A) common stock

B) common stock distributable

C) donated capital

D) treasury stock

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Characteristics of a corporation include

A) shareholders who are mutual agents

B) direct management by the shareholders (owners)

C) its inability to own property

D) shareholders who have limited liability

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

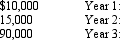

Sabas Company has 20,000 shares of $100 par, 1% cumulative preferred stock and 100,000 shares of $50 par common stock. The following amounts were distributed as dividends:

Determine the dividends per share for preferred and common stock for each year.

Determine the dividends per share for preferred and common stock for each year.

Correct Answer

verified

Correct Answer

verified

True/False

The stock dividends distributable account is listed in the current liability section of the balance sheet.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One of the main disadvantages of the corporate form is the

A) professional management

B) double taxation of dividends

C) charter

D) corporation must issue stock

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A corporation has 12,000 shares of $20 par value stock outstanding that has a current market value of $150. If the corporation issues a 4-for-1 stock split, the market value of the stock will fall to approximately $50.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not true of a corporation?

A) It may enter into binding legal contracts in its own name.

B) It may sue and be sued.

C) The acts of its owners bind the corporation.

D) It may buy, own, and sell property.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The charter of a corporation provides for the issuance of 100,000 shares of common stock. Assume that 45,000 shares were originally issued and 5,000 were subsequently reacquired. What is the number of shares outstanding?

A) 5,000

B) 45,000

C) 40,000

D) 50,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Organizational expenses are classified as intangible assets on the balance sheet.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The excess of sales price of treasury stock over its cost should be credited to

A) Treasury Stock Receivable

B) Premium on Capital Stock

C) Paid-In Capital from Sale of Treasury Stock

D) Income from Sale of Treasury Stock

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Under the Internal Revenue Code, corporations are required to pay federal income taxes.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The reduction in the par or stated value of common stock, accompanied by the issuance of a proportionate number of additional shares, is called a stock split.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

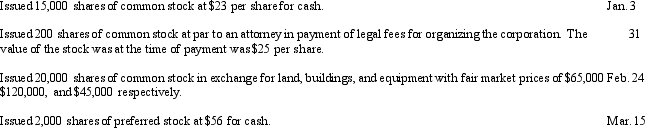

A corporation was organized on January 1 of the current year, with an authorization of 20,000 shares of $4 preferred stock, $12 par, and 100,000 shares of $3 par common stock.

The following selected transactions were completed during the first year of operations:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a prerequisite to paying a cash dividend?

A) formal action by the board of directors

B) market value in excess of par value per share

C) sufficient cash

D) sufficient retained earnings

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Par value

A) is the monetary value assigned per share in the corporate charter.

B) represents what a share of stock is worth.

C) represents the original selling price for a share of stock.

D) is established for a share of stock after it is issued.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a stock dividend is declared, which of the following accounts is credited?

A) Common Sock

B) Dividend Payable

C) Stock Dividends Distributable

D) Retained Earnings

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Retained earnings

A) is the same as contributed capital

B) cannot have a debit balance

C) changes are summarized in the retained earnings statement

D) is equal to cash on hand

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

On April 10, Maranda Corporation issued for cash 11,000 shares of no-par common stock at $25. On May 5, Maranda issued at par 1,000 shares of 4%, $50 par preferred stock for cash. On May 25, Maranda issued for cash 15,000 shares of 4%, $50 par preferred stock at $55. Journalize the entries to record the April 10, May 5, and May 25 transactions.

Correct Answer

verified

Correct Answer

verified

True/False

When the board of director's declares a cash or stock dividend, this action decreases retained earnings.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The retained earnings statement may be combined with the income statement.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 168

Related Exams