B) False

Correct Answer

verified

Correct Answer

verified

True/False

Computerized systems can be used to capture accounting information such as accounts receivable, inventory items, accounts payable, and sales.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In a periodic inventory system, the cost of merchandise purchased includes the cost of freight-in.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Sales Returns and Allowances is a contra-revenue account.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

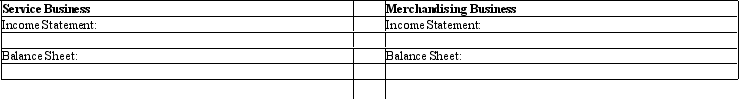

Describe the major differences in preparing the financial statements for a service business and a merchandising business.

Correct Answer

verified

_TB2085_00...

_TB2085_00...View Answer

Show Answer

Correct Answer

verified

View Answer

True/False

The seller records the sales tax as part of the sales amount.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the major difference between a periodic and perpetual inventory system?

A) Under the periodic inventory system, the purchase of inventory will be debited to the Purchases account

B) Under the periodic inventory system, no journal entry is recorded at the time of the sale of inventory for the cost of the inventory.

C) Under the periodic inventory system, all adjustments such as purchases returns and allowances and discounts are reconciled at the end of the month.

D) All are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Who pays the freight cost when the terms are FOB destination?

A) the seller

B) the buyer

C) the customer

D) either the buyer or the seller

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

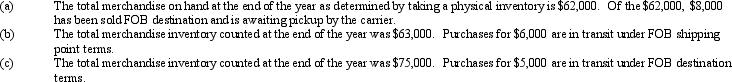

For each of the following, calculate the cost of inventory reported on the balance sheet.

Correct Answer

verified

_TB2085_00...

_TB2085_00...View Answer

Show Answer

Correct Answer

verified

View Answer

True/False

A business using the perpetual inventory system, with its detailed subsidiary records, does need to take a physical inventory.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

As we compare a merchandise business to a service business, the financial statement that changes the most is the Balance Sheet.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Who pays the freight costs when the terms are FOB shipping point?

A) the ultimate customer

B) the buyer

C) the seller

D) either the seller or the buyer

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Sellers and buyers are required to record trade discounts.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Office salaries, depreciation of office equipment, and office supplies are examples of what type of expense?

A) selling expense

B) miscellaneous expense

C) administrative expense

D) other expense

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company using the periodic inventory system has the following account balances: Merchandise Inventory at the beginning of the year, $3,600; Freight-In, $650; Purchases, $10,700; Purchases Returns and Allowances, $1,950; Purchases Discounts, $330. The cost of merchandise purchased is equal to

A) $12,670

B) $9,070

C) $8,420

D) $17,230

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

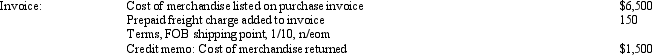

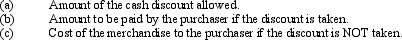

Details of a purchase invoice and related credit memo are summarized as follows:

Assume that the credit memo was received prior to payment and that the invoice is paid within the discount period. Determine the following:

Assume that the credit memo was received prior to payment and that the invoice is paid within the discount period. Determine the following:

Correct Answer

verified

_TB2085_00...

_TB2085_00...View Answer

Show Answer

Correct Answer

verified

View Answer

True/False

In a perpetual inventory system, merchandise returned to vendors reduces the merchandise inventory account.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using a perpetual inventory system, the entry to record the return of merchandise purchased on account includes a

A) debit to Cost of Merchandise Sold

B) credit to Accounts Payable

C) credit to Merchandise Inventory

D) credit to Sales

F) B) and C)

Correct Answer

verified

Correct Answer

verified

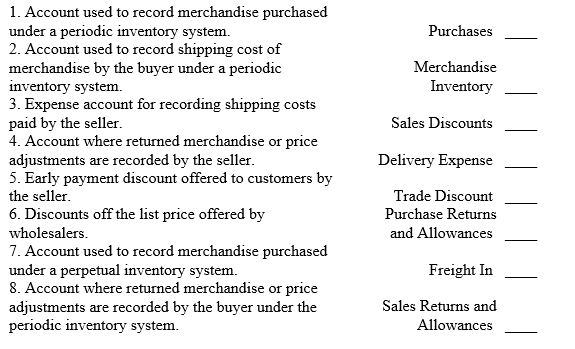

Essay

Match each of the following terms with the appropriate definition below.

Correct Answer

verified

_TB2085_00...

_TB2085_00...View Answer

Show Answer

Correct Answer

verified

View Answer

Matching

Match each of the following definitions with its term.

Correct Answer

Showing 141 - 160 of 218

Related Exams