A) stock price.

B) cost of equity.

C) cost of debt.

D) cost of preferred stock.

E) earnings per share (EPS) .

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

It is possible that two firms could have identical financial and operating leverage, yet have different degrees of risk as measured by the variability of EPS.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT, holding other things constant?

A) An increase in the personal tax rate is likely to increase the debt ratio of the average corporation.

B) If changes in the bankruptcy code make bankruptcy less costly to corporations, then this would likely reduce the debt ratio of the average corporation.

C) An increase in the company's degree of operating leverage is likely to encourage a company to use more debt in its capital structure.

D) An increase in the corporate tax rate is likely to encourage a company to use more debt in its capital structure.

E) Firms whose assets are relatively liquid tend to have relatively low bankruptcy costs, hence they tend to use relatively little debt.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The capital structure that minimizes the interest rate on debt also maximizes the expected EPS.

B) The capital structure that minimizes the required return on equity also maximizes the stock price.

C) The capital structure that minimizes the WACC also maximizes the price per share of common stock.

D) The capital structure that gives the firm the best credit rating also maximizes the stock price.

E) The capital structure that maximizes expected EPS also maximizes the price per share of common stock.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Daylight Solutions is considering a recapitalization that would increase its debt ratio and increase its interest expense.The company would issue new bonds and use the proceeds to buy back shares of its common stock.The company's CFO thinks the plan will not change total assets or operating income, but that it will increase earnings per share (EPS) .Assuming the CFO's estimates are correct, which of the following statements is CORRECT?

A) If the plan reduces the WACC, the stock price is also likely to decline.

B) Since the plan is expected to increase EPS, this implies that net income is also expected to increase.

C) If the plan does increase the EPS, the stock price will automatically increase at the same rate.

D) Under the plan there will be more bonds outstanding, and that will increase their liquidity and thus lower the interest rate on the currently outstanding bonds.

E) Since the proposed plan increases Daylight's financial risk, the company's stock price still might fall even if EPS increases.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

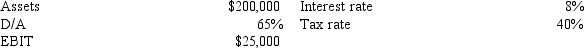

Refer to Exhibit 15.4.The firm is considering moving to a capital structure that is comprised of 40% debt and 60% equity, based on market values.The new funds would be used to replace the old debt and to repurchase stock.It is estimated that the increase in risk resulting from the additional leverage would cause the required rate of return on debt to rise to 7%, while the required rate of return on equity would rise to 9.5%.If this plan were carried out, what would be AJC's new WACC and total value?

A) 7.38%; $800, 008

B) 7.38%; $813, 008

C) 7.50%; $813, 008

D) 7.50%; $790, 008

E) 7.80%; $790, 008

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to Exhibit 15.1.Assume that PP is considering changing from its original capital structure to a new capital structure with 35% debt and 65% equity.This results in a weighted average cost of capital equal to 9.4% and a new value of operations of $510, 638.Assume PP raises $178, 723 in new debt and purchases T-bills to hold until it makes the stock repurchase.What is the stock price per share immediately after issuing the debt but prior to the repurchase?

A) $45.90

B) $48.12

C) $51.06

D) $53.33

E) $58.75

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on the information below for Benson Corporation, what is the optimal capital structure?

A) Debt = 50%; Equity = 50%; EPS = $3.05; Stock price = $28.90.

B) Debt = 60%; Equity = 40%; EPS = $3.18; Stock price = $31.20.

C) Debt = 80%; Equity = 20%; EPS = $3.42; Stock price = $30.40.

D) Debt = 70%; Equity = 30%; EPS = $3.31; Stock price = $30.00.

E) Debt = 40%; Equity = 60%; EPS = $2.95; Stock price = $26.50.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two operationally similar companies, HD and LD, have identical amounts of assets, operating income (EBIT) , tax rates, and business risk.Company HD, however, has a much higher debt ratio than LD.Company HD's basic earning power ratio (BEP) exceeds its cost of debt (rd) .Which of the following statements is CORRECT?

A) Company HD has a higher times interest earned (TIE) ratio than Company LD.

B) Company HD has a higher return on equity (ROE) than Company LD, and its risk, as measured by the standard deviation of ROE, is also higher than LD's.

C) The two companies have the same ROE.

D) Company HD's ROE would be higher if it had no debt.

E) Company HD has a higher return on assets (ROA) than Company LD.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to Exhibit 15.4.What is AJC's current total market value and weighted average cost of capital?

A) $600, 000; 7.5%

B) $600, 000; 8.0%

C) $800, 000; 7.0%

D) $800, 000; 7.5%

E) $800, 000; 8.0%

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Financial risk refers to the extra risk stockholders bear as a result of using debt as compared with the risk they would bear if no debt were used.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a firm lowered its fixed costs while increasing its variable costs, holding total costs at the present level of sales constant, this would decrease its operating leverage.

B) The debt ratio that maximizes EPS generally exceeds the debt ratio that maximizes share price.

C) If a company were to issue debt and use the money to repurchase common stock, this action would have no impact on its basic earning power ratio.(Assume that the repurchase has no impact on the company's operating income.)

D) If changes in the bankruptcy code made bankruptcy less costly to corporations, this would likely reduce the average corporation's debt ratio.

E) Increasing financial leverage is one way to increase a firm's basic earning power (BEP) .

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If debt financing is used, which of the following is CORRECT?

A) The percentage change in net operating income will be equal to a given percentage change in net income.

B) The percentage change in net income relative to the percentage change in net operating income will depend on the interest rate charged on debt.

C) The percentage change in net income will be greater than the percentage change in net operating income.

D) The percentage change in sales will be greater than the percentage change in EBIT, which in turn will be greater than the percentage change in net income.

E) The percentage change in net operating income will be greater than a given percentage change in net income.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The factors that affect a firm's business risk are affected by industry characteristics and economic conditions.Unfortunately, these factors are generally beyond the control of the firm's management.

B) One of the benefits to a firm of being at or near its target capital structure is that this eliminates any risk of bankruptcy.

C) A firm's financial risk can be minimized by diversification.

D) The amount of debt in its capital structure can under no circumstances affect a company's business risk.

E) A firm's business risk is determined solely by the financial characteristics of its industry.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hernandez Corporation expects to have the following data during the coming year.What is Hernandez's expected ROE?

A) 12.51%

B) 13.14%

C) 13.80%

D) 14.49%

E) 15.21%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to Exhibit 15.4.Now assume that AJC is considering changing from its original capital structure to a new capital structure that results in a stock price of $64 per share.The resulting capital structure would have a $336, 000 total market value of equity and a $504, 000 market value of debt.How many shares would AJC repurchase in the recapitalization?

A) 4, 250

B) 4, 500

C) 4, 750

D) 5, 000

E) 5, 250

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to Exhibit 15.2.What would the stock price be if VF issued the new debt and immediately used the proceeds to repurchase stock?

A) $49.43

B) $50.70

C) $52.00

D) $53.33

E) $56.00

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Companies HD and LD have identical tax rates, total assets, and basic earning power ratios, and their basic earning power exceeds their before-tax cost of debt, rd.However, Company HD has a higher debt ratio and thus more interest expense than Company LD.Which of the following statements is CORRECT?

A) Company HD has a lower ROA than Company LD.

B) Company HD has a lower ROE than Company LD.

C) The two companies have the same ROA.

D) The two companies have the same ROE.

E) Company HD has a higher net income than Company LD.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Whenever a firm borrows money, it is using financial leverage.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The trade-off theory states that the capital structure decision involves a tradeoff between the costs and benefits of debt financing.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 72

Related Exams