A) $5.00

B) $2.50

C) $6.00

D) $3.00

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the contract rate of interest on bonds is higher than the market rate of interest,the bonds sell at

A) a premium.

B) their face value.

C) their maturity value.

D) a discount.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation has 50,000 shares of $100 par value stock outstanding.If the corporation issues a 4-for-1 stock split,the number of shares outstanding after the split will be

A) 200,000 shares.

B) 50,000 shares.

C) 250,000 shares.

D) 12,500 shares.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The declaration and issuance of a stock dividend does NOT affect the total amount of a corporation's assets,liabilities,or stockholders' equity.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the market rate of interest is 7% and a corporation's bonds bear interest at 8%,the bonds will sell at a premium.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The total earnings of an employee for a payroll period is referred to as the net pay.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The declaration of a stock dividend decreases a corporation's stockholders' equity and decreases its liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The major subdivisions of the Stockholders' Equity section of the balance sheet are

A) Paid-in Capital and Retained Earnings.

B) Common Stock and Retained Earnings.

C) Stock,Paid-In Capital,and Retained Earnings.

D) Common Stock and Preferred Stock.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

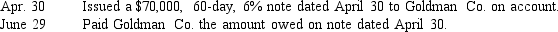

Essay

Illustrate the effects on the accounts and the financial statements of each of the following transactions:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The interest rate specified in the bond indenture is called the

A) discount rate.

B) contract rate.

C) market rate.

D) effective rate.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company sold 200 shares of common stock with a par value of $5 at a price of $13 per share.What is the effect on the accounts of this transaction?

A) Increase cash $2,600;increase retained earnings $2,600

B) Increase cash $1,000;increase common stock $1,000

C) Increase cash $2,600;increase common stock $1,000 and increase paid-in capital $1,600

D) Increase cash $2,600;increase common stock $1,600 and increase paid-in capital $1,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The primary purpose of a stock split is to

A) increase paid-in capital.

B) reduce the market price of the stock per share.

C) increase the market price of the stock per share.

D) increase retained earnings.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

In order to record a contingent liability,the liability must be probable and reasonably estimated.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The charter of a corporation provides for the issuance of 100,000 shares of common stock.Assume that 60,000 shares were originally issued and 5,000 were subsequently reacquired.What is the number of shares outstanding?

A) 5,000

B) 100,000

C) 60,000

D) 55,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The excess of issue price over par of common stock is termed a(n)

A) discount.

B) income.

C) deficit.

D) premium.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An employee receives an hourly rate of $30,with time and a half for all hours worked in excess of 40 during a week.Payroll data for the current week are as follows: hours worked,46;federal income tax withheld,$300;cumulative earnings for year prior to current week,$90,700;social security tax rate,6.0% on maximum of $106,800;and Medicare tax rate,1.5% on all earnings.What is the net pay for the employee?

A) $1,147.95

B) $1,059.75

C) $1,470.00

D) $1,359.75

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When are contingent liabilities required to be recorded?

A) When the liability is probable

B) When the amount is reasonably estimable

C) When the liability becomes legally enforceable

D) Both the liability must be probable and the amount must be reasonably estimable before the contingent liability is recorded.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If 20,000 shares are authorized,14,000 shares are issued,and 500 shares are held as treasury stock,a cash dividend of $1 per share would amount to $13,500.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the market rate of interest on bonds is equal to the contract rate,the bonds will sell at

A) a premium.

B) their face value.

C) a discount.

D) a discount or a premium.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On June 5 Glover Co.issued a $60,000,6%,120-day note payable to Jones Co.How much will Glover Co.have to pay at maturity?

A) $63,600

B) $58,800

C) $60,000

D) $61,200

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 132

Related Exams