B) False

Correct Answer

verified

Correct Answer

verified

Essay

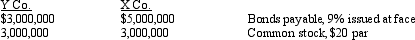

Two companies are financed as follows:

Income tax is estimated at 40% of income.

Determine for each company the earnings per share of common stock, assuming that the income before bond interest and income taxes is $1,500,000 each.

Income tax is estimated at 40% of income.

Determine for each company the earnings per share of common stock, assuming that the income before bond interest and income taxes is $1,500,000 each.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Victor Corporation issues 1,000, 10-year, 8%, $1,000 bonds dated January 1, 2011, at 96. The journal entry to record the issuance will show a

A) debit to Cash of $1,000,000.

B) credit to Discount on Bonds Payable for $40,000.

C) credit to Bonds Payable for $960,000.

D) debit to Cash for $960,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Marx Company issued $100,000 of 12% bonds on April 1, 2010 at face value. The bonds pay interest semiannually on January 1 and July 1. The bonds are dated January 1, 2010, and mature on January 1, 2014. The total interest expense related to these bonds for the year ended December 31, 2010 is

A) $1,000

B) $3,000

C) $9,000

D) 12,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The prices of bonds are quoted as a percentage of the bonds' market value.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If bonds are issued at a premium, the stated interest rate is

A) higher than the market rate of interest.

B) lower than the market rate of interest.

C) too low to attract investors.

D) adjusted to a higher rate of interest.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

On the first day of the fiscal year, a company issues a $1,000,000, 7%, 5 year bond that pays semi-annual interest of $35,000 ($1,000,000 x 7% x 1/2), receiving cash of $884,171. Journalize the first interest payment and the amortization of the related bond discount using the straight-line method. Round answer to the nearest dollar.

Correct Answer

verified

Correct Answer

verified

True/False

Bondholders claims on the assets of the corporation rank ahead of stockholders.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An unsecured bond is the same as a

A) debenture bond.

B) zero coupon bond.

C) term bond.

D) bond indenture.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the market rate of interest is 8%, the price of 6% bonds paying interest semiannually with a face value of $100,000 will be

A) Equal to $100,000

B) Greater than $100,000

C) Less than $100,000

D) Greater than or less than $100,000, depending on the maturity date of the bonds

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If bonds payable are not callable, the issuing corporation

A) cannot repurchase them before maturity

B) can repurchase them in the open market

C) must get special permission from the SEC to repurchase them

D) is more likely to repurchase them if the interest rates increase

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bonds Payable has a balance of $1,000,000 and Premium on Bonds Payable has a balance of $7,000. If the issuing corporation redeems the bonds at 101, what is the amount of gain or loss on redemption?

A) $3,000 loss

B) $3,000 gain

C) $7,000 loss

D) $7,000 gain

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

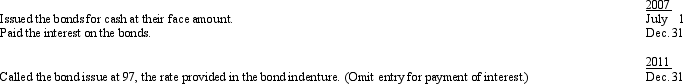

Dennis Corp. issued $2,500,000 of 20-year, 9% callable bonds on July 1, 2007, with interest payable on June 30 and December 31. The fiscal year of the company is the calendar year. Journalize the entries to record the following selected transactions:

Correct Answer

verified

Correct Answer

verified

Essay

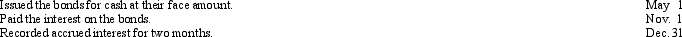

Brubeck Co. issued $10,000,000 of 30-year, 8% bonds on May 1 of the current year, with interest payable on May 1 and November 1. The fiscal year of the company is the calendar year. Journalize the entries to record the following selected transactions for the current year:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the market rate of interest was 11%, Munson Corporation issued $1,000,000, 12%, 8-year bonds that pay interest semiannually. The selling price of this bond issue was

A) $1,052,310

B) $1,154,387

C) $1,000,000

D) $720,495

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, 2011, Zero Company obtained a $52,000, four-year, 6.5% installment note from Regional Bank. The note requires annual payments of $15,179, beginning on December 31, 2011. The December 31, 2013 carrying amount in the amortization table for this installment note will be equal to:

A) $0

B) $13,000

C) $14,252

D) $16,603

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Bonds of major corporations are traded on bond exchanges.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The balance in Discount on Bonds Payable

A) should be reported on the balance sheet as an asset because it has a debit balance

B) should be allocated to the remaining periods for the life of the bonds by the straight-line method, if the results obtained by that method materially differ from the results that would be obtained by the interest method

C) would be added to the related bonds payable to determine the carrying amount of the bonds

D) would be subtracted from the related bonds payable on the balance sheet

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sinking Fund Income is reported in the income statement as

A) income from operations

B) extraordinary

C) gain on sinking fund transactions

D) other income

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The amortization of a premium on bonds payable decreases bond interest expense.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 181

Related Exams