A) $568.74

B) $601.50

C) $660.00

D) $574.90

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During its first year of operations,a company granted employees vacation privileges and pension rights estimated at a cost of $21,500 and $15,000.The vacations are expected to be taken in the next year and the pension rights are expected to be paid in the future 5-30 years.What is the total cost of vacation pay and pension rights to be recognized in the first year?

A) $15,000

B) $36,500

C) $6,500

D) $21,500

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An employee receives an hourly rate of $30,with time and a half for all hours worked in excess of 40 during a week.Payroll data for the current week are as follows: hours worked,48;federal income tax withheld,$300;cumulative earnings for year prior to current week,$90,700;social security tax rate,6.0% on maximum of $100,000;and Medicare tax rate,1.5% on all earnings.What is the net amount to be paid to the employee?

A) $1,032.00

B) $1,143.00

C) $1,053.60

D) $1,166.40

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

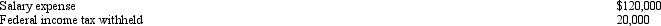

Excel Products Inc.pays its employees semimonthly.The summary of the payroll for December 31,2012 indicated the following:

For the year ended 2012,$40,000 of the December 31 payroll is subject to social security tax of 6%;$120,000 is subject to Medicare tax of 1.5%;$10,000 is subject to state unemployment tax of 4.3% and federal unemployment tax of 0.8%.As of January 1,2013 all of the $120,000 is subject to all payroll taxes.Present the journal entries for payroll tax expense if the employees are paid (a)December 31 of the current year, (b)January 2 of the following year.

For the year ended 2012,$40,000 of the December 31 payroll is subject to social security tax of 6%;$120,000 is subject to Medicare tax of 1.5%;$10,000 is subject to state unemployment tax of 4.3% and federal unemployment tax of 0.8%.As of January 1,2013 all of the $120,000 is subject to all payroll taxes.Present the journal entries for payroll tax expense if the employees are paid (a)December 31 of the current year, (b)January 2 of the following year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

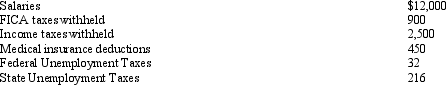

Based on the following data,what is the acid-test ratio,rounded to one decimal point?

A) 3.4

B) 3.0

C) 2.2

D) 1.8

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The total net pay for a period is determined from the payroll register.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

The payroll summary for December 31 for Waters Co.revealed total earnings of $80,000.Earnings subject to 6% social security tax were $60,000;earnings subject to 1.5% Medicare tax were $80,000;and earnings of $3,000 were subject to 4.3% state and 0.8% federal unemployment compensation tax.Journalize the entry to record the accrual of payroll taxes.

Correct Answer

verified

Correct Answer

verified

Essay

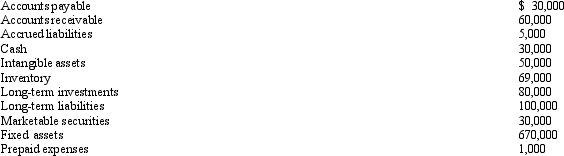

John Woods' weekly gross earnings for the present week were $2,500.Woods has two exemptions.Using $80 value for each exemption,what is Woods' federal income tax withholding?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Chang Co.issued a $50,000,120-day,discounted note to Guarantee Bank.The discount rate is 6%.Assuming a 360-day year,the cash proceeds to Chang Co.are

A) $49,750

B) $47,000

C) $49,000

D) $51,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry a company uses to record the issuance of a discounted note for the purpose of borrowing funds for the business is

A) debit Cash and Interest Expense;credit Notes Payable

B) debit Cash and Interest Payable;credit Notes Payable

C) debit Accounts Payable;credit Notes Payable

D) debit Notes Payable;credit Cash

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On July 8,Alton Co.issued an $80,000,6%,120-day note payable to Seller Co.Assume that the fiscal year of Alton Co.ends July 31.Using the 360-day year in your calculations,what is the amount of interest expense recognized by Alton in the current fiscal year?

A) $1,200.00

B) $106.67

C) $306.67

D) $400.00

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mobile Co.issued a $45,000,60-day,discounted note to Guarantee Bank.The discount rate is 6%.At maturity,assuming a 360-day year,the borrower will pay:

A) $45,450

B) $42,300

C) $45,000

D) $44,550

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to a summary of the payroll of Scotland Company,$450,000 was subject to the 7.0% social security tax and $500,000 was subject to the 1.5% Medicare tax.Federal income tax withheld was $98,000.Also,$15,000 was subject to state (4.2%) and federal (0.8%) unemployment taxes.The journal entry to record accrued salaries would include:

A) a debit to Salary Payable of $313,000

B) a credit to Salary Payable of $363,000

C) a debit to Salary Expense of $363,000

D) a credit to Salary Expense of $313,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming a 360-day year,the interest charged by the bank,at the rate of 9%,on a 90-day,discounted note payable of $100,000 is

A) $9,000

B) $2,250

C) $750

D) $1,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

While separation of duties may play a strong role in the internal control of inventory,it is not significant in controlling payroll.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming a 360-day year,when a $30,000,90-day,5% interest-bearing note payable matures,total payment will amount to:

A) $31,500

B) $1,500

C) $30,375

D) $375

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The detailed record indicating the data for each employee for each payroll period and the cumulative total earnings for each employee is called the

A) payroll register

B) payroll check

C) employee's earnings record

D) employer's earnings record

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following taxes would be deducted in determining an employee's net pay?

A) FUTA taxes

B) SUTA taxes

C) FICA taxes

D) all of the above

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information to answer the following questions.

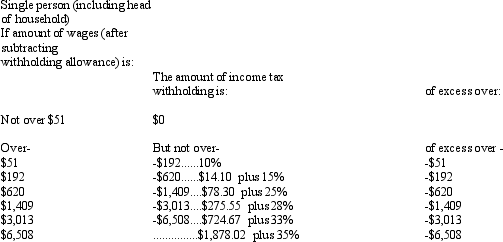

The following totals for the month of April were taken from the payroll register of Magnum Company.

The journal entry to record the monthly payroll on April 30 would include a

The journal entry to record the monthly payroll on April 30 would include a

A) credit to Salaries Payable for $8,150

B) debit to Salaries Expense for $7,902

C) debit to Salaries Payable for $8,150

D) debit to Salaries Payable for $7,902

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

FICA tax is a payroll tax that is paid only by employers.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 171

Related Exams