B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If the calculated beta underestimates the firm's true investment risk¾i.e., if the forward-looking beta that investors think exists exceeds the historical beta¾then the CAPM method based on the historical beta will produce an estimate of rs and thus WACC that is too high.

B) Beta measures market risk, which is, theoretically, the most relevant risk measure for a publicly-owned firm that seeks to maximize its intrinsic value.This is true even if not all of the firm's stockholders are well diversified.

C) An advantage shared by both the DCF and CAPM methods when they are used to estimate the cost of equity is that they are both "objective" as opposed to "subjective, " hence little or no judgment is required.

D) The specific risk premium used in the CAPM is the same as the risk premium used in the bond-yield-plus-risk-premium approach.

E) The discounted cash flow method of estimating the cost of equity cannot be used unless the growth rate, g, is expected to be constant forever.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Avery Corporation's target capital structure is 35% debt, 10% preferred, and 55% common equity.The interest rate on new debt is 6.50%, the yield on the preferred is 6.00%, the cost of common from reinvested earnings is 11.25%, and the tax rate is 40%.The firm will not be issuing any new common stock.What is Avery's WACC?

A) 8.15%

B) 8.48%

C) 8.82%

D) 9.17%

E) 9.54%

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The CEO of Harding Media Inc.as asked you to help estimate its cost of common equity.You have obtained the following data: D? = $0.85; P? = $22.00; and g = 6.00% (constant) .The CEO thinks, however, that the stock price is temporarily depressed, and that it will soon rise to $40.00.Based on the DCF approach, by how much would the cost of common from reinvested earnings change if the stock price changes as the CEO expects?

A) -1.49%

B) -1.66%

C) -1.84%

D) -2.03%

E) -2.23%

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The cost of common equity obtained by retaining earnings is the rate of return the marginal stockholder requires on the firm's common stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that you are an intern with the Brayton Company, and you have collected the following data: The yield on the company's outstanding bonds is 7.75%; its tax rate is 40%; the next expected dividend is $0.65 a share; the dividend is expected to grow at a constant rate of 6.00% a year; the price of the stock is $15.00 per share; the flotation cost for selling new shares is F = 10%; and the target capital structure is 45% debt and 55% common equity.What is the firm's WACC, assuming it must issue new stock to finance its capital budget?

A) 6.89%

B) 7.26%

C) 7.64%

D) 8.04%

E) 8.44%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The text identifies three methods for estimating the cost of common stock from reinvested earnings (not newly issued stock): the CAPM method, the DCF method, and the bond-yield-plus-risk-premium method.Since we cannot be sure that the estimate obtained with any of these methods is correct, it is often appropriate to use all three methods, then consider all three estimates, and end up using a judgmental estimate when calculating the WACC.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The cost of equity raised by retaining earnings can be less than, equal to, or greater than the cost of external equity raised by selling new issues of common stock, depending on tax rates, flotation costs, the attitude of investors, and other factors.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT a capital component when calculating the weighted average cost of capital (WACC) for use in capital budgeting?

A) Accounts payable.

B) Common stock "raised" by reinvesting earnings.

C) Common stock raised by new issues.

D) Preferred stock.

E) Long-term debt.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The DCF model is generally preferred by academics and financial executives over other models for estimating the cost of equity.This is because of the DCF model's logical appeal and also because accurate estimates for its key inputs, the dividend yield and the growth rate, are easy to obtain.

B) The bond-yield-plus-risk-premium approach to estimating the cost of equity may not always be accurate, but it has the advantage that its two key inputs, the firm's own cost of debt and its risk premium, can be found by using standardized and objective procedures.

C) Surveys indicate that the CAPM is the most widely used method for estimating the cost of equity.However, other methods are also used because CAPM estimates may be subject to error, and people like to use different methods as checks on one another.If all of the methods produce similar results, this increases the decision maker's confidence in the estimated cost of equity.

D) The DCF model is preferred by academics and finance practitioners over other cost of capital models because it correctly recognizes that the expected return on a stock consists of a dividend yield plus an expected capital gains yield.

E) Although some methods used to estimate the cost of equity are subject to severe limitations, the CAPM is a simple, straightforward, and reliable model that consistently produces accurate cost of equity estimates.In particular, academics and corporate finance people generally agree that its key inputs¾beta, the risk-free rate, and the market risk premium¾can be estimated with little error.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If expectations for long-term inflation rose, but the slope of the SML remained constant, this would have a greater impact on the required rate of return on equity, rs, than on the interest rate on long-term debt, rd, for most firms.Therefore, the percentage point increase in the cost of equity would be greater than the increase in the interest rate on long-term debt.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Trahern Baking Co.common stock sells for $32.50 per share.It expects to earn $3.50 per share during the current year, its expected dividend payout ratio is 65%, and its expected constant dividend growth rate is 6.0%.New stock can be sold to the public at the current price, but a flotation cost of 5% would be incurred.What would be the cost of equity from new common stock?

