Correct Answer

verified

Correct Answer

verified

Multiple Choice

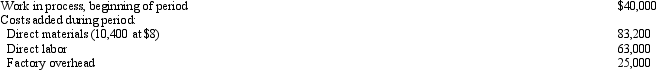

Department G had 3,600 units, 25% completed at the beginning of the period, 11,000 units were completed during the period, 3,000 units were one-fifth completed at the end of the period, and the following manufacturing costs were debited to the departmental work in process account during the period:  Assuming that all direct materials are placed in process at the beginning of production and that the first-in, first-out method of inventory costing is used, what is the total cost of the departmental work in process inventory at the end of the period (round unit cost calculations to four decimal places) ?

Assuming that all direct materials are placed in process at the beginning of production and that the first-in, first-out method of inventory costing is used, what is the total cost of the departmental work in process inventory at the end of the period (round unit cost calculations to four decimal places) ?

A) $16,163

B) $21,432

C) $35,670

D) $28,935

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Carmelita Inc., has the following information available:  At the beginning of the period, there were 500 units in process that were 60 percent complete as to conversion costs and 100 percent complete as to direct materials costs. During the period 4,500 units were started and completed. Ending inventory contained 340 units that were 30 percent complete as to conversion costs and 100 percent complete as to materials costs. (Assume that the company uses the FIFO process cost method. Round cost per unit figures to two cents, i.e. $2.22 when calculating total costs.)

The total costs that will be transferred into Finished Goods for units started and completed were

At the beginning of the period, there were 500 units in process that were 60 percent complete as to conversion costs and 100 percent complete as to direct materials costs. During the period 4,500 units were started and completed. Ending inventory contained 340 units that were 30 percent complete as to conversion costs and 100 percent complete as to materials costs. (Assume that the company uses the FIFO process cost method. Round cost per unit figures to two cents, i.e. $2.22 when calculating total costs.)

The total costs that will be transferred into Finished Goods for units started and completed were

A) $161,775

B) $156,960

C) $162,855

D) $161,505

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Department A had 4,000 units in work in process that were 60% completed as to labor and overhead at the beginning of the period, 29,000 units of direct materials were added during the period, 31,000 units were completed during the period, and 2,000 units were 80% completed as to labor and overhead at the end of the period. All materials are added at the beginning of the process. The first-in, first-out method is used to cost inventories. The number of equivalent units of production for material costs for the period was:

A) 33,000

B) 29,800

C) 29,000

D) 32,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the manufacture of 10,000 units of a product, direct materials cost incurred was $145,800, direct labor cost incurred was $82,000, and applied factory overhead was $45,500. What is the total conversion cost?

A) $127,500

B) $145,800

C) $272,200

D) $273,300

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If a department that applies FIFO process costing starts the reporting period with 50,000 physical units that were 25% complete with respect to direct materials and 40% complete with respect to conversion, it must add 12,500 equivalent units of direct materials and 20,000 equivalent units to direct labor to complete them.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

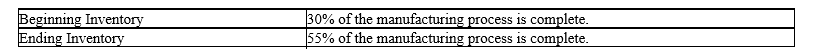

Carolwood Company manufactures widgets and uses process costing. The status of their beginning and ending inventory is as follows:  Direct materials are added to the manufacturing process in stages. None are added when production begins. Approximately 1/2 of the materials are added when the product is 25% complete. The other half is added when the product is 50% complete.

What percentage complete are Beginning Inventory and Ending Inventory with respect to Direct materials(DM) and Conversion Costs(CC) ?

Direct materials are added to the manufacturing process in stages. None are added when production begins. Approximately 1/2 of the materials are added when the product is 25% complete. The other half is added when the product is 50% complete.

What percentage complete are Beginning Inventory and Ending Inventory with respect to Direct materials(DM) and Conversion Costs(CC) ?

