B) False

Correct Answer

verified

Correct Answer

verified

True/False

To determine the amount of additional funds needed (AFN), you may subtract the expected increase in liabilities, which represents a source of funds, from the sum of the expected increases in retained earnings and assets, both of which are uses of funds.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

As a firm's sales grow, its current assets also tend to increase.For instance, as sales increase, the firm's inventories generally increase, and purchases of inventories result in more accounts payable.Thus, spontaneous liabilities that reduce AFN arise from transactions brought on by sales increases.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Baron Enterprises had $350 million of sales, and it had $270 million of fixed assets that were used at 65% of capacity last year.In millions, by how much could Baron's sales increase before it is required to increase its fixed assets?

A) $170.09

B) $179.04

C) $188.46

D) $197.88

E) $207.78

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

One of the first steps in arriving at a firm's forecasted financial statements is a review of industry-average operating ratios relative to these same ratios for the firm to determine whether changes to the ratios need to be made.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Two firms with identical capital intensity ratios are generating the same amount of sales.However, Firm A is operating at full capacity, while Firm B is operating below capacity.If the two firms expect the same growth in sales during the next period, then Firm A is likely to need more additional funds than Firm B, other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a firm wants to maintain its ratios at their existing levels, then if it has a positive sales growth rate of any amount, it will require some amount of external funding.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Companies with relatively high assets-to-sales ratios require a relatively large amount of new assets for any given increase in sales; hence, they have a greater need for external financing.There are currently no alternatives for these types of firms to lower their asset requirements.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a firm's capital intensity ratio (A?*/S?)decreases as sales increase, use of the AFN formula is likely to understate the amount of additional funds required, other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Marston, Inc.has developed a forecasting model to estimate its AFN for the upcoming year.All else being equal, which of the following factors is most likely to lead to an increase of the additional funds needed (AFN) ?

A) A switch to a just-in-time inventory system and outsourcing production.

B) The company reduces its dividend payout ratio.

C) The company switches its materials purchases to a supplier that sells on terms of 1/5, net 90, from a supplier whose terms are 3/15, net 35.

D) The company discovers that it has excess capacity in its fixed assets.

E) A sharp increase in its forecasted sales.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Spontaneous funds are generally defined as follows:

A) A forecasting approach in which the forecasted percentage of sales for each item is held constant.

B) Funds that a firm must raise externally through short-term or long-term borrowing and/or by selling new common or preferred stock.

C) Funds that arise out of normal business operations from its suppliers, employees, and the government, and they include immediate increases in accounts payable, accrued wages, and accrued taxes.

D) The amount of cash raised in a given year minus the amount of cash needed to finance the additional capital expenditures and working capital needed to support the firm's growth.

E) Assets required per dollar of sales.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) When fixed assets are added in large, discrete units as a company grows, the assumption of constant ratios is more appropriate than if assets are relatively small and can be added in small increments as sales grow.

B) Firms whose fixed assets are "lumpy" frequently have excess capacity, and this should be accounted for in the financial forecasting process.

C) For a firm that uses lumpy assets, it is impossible to have small increases in sales without expanding fixed assets.

D) There are economies of scale in the use of many kinds of assets.When economies occur the ratios are likely to remain constant over time as the size of the firm increases.The Economic Ordering Quantity model for establishing inventory levels demonstrates this relationship.

E) When we use the AFN equation, we assume that the ratios of assets and liabilities to sales (A0*/S0 and L0*/S0) vary from year to year in a stable, predictable manner.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The fact that long-term debt and common stock are raised infrequently and in large amounts lessens the need for the firm to forecast those accounts on a continual basis.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Firms with high capital intensity ratios have found ways to lower this ratio permitting them to achieve a given level of growth with fewer assets and consequently less external capital.For example, just-in-time inventory systems, multiple shifts for labor, and outsourcing production are all feasible ways for firms to reduce their capital intensity ratios.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year National Aeronautics had a FA/Sales ratio of 40%, comprised of $250 million of sales and $100 million of fixed assets.However, its fixed assets were used at only 75% of capacity.Now the company is developing its financial forecast for the coming year.As part of that process, the company wants to set its target Fixed Assets/Sales ratio at the level it would have had had it been operating at full capacity.What target FA/Sales ratio should the company set?

A) 28.5%

B) 30.0%

C) 31.5%

D) 33.1%

E) 34.7%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

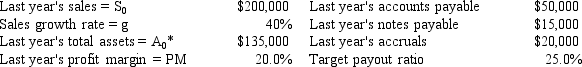

In your internship with Lewis, Lee, & Taylor Inc.you have been asked to forecast the firm's additional funds needed (AFN) for next year.The firm is operating at full capacity.Data for use in your forecast are shown below.Based on the AFN equation, what is the AFN for the coming year?

A) -$14, 440

B) -$15, 200

C) -$16, 000

D) -$16, 800

E) -$17, 640

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A firm's AFN must come from external sources.Typical sources include short-term bank loans, long-term bonds, preferred stock, and common stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The first, and perhaps the most critical, step in forecasting financial requirements is to forecast future sales.

B) Forecasted financial statements, as discussed in the text, are used primarily as a part of the managerial compensation program, where management's historical performance is evaluated.

C) The capital intensity ratio gives us an idea of the physical condition of the firm's fixed assets.

D) The AFN equation produces more accurate forecasts than the forecasted financial statement method, especially if fixed assets are lumpy, economies of scale exist, or if excess capacity exists.

E) Perhaps the most important step when developing forecasted financial statements is to determine the breakdown of common equity between common stock and retained earnings.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Suppose a firm is operating its fixed assets at below 100% of capacity, but it has no excess current assets.Based on the AFN equation, its AFN will be larger than if it had been operating with excess capacity in both fixed and current assets.

B) If a firm retains all of its earnings, then it cannot require any additional funds to support sales growth.

C) Additional funds needed (AFN) are typically raised using a combination of notes payable, long-term debt, and common stock.Such funds are non-spontaneous in the sense that they require explicit financing decisions to obtain them.

D) If a firm has a positive free cash flow, then it must have either a zero or a negative AFN.

E) Since accounts payable and accrued liabilities must eventually be paid off, as these accounts increase, AFN as calculated by the AFN equation must also increase.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a firm's assets are growing at a positive rate, but its retained earnings are not increasing, then it would be impossible for the firm's AFN to be negative.

B) If a firm increases its dividend payout ratio in anticipation of higher earnings, but sales and earnings actually decrease, then the firm's actual AFN must, mathematically, exceed the previously calculated AFN.

C) Higher sales usually require higher asset levels, and this leads to what we call AFN.However, the AFN will be zero if the firm chooses to retain all of its profits, i.e., to have a zero dividend payout ratio.

D) Dividend policy does not affect the requirement for external funds based on the AFN equation.

E) The sustainable growth rate is the maximum achievable growth rate without the firm having to raise external funds.In other words, it is the growth rate at which the firm's AFN equals zero.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 41

Related Exams