B) False

Correct Answer

verified

Correct Answer

verified

True/False

The Y-axis intercept of the SML indicates the required return on an individual asset whenever the realized return on an average (b = 1)stock is zero.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock A has a beta = 0.8, while Stock B has a beta = 1.6.Which of the following statements is CORRECT?

A) If the marginal investor becomes more risk averse, the required return on Stock B will increase by more than the required return on Stock A.

B) An equally weighted portfolio of Stocks A and B will have a beta lower than 1.2.

C) If the marginal investor becomes more risk averse, the required return on Stock A will increase by more than the required return on Stock B.

D) If the risk-free rate increases but the market risk premium remains constant, the required return on Stock A will increase by more than that on Stock B.

E) Stock B's required return is double that of Stock A's.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Shirley Paul's 2-stock portfolio has a total value of $100, 000.$37, 500 is invested in Stock A with a beta of 0.75 and the remainder is invested in Stock B with a beta of 1.42.What is her portfolio's beta?

A) 1.17

B) 1.23

C) 1.29

D) 1.35

E) 1.42

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stocks A and B are quite similar: Each has an expected return of 12%, a beta of 1.2, and a standard deviation of 25%.The returns on the two stocks have a correlation of 0.6.Portfolio P has 50% in Stock A and 50% in Stock B.Which of the following statements is CORRECT?

A) Portfolio P has a standard deviation that is greater than 25%.

B) Portfolio P has an expected return that is less than 12%.

C) Portfolio P has a standard deviation that is less than 25%.

D) Portfolio P has a beta that is less than 1.2.

E) Portfolio P has a beta that is greater than 1.2.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The two stocks in your portfolio, X and Y, have independent returns, so the correlation between them, rXY is zero.Your portfolio consists of $50, 000 invested in Stock X and $50, 000 invested in Stock Y.Both stocks have an expected return of 15%, betas of 1.6, and standard deviations of 30%.Which of the following statements best describes the characteristics of your 2-stock portfolio?

A) Your portfolio has a standard deviation less than 30%, and its beta is greater than 1.6.

B) Your portfolio has a beta equal to 1.6, and its expected return is 15%.

C) Your portfolio has a beta greater than 1.6, and its expected return is greater than 15%.

D) Your portfolio has a standard deviation greater than 30% and a beta equal to 1.6.

E) Your portfolio has a standard deviation of 30%, and its expected return is 15%.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In historical data, we see that investments with the highest average annual returns also tend to have the highest standard deviations of annual returns.This observation supports the notion that there is a positive correlation between risk and return.Which of the following answers correctly ranks investments from highest to lowest risk (and return) , where the security with the highest risk is shown first, the one with the lowest risk last?

A) Large-company stocks, small-company stocks, long-term corporate bonds, U.S.Treasury bills, long-term government bonds.

B) Small-company stocks, large-company stocks, long-term corporate bonds, long-term government bonds, U.S.Treasury bills.

C) U.S.Treasury bills, long-term government bonds, long-term corporate bonds, small-company stocks, large-company stocks.

D) Large-company stocks, small-company stocks, long-term corporate bonds, long-term government bonds, U.S.Treasury bills.

E) Small-company stocks, long-term corporate bonds, large-company stocks, long-term government bonds, U.S.Treasury bills.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock A's beta is 1.7 and Stock B's beta is 0.7.Which of the following statements must be true about these securities? (Assume market equilibrium.)

A) Stock B must be a more desirable addition to a portfolio than A.

B) Stock A must be a more desirable addition to a portfolio than B.

C) The expected return on Stock A should be greater than that on B.

D) The expected return on Stock B should be greater than that on A.

E) When held in isolation, Stock A has more risk than Stock B.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

We would almost always find that the beta of a diversified portfolio is less stable over time than the beta of a single security.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stocks A, B, and C are similar in some respects: Each has an expected return of 10% and a standard deviation of 25%.Stocks A and B have returns that are independent of one another; i.e., their correlation coefficient, r, equals zero.Stocks A and C have returns that are negatively correlated with one another; i.e., r is less than 0.Portfolio AB is a portfolio with half of its money invested in Stock A and half in Stock B.Portfolio AC is a portfolio with half of its money invested in Stock A and half invested in Stock C.Which of the following statements is CORRECT?

A) Portfolio AC has an expected return that is greater than 25%.

B) Portfolio AB has a standard deviation that is greater than 25%.

C) Portfolio AB has a standard deviation that is equal to 25%.

D) Portfolio AC has a standard deviation that is less than 25%.

E) Portfolio AC has an expected return that is less than 10%.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

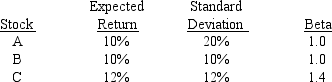

Consider the following information for three stocks, A, B, and C.The stocks' returns are positively but not perfectly positively correlated with one another, i.e., the correlations are all between 0 and 1.

Portfolio AB has half of its funds invested in Stock A and half in Stock B.Portfolio ABC has one third of its funds invested in each of the three stocks.The risk-free rate is 5%, and the market is in equilibrium, so required returns equal expected returns.Which of the following statements is CORRECT?

Portfolio AB has half of its funds invested in Stock A and half in Stock B.Portfolio ABC has one third of its funds invested in each of the three stocks.The risk-free rate is 5%, and the market is in equilibrium, so required returns equal expected returns.Which of the following statements is CORRECT?

A) Portfolio AB's coefficient of variation is greater than 2.0.

B) Portfolio AB's required return is greater than the required return on Stock A.

C) Portfolio ABC's expected return is 10.66667%.

