A) debit Accounts Payable; credit Notes Payable

B) debit Cash; credit Notes Payable

C) debit Notes Payable; credit Cash

D) debit Cash and Interest Expense; credit Notes Payable

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An aid in internal control over payrolls that indicates employee attendance is

A) time card

B) voucher system

C) payroll register

D) employee's earnings record

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Federal unemployment taxes are paid by the employer and the employee.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Generally, all deductions made from an employee's gross pay are required by law.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

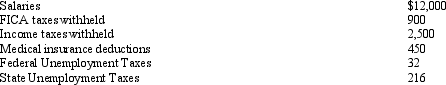

Use the following information to answer the following questions. The following totals for the month of April were taken from the payroll register of Magnum Company.

The entry to record accrual of employer's payroll taxes would include a

The entry to record accrual of employer's payroll taxes would include a

A) debit to Payroll Tax Expense for $248

B) debit to FICA Taxes Payable for $1,800

C) credit to Payroll Tax Expense for $248

D) debit to Payroll Tax Expense for $1,148

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

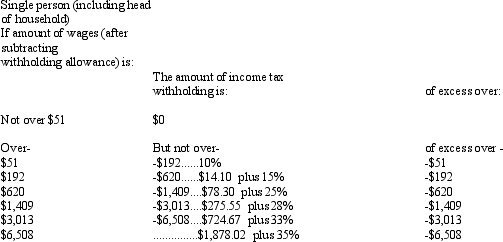

John Woods' weekly gross earnings for the present week were $2,500. Woods has two exemptions. Using $80 value for each exemption, what is Woods' federal income tax withholding?

Correct Answer

verified

Correct Answer

verified

Essay

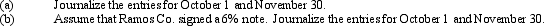

On October 1, Ramos Co. signed a $90,000, 60-day discounted note at the bank. The discount rate was 6%, and the note was paid on November 30. (Assume a 360-day year is used for interest calculations.)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry a company uses to record the payment of an interest-bearing note is

A) debit Cash; credit Notes Payable

B) debit Accounts Payable; credit Cash

C) debit Notes Payable and Interest Expense; credit Cash

D) debit Notes Payable and Interest Receivable; credit Cash

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A current liability is a debt that is reasonably expected to be paid

A) between 6 months and 18 months.

B) out of currently recognized revenues.

C) within one year.

D) out of cash currently on hand.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On October 30, Seba Salon, Inc. issued a 90-day note with a face amount of $60,000 to Reyes Products, Inc. for merchandise inventory. Assuming a 360-day year, determine the proceeds of the note assuming the note is discounted at 8%.

A) $55,200

B) $64,800

C) $58,800

D) $61,200

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would most likely be classified as a current liability?

A) Two-year Notes Payable

B) Bonds Payable

C) Mortgage Payable

D) Unearned Rent

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

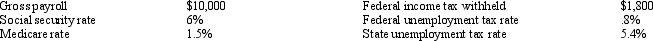

Use the following information to answer the following questions. Assuming no employees are subject to ceilings for their earnings, Jensen Company has the following information for the pay period of January 15 - 31, 20xx.

Salaries Payable would be recorded in the amount of:

Salaries Payable would be recorded in the amount of:

A) $8,200

B) $6,830

C) $8,630

D) $7,450

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The accounting for defined benefit plans is usually very easy and straight forward.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following taxes would be deducted in determining an employee's net pay?

A) FUTA taxes

B) SUTA taxes

C) FICA taxes

D) all of the above

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of federal income taxes withheld from an employee's gross pay is recorded as a(n)

A) payroll expense

B) contra account

C) asset

D) liability

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An employee receives an hourly rate of $40, with time and a half for all hours worked in excess of 40 during a week. Payroll data for the current week are as follows: hours worked, 46; federal income tax withheld, $350; cumulative earnings for year prior to current week, $99,700; social security tax rate, 6.0% on maximum of $100,000; and Medicare tax rate, 1.5% on all earnings. What is the gross pay for the employee?

A) $775.00

B) $1,840.00

C) $1,960.00

D) $1,562.60

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

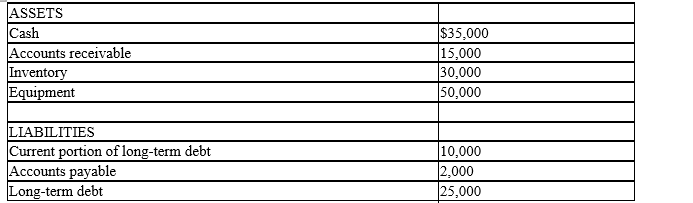

The Crafter Company had the following assets and liabilities as of December 31, 2012:  Determine the quick ratio for the end of the year (rounded to one decimal point) .

Determine the quick ratio for the end of the year (rounded to one decimal point) .

A) 6.7

B) 13.0

C) 4.2

D) 3.5

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The borrower is the one who issues a note payable to a creditor.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

The payroll register of Seaside Architecture Company indicates $970 of Social Security and $257 of Medicare tax withheld on total salaries of $16,500 for the period. Federal withholding for the period totaled $4,235. Provide the journal entry for the period's payroll.

Correct Answer

verified

Correct Answer

verified

True/False

Obligations that depend on past events and that are based on future possible events are contingent liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 174

Related Exams