A) gain on the retirement of a bond payable

B) gain from land condemned for public use

C) loss due to an discontinued operation

D) selling treasury stock for more than the company paid for it

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on the following data for the current year, what is the number of days' sales in inventory?

A) 50.1

B) 45.3

C) 24.7

D) 29.9

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

In the vertical analysis of a balance sheet, the base for current liabilities is total liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The excess of current assets over current liabilities is referred to as working capital.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the following sales data for a company: What is the percentage increase in sales from 2011 to 2012?

A) 100%

B) 80%

C) 180%

D) 44.4%

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A financial statement showing each item on the statement as a percentage of one key item on the statement is called common-sized financial statements.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on the following data for the current year, what is the number of days' sales in accounts receivable?

A) 7.3

B) 2.5

C) 14.6

D) 25

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

In computing the ratio of net sales to assets, long-term investments are excluded from average total assets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following should be reported net of the related income tax effect on the income statement?

A) sale of an inventory item at a loss

B) loss due to theft

C) loss due to a discontinued operations of the business

D) sale of a temporary investment at a loss

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In horizontal analysis, each item is expressed as a percentage of the

A) base year figure.

B) retained earnings figure.

C) total assets figure.

D) net income figure.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company with working capital of $500,000 and a current ratio of 2.5 pays a $85,000 short-term liability. The amount of working capital immediately after payment is

A) $585,000

B) $415,000

C) $500,000

D) $85,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

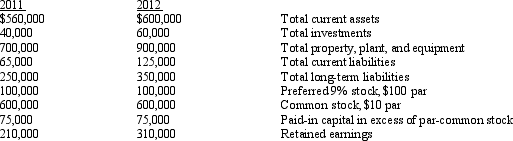

The balance sheets at the end of each of the first two years of operations indicate the following:  If net income is $115,000 and interest expense is $30,000 for 2012 what is the rate earned on total assets for 2012 (round percent to one decimal point) ?

If net income is $115,000 and interest expense is $30,000 for 2012 what is the rate earned on total assets for 2012 (round percent to one decimal point) ?

A) 9.3%

B) 10.1%

C) 8.0%

D) 7.4%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

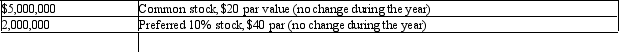

The following information was taken from the financial statement of Fox Resources for December 31 of the current fiscal year:

The net income was $600,000 and the declared dividends on the common stock were $125,000 for the current year. The market price of the common stock is $20 per share.

Required:

Calculate for the common stock:

(1) earnings per share

(2) the price-earnings ratio

(3) the dividends per share and the dividend yield.

Round to one decimal place except earnings per share, which should be rounded to two decimal places.

The net income was $600,000 and the declared dividends on the common stock were $125,000 for the current year. The market price of the common stock is $20 per share.

Required:

Calculate for the common stock:

(1) earnings per share

(2) the price-earnings ratio

(3) the dividends per share and the dividend yield.

Round to one decimal place except earnings per share, which should be rounded to two decimal places.

Correct Answer

verified

Correct Answer

verified

Essay

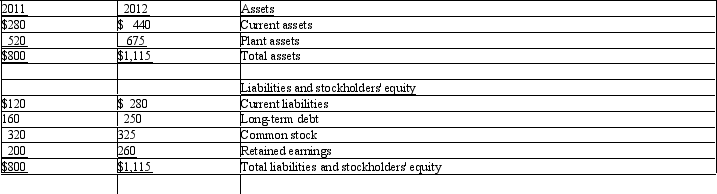

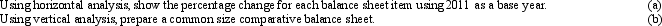

The comparative balance sheet of Ramos Company appears below:

(a) RAMOS COMPANY

Comparative Balance Sheet

December 31, 2012 and 2011

Instructions

Instructions

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would appear as an extraordinary item on the income statement?

A) loss resulting from the sale of fixed assets

B) gain resulting from the disposal of a segment of the business

C) loss from land condemned for public use

D) liquidating dividend

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Assuming that the quantities of inventory on hand during the current year were sufficient to meet all demands for sales, a decrease in the inventory turnover for the current year when compared with the turnover for the preceding year indicates an improvement in inventory management.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Unusual items affecting the current period's income statement consist of changes in accounting principles and discontinued operations.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A 15% change in sales will result in a 15% change in net income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is required by the Sarbanes-Oxley Act of 2002?

A) A price-earnings ratio.

B) A report on internal control.

C) A vertical analysis.

D) A common-sized statement.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

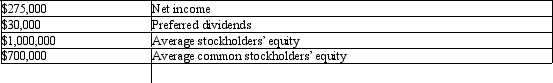

A company reports the following:

Determine the (a) rate earned on stockholders' equity, and (b) rate earned on common stockholders' equity. Round your answer to one decimal place.

Determine the (a) rate earned on stockholders' equity, and (b) rate earned on common stockholders' equity. Round your answer to one decimal place.

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 184

Related Exams