A) $775.00

B) $1,840.00

C) $1,960.00

D) $1,562.60

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

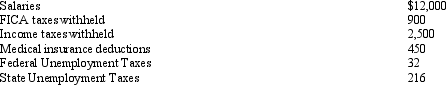

Use the following information to answer the following questions. The following totals for the month of April were taken from the payroll register of Magnum Company.

The entry to record accrual of employer's payroll taxes would include a

The entry to record accrual of employer's payroll taxes would include a

A) debit to Payroll Tax Expense for $248

B) debit to FICA Taxes Payable for $1,800

C) credit to Payroll Tax Expense for $248

D) debit to Payroll Tax Expense for $1,148

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

One of the more popular defined contribution plans is the 401k plan.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Federal unemployment compensation tax becomes an employer's liability at the time the employee is paid.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An employee receives an hourly rate of $30, with time and a half for all hours worked in excess of 40 during a week. Payroll data for the current week are as follows: hours worked, 48; federal income tax withheld, $300; cumulative earnings for year prior to current week, $90,700; social security tax rate, 6.0% on maximum of $100,000; and Medicare tax rate, 1.5% on all earnings. What is the net amount to be paid to the employee?

A) $1,032.00

B) $1,143.00

C) $1,053.60

D) $1,166.40

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A business borrowed $40,000 on March 1 of the current year by signing a 60-day, 9% interest bearing note. Assuming a 360-day year, when the note is paid on April 30, the entry to record the payment should include a

A) debit to Interest Payable $600

B) debit to Interest Expense $600

C) credit to Cash for $40,000

D) credit to Cash for $46,300

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

All long-term liabilities eventually become current liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

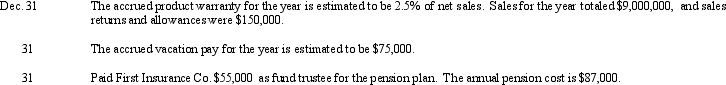

Essay

Journalize the following transactions for Riley Corporation:

Correct Answer

verified

Correct Answer

verified

Essay

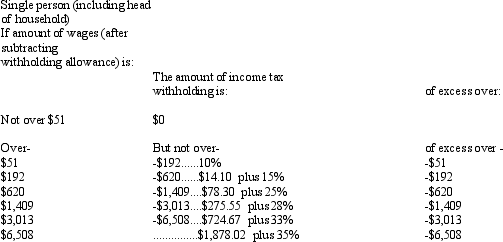

John Woods' weekly gross earnings for the present week were $2,500. Woods has two exemptions. Using $80 value for each exemption, what is Woods' federal income tax withholding?

Correct Answer

verified

Correct Answer

verified

Essay

Mobile Sales has five sales employees which receive weekly paychecks. Each earns $11.50 per hour and each has worked 40 hours in the pay period. Each employee pays 12% of gross in Federal Income Tax, 3% in State Income Tax, 6% of gross in Social Security Tax, 1.5% of gross in Medicare Tax, and 1/2% in State Disability Insurance. Journalize the recognition the pay period ending January 19th which will be paid to the employees January 26th. (Keep in mind that none of the employees is subject to a ceiling amount for social security.)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the most desirable quick ratio?

A) 2.20

B) 1.80

C) 1.95

D) 1.50

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry a company uses to record pension rights that have not been funded for its salaried employees, at the end of the year is

A) debit Salary Expense; credit Cash

B) debit Pension Expense; credit Unfunded Pension Liability

C) debit Pension Expense; credit Unfunded Pension Liability and Cash

D) debit Pension Expense; credit Cash

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The payroll register is a multicolumn form used to assemble the data related for all employees.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An employee's take home pay is equal to gross pay less all voluntary deductions.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

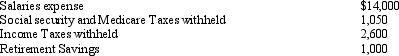

The following totals for the month of June were taken from the payroll register of Arcon Company:  The entry to record the payment of net pay would include a

The entry to record the payment of net pay would include a

A) debit to Salaries Payable for $14,000

B) Debit to Salaries Payable for $9,350

C) Credit to Salaries Expense for $9,350

D) Credit to Salaries Payable for $9,350

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The total net pay for a period is determined from the payroll register.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

FICA tax becomes a liability to the federal government at the time an employee's payroll is prepared.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On June 8, Alton Co. issued an $80,000, 6%, 120-day note payable on an overdue account payable to Seller Co. Assume that the fiscal year of Alton Co. ends June 30. Which of the following relationships is true?

A) Alton is the creditor and credits Accounts Receivable

B) Seller is the creditor and debits Accounts Receivable

C) Seller is the borrower and credits Accounts Payable

D) Alton is the borrower and debits Accounts Payable

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On October 30, Seba Salon, Inc. issued a 90-day note with a face amount of $60,000 to Reyes Products, Inc. for merchandise inventory. Assuming a 360-day year, determine the proceeds of the note assuming the note is discounted at 8%.

A) $55,200

B) $64,800

C) $58,800

D) $61,200

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During September, Excom sold 100 radios for $50 each. Each radio cost Excom $30 to purchase, and carried a two-year warranty. If 5% of the goods sold typically need to be replaced over the warranty period and one is actually replaced during September, for what amount in September would Excom debit Product Warranty Expense?

A) $50

B) $150

C) $30

D) $120

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 169

Related Exams