A) 7.32

B) 7.70

C) 8.09

D) 8.49

E) 8.92

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Chambliss Corp.'s total assets at the end of last year were $305, 000 and its EBIT was 62, 500.What was its basic earning power (BEP) ?

A) 18.49%

B) 19.47%

C) 20.49%

D) 21.52%

E) 22.59%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Companies Heidee and Leaudy have the same total assets, sales, operating costs, and tax rates, and they pay the same interest rate on their debt.However, company Heidee has a higher debt ratio.Which of the following statements is CORRECT?

A) If the interest rate the companies pay on their debt is less than their basic earning power (BEP) , then Company Heidee will have the higher ROE.

B) Given this information, Leaudy must have the higher ROE.

C) Company Leaudy has a higher basic earning power ratio (BEP) .

D) Company Heidee has a higher basic earning power ratio (BEP) .

E) If the interest rate the companies pay on their debt is more than their basic earning power (BEP) , then Company Heidee will have the higher ROE.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

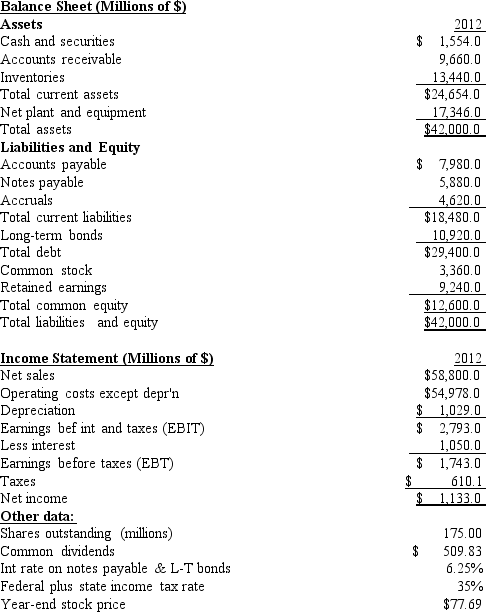

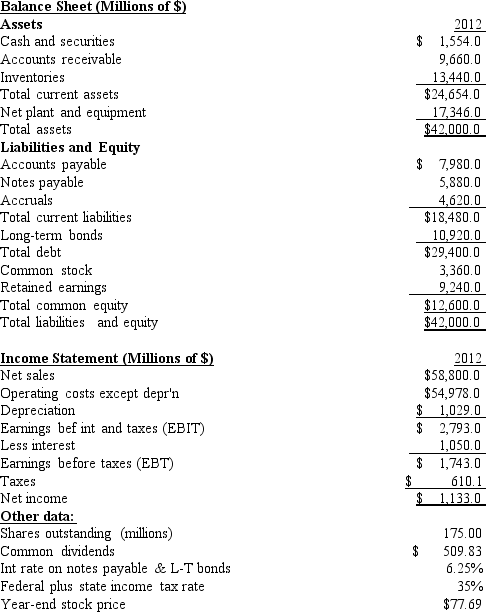

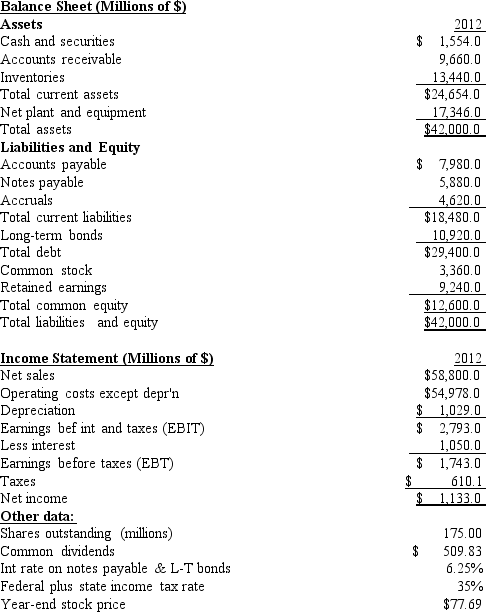

Exhibit 3.1

The balance sheet and income statement shown below are for Pettijohn Inc.Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to Exhibit 3.1.What is the firm's book value per share?

-Refer to Exhibit 3.1.What is the firm's book value per share?

A) $61.73

B) $64.98

C) $68.40

D) $72.00

E) $75.60

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Firms A and B have the same current ratio, 0.75, the same amount of sales and cost of goods sold, and the same amount of current liabilities.However, Firm A has a higher inventory turnover ratio than B.Therefore, we can conclude that A's quick ratio must be smaller than B's.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Suppose firms follow similar financing policies, face similar risks, have equal access to capital, and operate in competitive product and capital markets.Under these conditions, then firms that have high profit margins will tend to have high asset turnover ratios, and firms with low profit margins will tend to have low turnover ratios.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Aziz Industries has sales of $100, 000 and accounts receivable of $11, 500, and it gives its customers 30 days to pay.The industry average DSO is 27 days, based on a 365-day year.If the company changes its credit and collection policy sufficiently to cause its DSO to fall to the industry average, and if it earns 8.0% on any cash freed-up by this change, how would that affect its net income, assuming other things are held constant?

