A) debenture bond.

B) zero coupon bond.

C) term bond.

D) bond indenture.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation issues for cash $2,000,000 of 8%, 15-year bonds, interest payable annually, at a time when the market rate of interest is 7%. The straight-line method is adopted for the amortization of bond discount or premium. Which of the following statements is true?

A) The carrying amount increases from its amount at issuance date to $2,000,000 at maturity.

B) The carrying amount decreases from its amount at issuance date to $2,000,000 at maturity.

C) The amount of annual interest paid to bondholders increases over the 15-year life of the bonds.

D) The amount of annual interest expense decreases as the bonds approach maturity.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

If bonds of $1,000,000 with unamortized discount of $10,000 are redeemed at 98, the gain on redemption of bonds is $10,000.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An installment note is a debt that requires the borrower to make equal periodic payments to the lender for the term of the note.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When there are material differences between the results of using the straight-line method and using the effective interest method of amortization, the effective interest method should be used.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

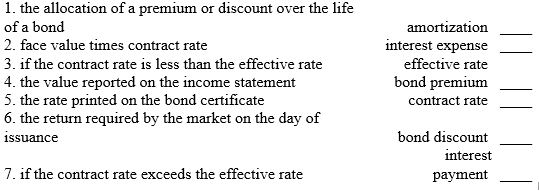

Match the following terms to the most appropriate answer:

Correct Answer

verified

Correct Answer

verified

True/False

Bonds may be purchased directly from the issuing corporation or through one of the bond exchanges.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The issue price of zero-coupon bonds is the present value of their face amount.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The present value of an annuity is the sum of the present values of each cash flow.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If $2,000,000 of 10% bonds are issued at 95, the amount of cash received from the sale is

A) $2,200,000

B) $2,000,000

C) $2,100,000

D) $1,900,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If $500,000 of 10-year bonds, with interest payable semiannually, are sold for $494,040 based on (1) the present value of $500,000 due in 20 periods at 5% plus (2) the present value of twenty, $25,000 payments at 5%, the nominal or contract rate and the market rate of interest for the bonds are both 10%.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the straight-line method of amortization of bond premium or discount is used, which of the following statements is true?

A) Annual interest expense will increase over the life of the bonds with the amortization of bond premium.

B) Annual interest expense will remain the same over the life of the bonds with the amortization of bond discount.

C) Annual interest expense will decrease over the life of the bonds with the amortization of bond discount.

D) Annual interest expense will increase over the life of the bonds with the amortization of bond discount.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Prepare an amortization schedule for the 1st 2 years (effective method) using the following data:

1. On January 1, 2010, ABC Co. issued $2,000,000, 5%, 10 year bonds, interest payable on June 30th and December 31st to yield 6%. Use the following format and round to nearest dollar (may have small rounding error). The bonds were issued for $1,851,234.

2. Show how this bond would be reported on the balance sheet at 12/31/11.

2. Show how this bond would be reported on the balance sheet at 12/31/11.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bonds that are subject to retirement at a stated dollar amount prior to maturity at the option of the issuer are called

A) debentures

B) callable bonds.

C) early retirement bonds.

D) options.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the market rate of interest is 8%, the price of 6% bonds paying interest semiannually with a face value of $250,000 will be

A) Equal to $250,000

B) Greater than $250,000

C) Less than $250,000

D) Greater than or less than $250,000, depending on the maturity date of the bonds

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the market rate of interest was 11%, Munson Corporation issued $1,000,000, 12%, 8-year bonds that pay interest semiannually. The selling price of this bond issue was

A) $1,052,310

B) $1,154,387

C) $1,000,000

D) $ 720,495

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

To determine the six month interest payment amount on a bond, you would take one-half of the market rate times the face value of the bond.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Bonds of major corporations are traded on bond exchanges.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The adjusting entry to record the amortization of a discount on bonds payable is

A) debit Discount on Bonds Payable, credit Interest Expense

B) debit Interest Expense, credit Discount on Bonds Payable

C) debit Interest Expense, credit Cash

D) debit Bonds Payable, credit Interest Expense

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

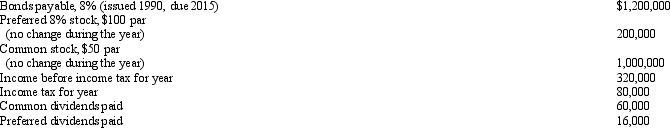

Balance sheet and income statement data indicate the following:  Based on the data presented above, what is the number of times bond interest charges were earned (round to two decimal places) ?

Based on the data presented above, what is the number of times bond interest charges were earned (round to two decimal places) ?

A) 5.67

B) 4.33

C) 3.24

D) 3.50

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 185

Related Exams