A) 11.34%

B) 11.63%

C) 11.92%

D) 12.22%

E) 12.52%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

If a stock's expected return as seen by the marginal investor exceeds this investor's required return, then the investor will buy the stock until its price has risen enough to bring the expected return down to equal the required return.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A portfolio's risk is measured by the weighted average of the standard deviations of the securities in the portfolio.It is this aspect of portfolios that allows investors to combine stocks and thus reduce the riskiness of their portfolios.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Freedman Flowers' stock has a 50% chance of producing a 25% return, a 30% chance of producing a 10% return, and a 20% chance of producing a -28% return.What is the firm's expected rate of return?

A) 9.41%

B) 9.65%

C) 9.90%

D) 10.15%

E) 10.40%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is most likely to be true for a portfolio of 40 randomly selected stocks?

A) The riskiness of the portfolio is the same as the riskiness of each stock if it was held in isolation.

B) The beta of the portfolio is less than the average of the betas of the individual stocks.

C) The beta of the portfolio is equal to the average of the betas of the individual stocks.

D) The beta of the portfolio is larger than the average of the betas of the individual stocks.

E) The riskiness of the portfolio is greater than the riskiness of each of the stocks if each was held in isolation.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If the price of money (e.g., interest rates and equity capital costs)increases due to an increase in anticipated inflation, the risk-free rate will also increase.If there is no change in investors' risk aversion, then the market risk premium (rM - rRF)will remain constant.Also, if there is no change in stocks' betas, then the required rate of return on each stock as measured by the CAPM will increase by the same amount as the increase in expected inflation.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The slope of the SML is determined by the value of beta.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If the risk-free rate rises, then the market risk premium must also rise.

B) If a company's beta is halved, then its required return will also be halved.

C) If a company's beta doubles, then its required return will also double.

D) The slope of the security market line is equal to the market risk premium, (rM - rRF) .

E) Beta is measured by the slope of the security market line.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If markets are in equilibrium, which of the following conditions will exist?

A) Each stock's expected return should equal its required return as seen by the marginal investor.

B) All stocks should have the same expected return as seen by the marginal investor.

C) The expected and required returns on stocks and bonds should be equal.

D) All stocks should have the same realized return during the coming year.

E) Each stock's expected return should equal its realized return as seen by the marginal investor.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

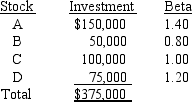

Paul McLaren holds the following portfolio:

Paul plans to sell Stock A and replace it with Stock E, which has a beta of 0.75.By how much will the portfolio beta change?

Paul plans to sell Stock A and replace it with Stock E, which has a beta of 0.75.By how much will the portfolio beta change?

A) -0.190

B) -0.211

C) -0.234

D) -0.260

E) -0.286

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that Federal Reserve actions have caused an increase in the risk-free rate, rRF.Meanwhile, investors are afraid of a recession, so the market risk premium, (rM - rRF) , has increased.Under these conditions, with other things held constant, which of the following statements is most correct?

A) The required return on all stocks would increase, but the increase would be greatest for stocks with betas of less than 1.0.

B) Stocks' required returns would change, but so would expected returns, and the result would be no change in stocks' prices.

C) The prices of all stocks would decline, but the decline would be greatest for high-beta stocks.

D) The prices of all stocks would increase, but the increase would be greatest for high-beta stocks.

E) The required return on all stocks would increase by the same amount.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A firm can change its beta through managerial decisions, including capital budgeting and capital structure decisions.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If you plotted the returns of a company against those of the market and found that the slope of your line was negative, the CAPM would indicate that the required rate of return on the stock should be less than the risk-free rate for a well-diversified investor, assuming that the observed relationship is expected to continue in the future.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If you were restricted to investing in publicly traded common stocks, yet you wanted to minimize the riskiness of your portfolio as measured by its beta, then according to the CAPM theory you should invest an equal amount of money in each stock in the market.That is, if there were 10, 000 traded stocks in the world, the least risky possible portfolio would include some shares of each one.

