agreement with a bank,the risk to the firm of being unable to obtain funds when needed is lower than if it had an informal line of credit.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT directly reflected in the cash budget of a firm that is in the zero tax bracket?

A) Payments lags.

B) Depreciation.

C) Cumulative cash.

D) Repurchases of common stock.

E) Payment for plant construction.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A firm's peak borrowing needs will probably be overstated if it bases its monthly cash budget on the assumption that both cash receipts and cash payments occur uniformly over the month but in reality payments are concentrated at the beginning of each month.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the credit terms offered to your firm by its suppliers are 2/10,net 30 days.Your firm is not taking discounts,but is paying after 22 days instead of Day 30.You point out that the nominal cost of not taking the discount and paying on Day 30 is approximately 37%.But since your firm is neither taking discounts nor paying on the due date,what is the effective annual percentage cost (not the nominal cost) of its costly trade credit,using a 365-day year?

A) 88.3%

B) 70.4%

C) 77.2%

D) 78.9%

E) 84.9%

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

On average,a firm collects checks totaling $250,000 per day.It takes the firm approximately 4 days from the day the checks were mailed until they result in usable cash for the firm.Assume that (1)a lockbox system could be employed which would reduce the cash conversion procedure to 2 1/2 days and (2)the firm could invest any additional cash generated at 6% after taxes.The lockbox system would be a good buy if it costs $25,000 annually.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A lockbox plan is most beneficial to firms that

A) have suppliers who operate in many different parts of the country.

B) have widely dispersed manufacturing facilities.

C) have a large marketable securities portfolio,and cash,to protect.

D) receive payments in the form of currency,such as fast food restaurants,rather than in the form of checks.

E) have customers who operate in many different parts of the country.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 124

Related Exams