D) Portfolio ABC has a standard deviation of 20%.

E) Portfolio AB has a standard deviation of 20%.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock A's beta is 1.7 and Stock B's beta is 0.7.Which of the following statements must be true, assuming the CAPM is correct.

A) In equilibrium, the expected return on Stock B will be greater than that on Stock A.

B) When held in isolation, Stock A has more risk than Stock B.

C) Stock B would be a more desirable addition to a portfolio than A.

D) In equilibrium, the expected return on Stock A will be greater than that on B.

E) Stock A would be a more desirable addition to a portfolio then Stock B.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Charlie and Lucinda each have $50, 000 invested in stock portfolios.Charlie's has a beta of 1.2, an expected return of 10.8%, and a standard deviation of 25%.Lucinda's has a beta of 0.8, an expected return of 9.2%, and a standard deviation that is also 25%.The correlation coefficient, r, between Charlie's and Lucinda's portfolios is zero.If Charlie and Lucinda marry and combine their portfolios, which of the following best describes their combined $100, 000 portfolio?

A) The combined portfolio's beta will be equal to a simple weighted average of the betas of the two individual portfolios, 1.0; its expected return will be equal to a simple weighted average of the expected returns of the two individual portfolios, 10.0%; and its standard deviation will be less than the simple average of the two portfolios' standard deviations, 25%.

B) The combined portfolio's expected return will be greater than the simple weighted average of the expected returns of the two individual portfolios, 10.0%.

C) The combined portfolio's standard deviation will be greater than the simple average of the two portfolios' standard deviations, 25%.

D) The combined portfolio's standard deviation will be equal to a simple average of the two portfolios' standard deviations, 25%.

E) The combined portfolio's expected return will be less than the simple weighted average of the expected returns of the two individual portfolios, 10.0%.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ann has a portfolio of 20 average stocks, and Tom has a portfolio of 2 average stocks.Assuming the market is in equilibrium, which of the following statements is CORRECT?

A) The required return on Ann's portfolio will be lower than that on Tom's portfolio because Ann's portfolio will have less total risk.

B) Tom's portfolio will have more diversifiable risk, the same market risk, and thus more total risk than Ann's portfolio, but the required (and expected) returns will be the same on both portfolios.

C) If the two portfolios have the same beta, their required returns will be the same, but Ann's portfolio will have less market risk than Tom's.

D) The expected return on Jane's portfolio must be lower than the expected return on Dick's portfolio because Jane is more diversified.

E) Ann's portfolio will have less diversifiable risk and also less market risk than Tom's portfolio.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT? (Assume that the risk-free rate is a constant.)

A) The effect of a change in the market risk premium depends on the slope of the yield curve.

B) If the market risk premium increases by 1%, then the required return on all stocks will rise by 1%.

C) If the market risk premium increases by 1%, then the required return will increase by 1% for a stock that has a beta of 1.0.

D) The effect of a change in the market risk premium depends on the level of the risk-free rate.

E) If the market risk premium increases by 1%, then the required return will increase for stocks that have a beta greater than 1.0, but it will decrease for stocks that have a beta less than 1.0.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If you found a stock with a zero historical beta and held it as the only stock in your portfolio, you would by definition have a riskless portfolio.

B) The beta coefficient of a stock is normally found by regressing past returns on a stock against past market returns.One could also construct a scatter diagram of returns on the stock versus those on the market, estimate the slope of the line of best fit, and use it as beta.However, this historical beta may differ from the beta that exists in the future.

C) The beta of a portfolio of stocks is always larger than the betas of any of the individual stocks.

D) It is theoretically possible for a stock to have a beta of 1.0.If a stock did have a beta of 1.0, then, at least in theory, its required rate of return would be equal to the risk-free (default-free) rate of return, rRF.

E) The beta of a portfolio of stocks is always smaller than the betas of any of the individual stocks.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

It is possible for a firm to have a positive beta, even if the correlation between its returns and those of another firm is negative.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ivan Knobel holds a well-diversified portfolio that has an expected return of 11.0% and a beta of 1.20.He is in the process of buying 1, 000 shares of Syngine Corp at $10 a share and adding it to his portfolio.Syngine has an expected return of 13.0% and a beta of 1.50.The total value of Ivan's current portfolio is $90, 000.What will the expected return and beta on the portfolio be after the purchase of the Syngine stock?

A) 10.64%; 1.17

B) 11.20%; 1.23

C) 11.76%; 1.29

D) 12.35%; 1.36

E) 12.97%; 1.42

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock A has a beta of 0.8 and Stock B has a beta of 1.2.50% of Portfolio P is invested in Stock A and 50% is invested in Stock B.If the market risk premium (rM - rRF) were to increase but the risk-free rate (rRF) remained constant, which of the following would occur?

A) The required return would decrease by the same amount for both Stock A and Stock B.

B) The required return would increase for Stock A but decrease for Stock B.

C) The required return on Portfolio P would remain unchanged.

D) The required return would increase for Stock B but decrease for Stock A.

E) The required return would increase for both stocks but the increase would be greater for Stock B than for Stock A.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

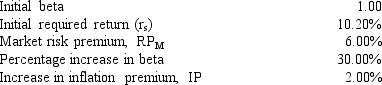

Data for Atwill Corporation is shown below.Now Atwill acquires some risky assets that cause its beta to increase by 30%.In addition, expected inflation increases by 2.00%.What is the stock's new required rate of return?

A) 14.00%

B) 14.70%

C) 15.44%

D) 16.21%

E) 17.02%

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 146

Related Exams