A) $60,000 increase

B) $85,000 increase

C) $85,000 decrease

D) $60,000 decrease

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

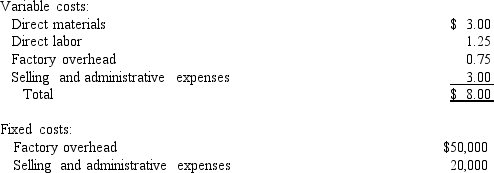

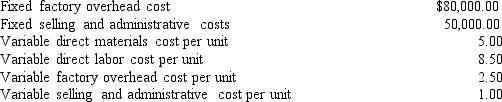

Jarvis Company uses the total cost concept of applying the cost-plus approach to product pricing.The costs and expenses of producing and selling 35,000 units of Product E are as follows:

Jarvis desires a profit equal to a 14% rate of return on invested assets of $450,000.

Jarvis desires a profit equal to a 14% rate of return on invested assets of $450,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

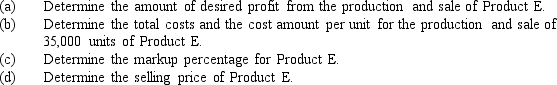

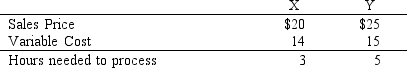

Soap Company manufactures Soap X and Soap Y and can sell all it can make of either.Based on the following data,which statement is true?

A) X is more profitable than Y.

B) Y is more profitable than X.

C) Neither X nor Y have a positive contribution margin.

D) X and Y are equally profitable.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nachos Co.can further process Product J to produce Product D.Product J is currently selling for $12 per pound and costs $9 per pound to produce.Product D would sell for $20 per pound and would require an additional cost of $5 per pound to produce.What is the differential cost of producing Product D?

A) $9 per pound

B) $14 per pound

C) $5 per pound

D) $3 per pound

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Hill Co.can further process Product O to produce Product P.Product O is currently selling for $65 per pound and costs $42 per pound to produce.Product P would sell for $82 per pound and would require an additional cost of $13 per pound to produce. The differential revenue of producing Product P is $82 per pound.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

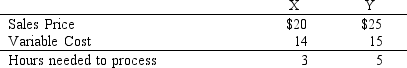

The condensed income statement for a business for the past year is presented as follows:

Management is considering the discontinuance of the manufacture and sale of Product G at the beginning of the current year.The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Products F and H.What is the amount of change in net income for the current year that will result from the discontinuance of Product G?

Management is considering the discontinuance of the manufacture and sale of Product G at the beginning of the current year.The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Products F and H.What is the amount of change in net income for the current year that will result from the discontinuance of Product G?

A) $30,000 decrease

B) $30,000 increase

C) $20,000 decrease

D) $20,000 increase

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is a bottleneck?

A) A narrow area in the plant layout often causing the production process to slow due to the inability of production workers to move the product from station to station

B) A manufacturing strategy used to control the production process by minimizing or eliminating excess inventory

C) The point in the manufacturing process where demand for the product exceeds the ability to produce the product

D) All of these describe a bottleneck in the production process.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A business is considering a cash outlay of $500,000 for the purchase of land,which it intends to lease for $90,000 per year.If alternative investments are available that yield a 12% return,the opportunity cost of the purchase of the land is

A) $60,000.

B) $49,200.

C) $90,000.

D) $30,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Raphael Corporation uses the product cost concept of product pricing.Below is cost information for the production and sale of 50,000 units of its sole product.Raphael desires

a profit equal to a 12% rate of return on invested assets of $1,000,000.

-The dollar amount of desired profit from the production and sale of the company's product is

-The dollar amount of desired profit from the production and sale of the company's product is

A) $117,600.

B) $250,000.

C) $120,000.

D) $245,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A cost that will NOT be affected by later decisions is termed a

A) historical cost.

B) differential cost.

C) sunk cost.

D) replacement cost.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The theory of constraints is a manufacturing strategy that focuses on reducing the influence of bottlenecks on a process.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Paul's Delivery Service is considering selling one of its smaller trucks that is no longer needed in the business.The truck originally cost $23,000 and has accumulated depreciation of $10,000.The truck can be sold for $14,000.Another company is interested in leasing the truck.It will pay $4,800 per year for three years.Paul's Delivery Service will continue to pay the taxes and license fees for the truck,but all other expenses will be paid by the lessee.Management assumes the expenses for the taxes and license will be $300 per year.Which of the following statements is correct?

A) Paul's Delivery Service should sell the truck because the differential loss from leasing is $500.

B) Paul's Delivery Service should lease the truck because the differential income from leasing is $12,200.

C) Paul's Delivery Service should lease the truck because the differential income from leasing is $300.

D) Paul's Delivery Service is indifferent as to whether the company should lease or sell the truck because there is no differential income or loss between the alternatives.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

In deciding whether to accept business at a special price,the short- run price should be set high enough to cover all costs and expenses,plus provide a reasonable amount for profit.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Pull Company is considering the disposal of equipment that is no longer needed for operations.The equipment originally cost $600,000,and accumulated depreciation to date totals $460,000.An offer has been received to lease the machine for its remaining useful life for a total of $300,000,after which the equipment will have no salvage value.The repair,insurance,and property tax expenses during the period of the lease are estimated at $75,800.Alternatively,the equipment can be sold through a broker for $230,000 less a 10% commission. Prepare a differential analysis report,dated June 15 of the current year,on whether the equipment should be leased or sold.

Correct Answer

verified

Correct Answer

verified

True/False

When standard costs are used in applying the cost-plus approach to product pricing,the standards should be based upon ideal levels of performance.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In addition to the differential costs in an equipment replacement decision,the remaining useful life of the old equipment and the estimated life of the new equipment are important considerations.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The unit selling price for the company's product is

A) $17.00.

B) $13.94.

C) $20.06.

D) $20.96.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Matthews Company is considering replacing equipment that originally cost $250,000 and that has $225,000 accumulated depreciation to date.A new machine will cost $500,000,and the old equipment can be sold for $6,000.What is the sunk cost in this situation?

A) $225,000

B) $25,000

C) $250,000

D) $0

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

In using the total cost concept of applying the cost-plus approach to product pricing,only profit is covered in the markup.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Soap Company manufactures Soap X and Soap Y and can sell all it can make of either.Based on the following data,if Soap could reduce the processing time for X by 10%,which of the following statements is true?

A) It would take 162 minutes to process one unit of X.

B) There would be no difference in the contribution margin per hour as compared to it before the processing time reduction.

C) The contribution margin per hour for X would be $2.

D) Soap Y would still be the most profitable.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 102

Related Exams