A) 12.70%

B) 13.37%

C) 14.04%

D) 14.74%

E) 15.48%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You were recently hired by Garrett Design, Inc.to estimate its cost of common equity.You obtained the following data: D? = $1.75; P? = $42.50; g = 7.00% (constant) ; and F = 5.00%.What is the cost of equity raised by selling new common stock?

A) 10.77%

B) 11.33%

C) 11.90%

D) 12.50%

E) 13.12%

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As the assistant to the CFO of Johnstone Inc., you must estimate its cost of common equity.You have been provided with the following data: D? = $0.80; P? = $22.50; and g = 8.00% (constant) .Based on the DCF approach, what is the cost of common from reinvested earnings?

A) 10.69%

B) 11.25%

C) 11.84%

D) 12.43%

E) 13.05%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The cost of debt, rd, is normally less than rs, so rd(1 - T)will normally be much less than rs.Therefore, as long as the firm is not completely debt financed, the weighted average cost of capital (WACC)will normally be greater than rd(1 - T).

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The cost of perpetual preferred stock is found as the preferred's annual dividend divided by the market price of the preferred stock.No adjustment is needed for taxes because preferred dividends, unlike interest on debt, is not deductible by the issuing firm.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

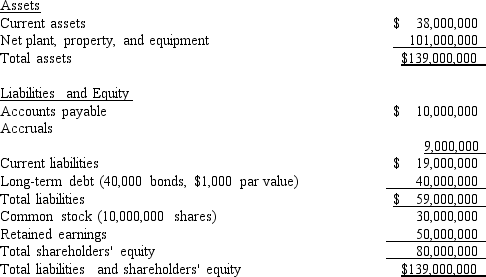

Exhibit 9.1

The Collins Group, a leading producer of custom automobile accessories, has hired you to estimate the firm's weighted average cost of capital.The balance sheet and some other information are provided below.

The stock is currently selling for $15.25 per share, and its noncallable $1, 000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00.The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%.The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years.The firm's tax rate is 40%.

-Refer to Exhibit 9.1.Based on the CAPM, what is the firm's cost of common stock?

The stock is currently selling for $15.25 per share, and its noncallable $1, 000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00.The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%.The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years.The firm's tax rate is 40%.

-Refer to Exhibit 9.1.Based on the CAPM, what is the firm's cost of common stock?

A) 11.15%

B) 11.73%

C) 12.35%

D) 13.00%

E) 13.65%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bloom and Co.has no debt or preferred stock¾it uses only equity capital, and has two equally-sized divisions.Division X's cost of capital is 10.0%, Division Y's cost is 14.0%, and the corporate (composite) WACC is 12.0%.All of Division X's projects are equally risky, as are all of Division Y's projects.However, the projects of Division X are less risky than those of Division Y.Which of the following projects should the firm accept?

A) A Division Y project with a 12% return.

B) A Division X project with an 11% return.

C) A Division X project with a 9% return.

D) A Division Y project with an 11% return.

E) A Division Y project with a 13% return.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The text identifies three methods for estimating the cost of common stock from reinvested earnings (not newly issued stock): the CAPM method, the DCF method, and the bond-yield-plus-risk-premium method.However, only the CAPM method always provides an accurate and reliable estimate.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Weatherall Enterprises has no debt or preferred stock¾it is an all-equity firm¾and has a beta of 2.0.The chief financial officer is evaluating a project with an expected return of 14%, before any risk adjustment.The risk-free rate is 5%, and the market risk premium is 4%.The project being evaluated is riskier than an average project, in terms of both its beta risk and its total risk.Which of the following statements is CORRECT?

A) The project should definitely be rejected because its expected return (before risk adjustment) is less than its required return.

B) Riskier-than-average projects should have their expected returns increased to reflect their higher risk.Clearly, this would make the project acceptable regardless of the amount of the adjustment.

C) The accept/reject decision depends on the firm's risk-adjustment policy.If Weatherall's policy is to increase the required return on a riskier-than-average project to 3% over rS, then it should reject the project.

D) Capital budgeting projects should be evaluated solely on the basis of their total risk.Thus, insufficient information has been provided to make the accept/reject decision.

E) The project should definitely be accepted because its expected return (before any risk adjustments) is greater than its required return.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 92

Related Exams