B) If you formed a portfolio that consisted of all stocks with betas less than 1.0, which is about half of all stocks, the portfolio would itself have a beta coefficient that is equal to the weighted average beta of the stocks in the portfolio, and that portfolio would have less risk than a portfolio that consisted of all stocks in the market.

C) Market risk can be eliminated by forming a large portfolio, and if some Treasury bonds are held in the portfolio, the portfolio can be made to be completely riskless.

D) A portfolio that consists of all stocks in the market would have a required return that is equal to the riskless rate.

E) If you add enough randomly selected stocks to a portfolio, you can completely eliminate all of the market risk from the portfolio.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that during the coming year, the risk free rate, rRF, is expected to remain the same, while the market risk premium (rM - rRF) , is expected to fall.Given this forecast, which of the following statements is CORRECT?

A) The required return on all stocks will remain unchanged.

B) The required return will fall for all stocks, but it will fall more for stocks with higher betas.

C) The required return for all stocks will fall by the same amount.

D) The required return will fall for all stocks, but it will fall less for stocks with higher betas.

E) The required return will increase for stocks with a beta less than 1.0 and will decrease for stocks with a beta greater than 1.0.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock LB has a beta of 0.5 and Stock HB has a beta of 1.5.The market is in equilibrium, with required returns equaling expected returns.Which of the following statements is CORRECT?

A) If both expected inflation and the market risk premium (rM - rRF) increase, the required return on Stock HB will increase by more than that on Stock LB.

B) If both expected inflation and the market risk premium (rM - rRF) increase, the required returns of both stocks will increase by the same amount.

C) Since the market is in equilibrium, the required returns of the two stocks should be the same.

D) If expected inflation remains constant but the market risk premium (rM - rRF) declines, the required return of Stock HB will decline but the required return of Stock LB will increase.

E) If expected inflation remains constant but the market risk premium (rM - rRF) declines, the required return of Stock LB will decline but the required return of Stock HB will increase.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If an investor buys enough stocks, he or she can, through diversification, eliminate all of the diversifiable risk inherent in owning stocks.Therefore, if a portfolio contained all publicly traded stocks, it would be essentially riskless.

B) The required return on a firm's common stock is, in theory, determined solely by its market risk.If the market risk is known, and if that risk is expected to remain constant, then no other information is required to specify the firm's required return.

C) Portfolio diversification reduces the variability of returns (as measured by the standard deviation) of each individual stock held in a portfolio.

D) A security's beta measures its non-diversifiable, or market, risk relative to that of an average stock.

E) A stock's beta is less relevant as a measure of risk to an investor with a well-diversified portfolio than to an investor who holds only that one stock.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

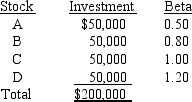

Sherrie Hymes holds a $200, 000 portfolio consisting of the following stocks.The portfolio's beta is 0.875.

If Sherrie replaces Stock A with another stock, E, which has a beta of 1.50, what will the portfolio's new beta be?

If Sherrie replaces Stock A with another stock, E, which has a beta of 1.50, what will the portfolio's new beta be?

A) 1.07

B) 1.13

C) 1.18

D) 1.24

E) 1.30

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Portfolio A has but one stock, while Portfolio B consists of all stocks that trade in the market, each held in proportion to its market value.Because of its diversification, Portfolio B will by definition be riskless.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The CAPM has been thoroughly tested, and the theory has been confirmed beyond any reasonable doubt.

B) If two "normal" or "typical" stocks were combined to form a 2-stock portfolio, the portfolio's expected return would be a weighted average of the stocks' expected returns, but the portfolio's standard deviation would probably be greater than the average of the stocks' standard deviations.

C) If investors become more risk averse, then (1) the slope of the SML would increase and (2) the required rate of return on low-beta stocks would increase by more than the required return on high-beta stocks.

D) An increase in expected inflation, combined with a constant real risk-free rate and a constant market risk premium, would lead to identical increases in the required returns on a riskless asset and on an average stock, other things held constant.

E) A graph of the SML as applied to individual stocks would show required rates of return on the vertical axis and standard deviations of returns on the horizontal axis.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 146

Related Exams