A) Market Price

B) Cost Price

C) Negotiated Price

D) Variable Price

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mason Corporation had $650,000 in invested assets, sales of $700,000, income from operations amounting to $99,000, and a desired minimum rate of return of 15%. The profit margin for Mason is:

A) 7.1%

B) 20%

C) 15.2%

D) 14.1%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

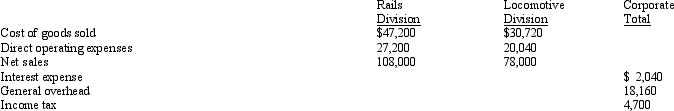

The following financial information was summarized from the accounting records of Train Corporation for the current year ended December 31:  The income from operations for the Locomotive Division is:

The income from operations for the Locomotive Division is:

A) $57,960

B) $14,790

C) $27,240

D) $47,280

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Under the negotiated price approach, the transfer price is the price at which the product or service transferred could be sold to outside buyers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To calculate income from operations, total service department charges are:

A) added to income from operations before service department charges

B) subtracted from operating expenses

C) subtracted from income from operations before service department charges

D) subtracted from gross profit margin

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The objective of transfer pricing is to encourage each division manager to transfer goods and services between divisions if overall company income can be increased by doing so.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The negotiated price approach allows the managers of decentralized units to agree among themselves as to the transfer price.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If divisional income from operations is $100,000, invested assets are $850,000, and the minimum rate of return on invested assets is 8%, the residual income is $68,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not one of the common types of responsibility centers?

A) Cost Center

B) Profit Center

C) Investment Center

D) Revenue Center

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be most effective in a small owner/manager-operated business?

A) Profit centers

B) Centralization

C) Investment centers

D) Cost centers

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Division X of O'Blarney Company has sales of $300,000, cost of goods sold of $120,000, operating expenses of $58,000, and invested assets of $150,000. What is the profit margin for Division X?

A) 81.3%

B) 20.2%

C) 40.7%

D) 60%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A centralized business organization is one in which all major planning and operating decisions are made by top management.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following expenses incurred by a department store is an indirect expense?

A) Insurance on merchandise inventory

B) Sales salaries

C) Depreciation on store equipment

D) Salary of vice-president of finance

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In an investment center, the manager has responsibility and authority for making decisions that affect:

A) costs

B) revenues

C) assets

D) costs, revenues, and assets

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The profit margin for Atlantic Division is 28% and the investment turnover is 2.8. What is the rate of return on investment for Atlantic Division?

A) 20%

B) 28%

C) 14%

D) 78.4%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following is a measure of a manager's performance working in a cost center.

A) budget performance report

B) rate of return and residual income measures

C) divisional income statements

D) balance sheet

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

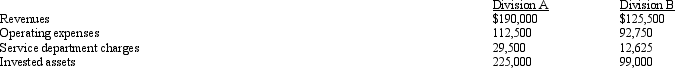

Bentz Co. has two divisions, A and B. Invested assets and condensed income statement data for each division for the past year ended December 31 are as follows:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

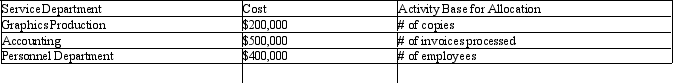

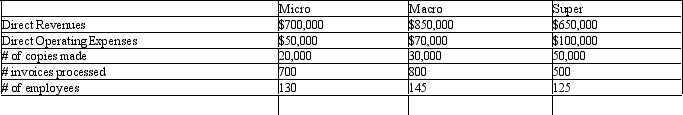

ABC Corporation has three service departments with the following costs and activity base:  ABC has three operating divisions, Micro, Macro and Super. Their revenue, cost and activity information are as follows:

ABC has three operating divisions, Micro, Macro and Super. Their revenue, cost and activity information are as follows:

How much service department cost would be allocated to the Super Division?

How much service department cost would be allocated to the Super Division?

A) $350,000

B) $100,000

C) $125,000

D) $550,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Income from operations of the Commercial Aviation Division is $2,225,000. If income from operations before service department charges is $3,250,000:

A) operating expenses are $1,025,000

B) total service department charges are $1,025,000

C) noncontrollable charges are $1,025,000

D) direct manufacturing charges are $1,025,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Separation of businesses into more manageable operating units is termed decentralization.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 202

Related Exams