A) $970

B) $650

C) $300

D) $620

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A buyer who acquires merchandise under credit terms of 1/10, n/30 has 30days after the invoice date to take advantage of the cash discount.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The seller records the sales tax as part of the sales amount.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When comparing a retail business to a service business, the financial statement that changes the most is the

A) balance sheet

B) income statement

C) retained earnings statement

D) statement of cash flows

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When comparing a retail business to a service business, the financial statement that changes the least is the

A) balance sheet

B) income statement

C) retained earnings statement

D) statement of cash flows

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

In the merchandising income statement, sales will be reduced by sales discounts and sales returns and allowances to arrive at net sales.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In a merchandise business, sales minus operating expenses equals net income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The retained earnings statement shows

A) net income, dividends, and beginning and ending retained earnings

B) total assets and beginning and ending retained earnings

C) net income and ending retained earnings only

D) the changes in all stockholders' equity accounts during the period

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the seller is to pay the freight costs of delivering merchandise, the delivery terms are stated as

A) FOB shipping point

B) FOB destination

C) FOB n/30

D) FOB seller

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Discounts taken by a buyer because of early payment are recorded on the seller's accounting records as a(n)

A) purchases discount

B) sales discount

C) trade discount

D) early payment discount

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taking advantage of a 2/10, n/30 purchases discount is equal to a savings yearly rate of approximately

A) 2%

B) 24%

C) 20%

D) 36%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The ratio of net sales to assets measures how effectively a business is using its assets to generate sales.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following accounts usually has a debit balance?

A) Purchase Discounts

B) Sales Tax Payable

C) Allowance for Doubtful Accounts

D) Freight In

F) B) and C)

Correct Answer

verified

Correct Answer

verified

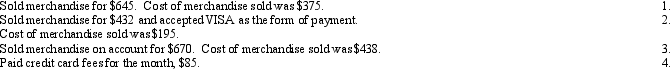

Essay

Journalize the following transactions for the Evans Company. Assume the company uses a perpetual inventory system.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If title to merchandise purchases passes to the buyer when the goods are shipped from the seller, the terms are

A) n/30

B) FOB shipping point

C) FOB destination

D) consigned

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Isaac Co. sells merchandise on credit to Sonar Co in the amount of $9,600. The invoice is dated on April 15 with terms of 1/15, net 45. If Sonar Co. chooses not to take the discount, by when should the payment be made?

A) April 30

B) May 30

C) May 15

D) April 25

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Sales to customers who use bank credit cards, such as MasterCard and VISA, are generally treated as credit sales.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the merchandise costs $5,000, insurance in transit costs $250, tariff costs $75, processing the purchase order by the purchasing department costs $25, and the company receiving dock personnel cost $20, what is the total cost charged to the merchandise?

A) $5,325

B) $5,370

C) $5,350

D) $5,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Service businesses provide services for income, while a merchandising business sells merchandise.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

During the current year, merchandise is sold for $117,500 cash and $241,750 on account. The cost of the merchandise sold is $157,400. What is the amount of the gross profit?

Correct Answer

verified

$201,850 (...View Answer

Show Answer

Correct Answer

verified

View Answer

Showing 81 - 100 of 221

Related Exams