A) These two stocks must have the same dividend yield.

B) These two stocks should have the same expected return.

C) These two stocks must have the same expected capital gains yield.

D) These two stocks must have the same expected year-end dividend.

E) These two stocks should have the same price.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

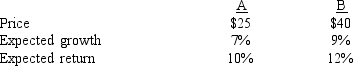

Stocks A and B have the following data.Assuming the stock market is efficient and the stocks are in equilibrium, which of the following statements is CORRECT?

A) The two stocks could not be in equilibrium with the numbers given in the question.

B) A's expected dividend is $0.50.

C) B's expected dividend is $0.75.

D) A's expected dividend is $0.75 and B's expected dividend is $1.20.

E) The two stocks should have the same expected dividend.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Connolly Co.'s expected year-end dividend is D? = $1.60, its required return is rs = 11.00%, its dividend yield is 6.00%, and its growth rate is expected to be constant in the future.What is Connolly's expected stock price in 7 years, i.e., what is  ?

?

A) $37.52

B) $39.40

C) $41.37

D) $43.44

E) $45.61

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Preferred stock is normally expected to provide steadier, more reliable income to investors than the same firm's common stock, and, as a result, the expected after-tax yield on the preferred is lower than the after-tax expected return on the common stock.

B) The preemptive right is a provision in all corporate charters that gives preferred stockholders the right to purchase (on a pro rata basis) new issues of preferred stock.

C) One of the disadvantages to a corporation of owning preferred stock is that 70% of the dividends received represent taxable income to the corporate recipient, whereas interest income earned on bonds would be tax free.

D) One of the advantages to financing with preferred stock is that 70% of the dividends paid out are tax deductible to the issuer.

E) A major disadvantage of financing with preferred stock is that preferred stockholders typically have supernormal voting rights.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hirshfeld Corporation's stock has a required rate of return of 10.25%, and it sells for $57.50 per share.The dividend is expected to grow at a constant rate of 6.00% per year.What is the expected year-end dividend, D??

A) $2.20

B) $2.44

C) $2.69

D) $2.96

E) $3.25

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

National Advertising just paid a dividend of D? = $0.75 per share, and that dividend is expected to grow at a constant rate of 6.50% per year in the future.The company's beta is 1.25, the required return on the market is 10.50%, and the risk-free rate is 4.50%.What is the company's current stock price?

A) $14.52

B) $14.89

C) $15.26

D) $15.64

E) $16.03

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

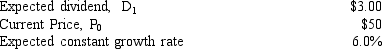

Stock X has the following data.Assuming the stock market is efficient and the stock is in equilibrium, which of the following statements is CORRECT?

A) The stock's expected dividend yield and growth rate are equal.

B) The stock's expected dividend yield is 5%.

C) The stock's expected capital gains yield is 5%.

D) The stock's expected price 10 years from now is $100.00.

E) The stock's required return is 10%.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A stock is expected to pay a year-end dividend of $2.00, i.e., D? = $2.00.The dividend is expected to decline at a rate of 5% a year forever (g = -5%) .If the company is in equilibrium and its expected and required rate of return is 15%, which of the following statements is CORRECT?

A) The company's dividend yield 5 years from now is expected to be 10%.

B) The constant growth model cannot be used because the growth rate is negative.

C) The company's expected capital gains yield is 5%.

D) The company's expected stock price at the beginning of next year is $9.50.

E) The company's current stock price is $20.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Classified stock differentiates various classes of common stock, and using it is one way companies can meet special needs such as when owners of a start-up firm need additional equity capital but don't want to relinquish voting control.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

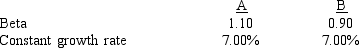

Stocks A and B have the following data.The market risk premium is 6.0% and the risk-free rate is 6.4%.Assuming the stock market is efficient and the stocks are in equilibrium, which of the following statements is CORRECT?

A) Stock A must have a higher dividend yield than Stock B.

B) Stock B's dividend yield equals its expected dividend growth rate.

C) Stock B must have the higher required return.

D) Stock B could have the higher expected return.

E) Stock A must have a higher stock price than Stock B.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If D? = $1.25, g (which is constant) = 4.7%, and P? = $26.00, what is the stock's expected dividend yield for the coming year?

A) 4.12%

B) 4.34%

C) 4.57%

D) 4.81%

E) 5.05%

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The projected cash flow for the next year for Minesuah Inc.is $100, 000, and FCF is expected to grow at a constant rate of 6%.If the company's weighted average cost of capital is 11%, what is the value of its operations?

A) $1, 714, 750

B) $1, 805, 000

C) $1, 900, 000

D) $2, 000, 000

E) $2, 100, 000

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The preemptive right is important to shareholders because it

A) will result in higher dividends per share.

B) is included in every corporate charter.

C) protects the current shareholders against a dilution of their ownership interests.

D) protects bondholders, and thus enables the firm to issue debt with a relatively low interest rate.

E) allows managers to buy additional shares below the current market price.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Free cash flows should be discounted at the firm's weighted average cost of capital to find the value of its operations.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Two firms with the same expected dividend and growth rates must also have the same stock price.

B) It is appropriate to use the constant growth model to estimate a stock's value even if its growth rate is never expected to become constant.

C) If a stock has a required rate of return rs = 12%, and if its dividend is expected to grow at a constant rate of 5%, this implies that the stock's dividend yield is also 5%.

D) The price of a stock is the present value of all expected future dividends, discounted at the dividend growth rate.

E) The constant growth model takes into consideration the capital gains investors expect to earn on a stock.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a firm's expected growth rate increased then its required rate of return would

A) decrease.

B) fluctuate less than before.

C) fluctuate more than before.

D) possibly increase, possibly decrease, or possibly remain constant.

E) increase.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

If a firm's stockholders are given the preemptive right, this means that stockholders have the right to call for a meeting to vote to replace the management.Without the preemptive right, dissident stockholders would have to seek a change in management through a proxy fight.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kelly Enterprises' stock currently sells for $35.25 per share.The dividend is projected to increase at a constant rate of 4.75% per year.The required rate of return on the stock, rs, is 11.50%.What is the stock's expected price 5 years from now?

A) $40.17

B) $41.20

C) $42.26

D) $43.34

E) $44.46

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

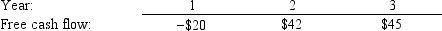

The free cash flows (in millions) shown below are forecast by Simmons Inc.If the weighted average cost of capital is 13% and the free cash flows are expected to continue growing at the same rate after Year 3 as from Year 2 to Year 3, what is the Year 0 value of operations, in millions?

A) $586

B) $617

C) $648

D) $680

E) $714

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT, assuming stocks are in equilibrium?

A) Assume that the required return on a given stock is 13%.If the stock's dividend is growing at a constant rate of 5%, its expected dividend yield is 5% as well.

B) A stock's dividend yield can never exceed its expected growth rate.

C) A required condition for one to use the constant growth model is that the stock's expected growth rate exceeds its required rate of return.

D) Other things held constant, the higher a company's beta coefficient, the lower its required rate of return.

E) The dividend yield on a constant growth stock must equal its expected total return minus its expected capital gains yield.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 80

Related Exams