A) Beg.Inventory DM-50% CC-30% End.Inventory DM-100% CC-55%

B) Beg.Inventory DM-50% CC-30% End.Inventory DM-55% CC-55%

C) Beg.Inventory DM-30% CC-30% End.Inventory DM-55% CC-55%

D) Beg.Inventory DM-50% CC-70% End.Inventory DM-100% CC-45%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

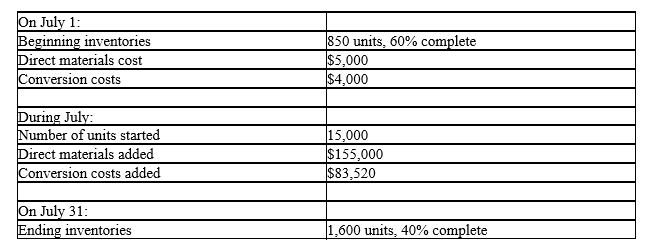

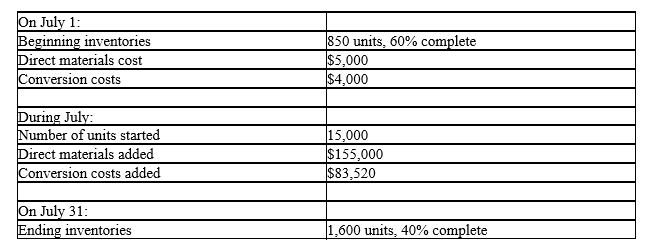

Penny, Inc. employs a process costing system. Direct materials are added at the beginning of the process. Here is information about July's activities:  Using the FIFO method, the cost per equivalent unit for materials used during July was

Using the FIFO method, the cost per equivalent unit for materials used during July was

A) $10.78

B) $10.33

C) $9.78

D) $10.65

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mocha Company manufactures a single product by a continuous process, involving three production departments. The records indicate that direct materials, direct labor, and applied factory overhead for Department 1 were $100,000, $125,000, and $150,000, respectively. The records further indicate that direct materials, direct labor, and applied factory overhead for Department 2 were $55,000, $65,000, and $80,000, respectively. In addition, work in process at the beginning of the period for Department 1 totaled $75,000, and work in process at the end of the period totaled $60,000. The journal entry to record the flow of costs into Department 2 during the period for direct labor is:

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Department E had 4,000 units in Work in Process that were 40% completed at the beginning of the period at a cost of $12,500. Of the $12,500, $8,000 was for material and $4,500 was for conversion costs. 14,000 units of direct materials were added during the period at a cost of $28,700. 15,000 units were completed during the period, and 3,000 units were 75% completed at the end of the period. All materials are added at the beginning of the process. Direct labor was $32,450 and factory overhead was $18,710. If the average cost method is used the conversion cost per unit (to the nearest cent) would be:

A) $3.71

B) $2.84

C) $2.97

D) $3.23

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Companies recognizing the need to simultaneously produce products with high quality, low cost, and instant availability have adopted a just-in-time processing philosophy.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Equivalent units of production are always the same as the total number of physical units finished during the period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Department K had 2,000 units, 40% completed, in process at the beginning of the period, 12,000 units were completed during the period, and 1,200 units were 25% completed at the end of the period, what was the number of equivalent units of production for conversion costs for the period if the first-in, first-out method is used to cost inventories?

A) 11,500

B) 11,200

C) 15,200

D) 10,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Department E had 4,000 units in Work in Process that were 40% completed at the beginning of the period at a cost of $12,500. 14,000 units of direct materials were added during the period at a cost of $28,700. 15,000 units were completed during the period, and 3,000 units were 75% completed at the end of the period. All materials are added at the beginning of the process. Direct labor was $32,450 and factory overhead was $18,710. The number of equivalent units of production for the period for conversion if the average cost method is used to cost inventories was:

A) 15,650

B) 14,850

C) 18,000

D) 17,250

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

If the principal products of a manufacturing process are identical, a process cost system is more appropriate than a job order cost system.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A process cost accounting system records all actual factory overhead costs directly in the Work in Process account.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not included in conversion costs?

A) Direct labor.

B) Factory overhead.

C) Indirect labor.

D) Direct materials.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Which of the following industries would normally use job order costing systems and which would normally use process costing systems? Business consulting Chemicals Food Movie Soap and cosmetics Web designing

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Penny, Inc. employs a process costing system. Direct materials are added at the beginning of the process. Here is information about July's activities:  Using the FIFO method, the number of equivalent units of conversion costs was

Using the FIFO method, the number of equivalent units of conversion costs was

A) 14,400

B) 14,380

C) 14,550

D) 15,850

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

In a process costing system, costs flow into finished goods inventory only from the work in process inventory of the last manufacturing process.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 177

Related Exams