B) False

Correct Answer

verified

Correct Answer

verified

True/False

When a new partner is admitted to a partnership, all partnership assets should be revised to reflect current prices.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

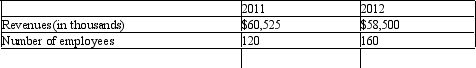

Top Notch, LLC provides repair services for oil rigs. The firm has 5 members in the LLC, which did not change between 2011 and 2012. During 2012, the business expanded into three new regions of the country. The following revenue and employee information is provided:

Required:

a. For 2011 and 2012, determine the revenue per employee (excluding members).

b. Interpret the trend between the two years.

Required:

a. For 2011 and 2012, determine the revenue per employee (excluding members).

b. Interpret the trend between the two years.

Correct Answer

verified

Correct Answer

verified

True/False

If a new partner is given a 20% interest in the firm then the new partner will receive a 20% interest in earnings.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The chart of accounts for a partnership, with the exception of drawing and capital accounts, does differ from the chart of accounts for a sole proprietorship.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a partner's capital balance is a debit after it has absorbed its share of the loss on realization, the balance is referred to as a deficiency.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ofelia and Teresa share income and losses in a 2:1 ratio after allowing for salaries to Ofelia of $48,000 and $60,000 to Teresa. Net income for the partnership is $132,000. Income should be divided as follows:

A) Ofelia, $56,000; Teresa, $76,000

B) Ofelia, $60,000; Teresa, $72,000

C) Ofelia, $72,000; Teresa, $60,000

D) Ofelia, $64,000; Teresa, $68,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jackson and Campbell have capital balances of $100,000 and $300,000 respectively. Jackson devotes full time and Campbell one-half time to the business. Determine the division of $150,000 of net income in ratio of time devoted to business.

A) $75,000 and $75,000

B) $37,500 and $112,500

C) $100,000 and $50,000

D) $112,500 and $37,500

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Xavier and Yolanda have original investments of $50,000 and $100,000 respectively in a partnership. The articles of partnership include the following provisions regarding the division of net income: interest on original investment at 20%, salary allowances of $27,000 and $18,000 respectively, and the remainder equally. How much of the net income of $91,000 is allocated to Yolanda?

A) $26,500

B) $46,000

C) $45,000

D) $45,500

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tomas and Saturn are partners who share income in the ratio of 3:1. Their capital balances are $80,000 and $120,000 respectively. Income Summary has a credit balance of $30,000. What is Saturn's capital balance after closing Income Summary to Capital?

A) $102,500

B) $120,000

C) $112,500

D) $127,500

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

If a new partner is to be admitted to a partnership and a bonus is attributed to the old partnership, the bonus should be divided between the capital accounts of the original partners according to their capital balances.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If nothing is stated, partnership income is divided in proportion to the individual partner's capital balance.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If enough partnership cash or other assets are available to pay the withdrawing partner, a liability may be created for the amount owed the withdrawing partner.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Partners Ken and Macki each have a $40,000 capital balance and share income and losses in a 3:2. Cash equals $20,000, noncash assets equal $120,000, and liabilities equal $60,000. If the noncash assets are sold for $80,000, the Macki's capital account will

A) decrease by $16,000.

B) decrease by $24,000.

C) increase by $24,000.

D) decrease by $40,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Calvin-Dogwood Partnership owns inventory that was purchased for $90,000, has a current replacement cost of $85,900, and is priced to sell for $125,000. At what amount should the inventory be recorded in the accounts of the new partnership if Alexis is to be admitted?

A) $129,100

B) $85,900

C) $90,000

D) $125,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The balance sheet of Morgan and Rockwell was as follows immediately prior to the partnership's being liquidated: cash, $20,000; other assets, $160,000; liabilities, $40,000; Morgan capital, $60,000; Rockwell capital, $80,000. The other assets were sold for $139,000. Morgan and Rockwell share profits and losses in a 2:1 ratio. As a final cash distribution from the liquidation, Morgan will receive cash totaling

A) $46,000

B) $51,000

C) $60,000

D) $49,500

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

X sells to A one-half of a partnership capital interest that totals $70,000 for $40,000. A's capital account in the partnership should be credited for $40,000.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A partnership is subject to federal income taxes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Xavier and Yolanda have original investments of $50,000 and $100,000 respectively in a partnership. The articles of partnership include the following provisions regarding the division of net income: interest on original investment at 20%, salary allowances of $34,000 and $26,000 respectively, and the remainder equally. How much of the net income of $100,000 is allocated to Xavier?

A) $49,000

B) $51,000

C) $50,000

D) $56,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Xavier and Yolonda have original investments of $50,000 and $100,000 respectively in a partnership. The articles of partnership include the following provisions regarding the division of net income: interest on original investment at 10%, salary allowances of $27,000 and $18,000 respectively, and the remainder equally. How much of the net income of $40,000 is allocated to Xavier?

A) $20,000

B) $22,000

C) $32,000

D) $0

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 190

Related Exams