A) $267.34

B) $281.41

C) $296.22

D) $311.81

E) $328.22

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If two firms differ only in their use of debt¾i.e., they have identical assets, sales, operating costs, and tax rates¾but one firm has a higher debt ratio, the firm that uses more debt will have a higher profit margin on sales.

B) If one firm has a higher debt ratio than another, we can be certain that the firm with the higher debt ratio will have the lower TIE ratio, as that ratio depends entirely on the amount of debt a firm uses.

C) A firm's use of debt will have no effect on its profit margin on sales.

D) If two firms differ only in their use of debt¾i.e., they have identical assets, sales, operating costs, interest rates on their debt, and tax rates¾but one firm has a higher debt ratio, the firm that uses more debt will have a lower profit margin on sales.

E) The debt ratio as it is generally calculated makes an adjustment for the use of assets leased under operating leases, so the debt ratios of firms that lease different percentages of their assets are still comparable.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would indicate an improvement in a company's financial position, holding other things constant?

A) The current and quick ratios both increase.

B) The inventory and total assets turnover ratios both decline.

C) The debt ratio increases.

D) The profit margin declines.

E) The EBITDA coverage ratio declines.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things held constant, which of the following alternatives would increase a company's cash flow for the current year?

A) Increase the number of years over which fixed assets are depreciated for tax purposes.

B) Pay down the accounts payables.

C) Reduce the days' sales outstanding (DSO) without affecting sales or operating costs.

D) Pay workers more frequently to decrease the accrued wages balance.

E) Reduce the inventory turnover ratio without affecting sales or operating costs.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The times-interest-earned ratio is one, but not the only, indication of a firm's ability to meet its long-term and short-term debt obligations.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

One problem with ratio analysis is that relationships can be manipulated.For example, we know that if our current ratio is less than 1.0, then using some of our cash to pay off some of our current liabilities would cause the current ratio to increase and thus make the firm look stronger.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

LeCompte Corp.has $312, 900 of assets, and it uses only common equity capital (zero debt) .Its sales for the last year were $620, 000, and its net income after taxes was $24, 655.Stockholders recently voted in a new management team that has promised to lower costs and get the return on equity up to 15%.What profit margin would LeCompte need in order to achieve the 15% ROE, holding everything else constant?

A) 7.57%

B) 7.95%

C) 8.35%

D) 8.76%

E) 9.20%

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Since the ROA measures the firm's effective utilization of assets (without considering how these assets are financed), two firms with the same EBIT must have the same ROA.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Vang Corp.'s stock price at the end of last year was $33.50 and its earnings per share for the year were $2.30.What was its P/E ratio?

A) 13.84

B) 14.57

C) 15.29

D) 16.06

E) 16.86

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Rosenberg Corp.had $195, 000 of assets, $18, 775 of net income, and a debt-to-total-assets ratio of 32%.Now suppose the new CFO convinces the president to increase the debt ratio to 48%.Sales and total assets will not be affected, but interest expenses would increase.However, the CFO believes that better cost controls would be sufficient to offset the higher interest expense and thus keep net income unchanged.By how much would the change in the capital structure improve the ROE?

A) 4.36%

B) 4.57%

C) 4.80%

D) 5.04%

E) 5.30%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Northwest Lumber had a profit margin of 5.25%, a total assets turnover of 1.5, and an equity multiplier of 1.8.What was the firm's ROE?

A) 12.79%

B) 13.47%

C) 14.18%

D) 14.88%

E) 15.63%

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Altman Corp.had $205, 000 of assets, $303, 500 of sales, $18, 250 of net income, and a debt-to-total-assets ratio of 41%.The new CFO believes the firm has excessive fixed assets and inventory that could be sold, enabling it to reduce its total assets to $152, 500.Sales, costs, and net income would not be affected, and the firm would maintain the 41% debt ratio.By how much would the reduction in assets improve the ROE?

A) 4.69%

B) 4.93%

C) 5.19%

D) 5.45%

E) 5.73%

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 3.1

The balance sheet and income statement shown below are for Pettijohn Inc.Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to Exhibit 3.1.What is the firm's days sales outstanding? Assume a 360-day year for this calculation.

-Refer to Exhibit 3.1.What is the firm's days sales outstanding? Assume a 360-day year for this calculation.

A) 48.17

B) 50.71

C) 53.38

D) 56.19

E) 59.14

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 3.1

The balance sheet and income statement shown below are for Pettijohn Inc.Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to Exhibit 3.1.What is the firm's EBITDA coverage?

-Refer to Exhibit 3.1.What is the firm's EBITDA coverage?

A) 3.29

B) 3.46

C) 3.64

D) 3.82

E) 4.01

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 104

Related Exams