A) $10,000 decrease

B) $40,000 decrease

C) $10,000 increase

D) $70,000 decrease

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

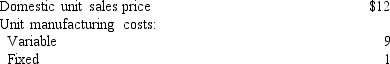

A business received an offer from an exporter for 5,000 units of product at $10 per unit.

The acceptance of the offer will not affect normal production or domestic sales prices.

The following data are available:

-What is the amount of gain or loss from acceptance of the offer?

-What is the amount of gain or loss from acceptance of the offer?

A) $5,000 gain

B) $10,000 loss

C) $5,000 loss

D) $10,000 gain

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If the total unit cost of manufacturing Product Y is currently $40 and the total unit cost after modifying the style is estimated to be $48,the differential cost for this situation is $8.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Opportunity cost is the amount of increase or decrease in revenue that would result from the best available alternative to the proposed use of cash or its equivalent.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Granger Co.can further process Product B to produce Product C.Product B is currently selling for $55 per pound and costs $42 per pound to produce.Product C would sell for $82 per pound and would require an additional cost of $13 per pound to produce.What is The differential revenue of producing and selling Product C?

A) $15 per pound

B) $42 per pound

C) $45 per pound

D) $27 per pound

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Defense contractors would be more likely to use which of the following cost concepts in pricing their product?

A) Variable cost

B) Product cost

C) Total cost

D) Fixed cost

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that Marlow Co.is considering disposing of equipment that cost $200,000 and has $160,000 of accumulated depreciation to date.Marlow Co.can sell the equipment through a broker for $100,000 less 5% commission.Alternatively,Minton Co.has offered to lease the equipment for five years for a total of $195,000.Marlow will incur repair,insurance,and property tax expenses estimated at $40,000.At lease-end,the equipment is expected to have no residual value.The net differential income from the lease alternative is

A) $55,000.

B) $20,000.

C) $100,000.

D) $60,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Manufacturers must conform to the Robinson-Patman Act,which prohibits price discrimination within the United States unless differences in prices can be justified by different costs of serving different customers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In using the total cost concept of applying the cost-plus approach to product pricing,what is included in the markup?

A) Total selling and administrative expenses plus desired profit

B) Total fixed manufacturing costs,total fixed selling and administrative expenses,and desired profit

C) Total costs plus desired profit

D) Desired profit

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When a product or segment of a business is determined to be generating a loss,the total income from operations for the company will always increase if management eliminates the product or segment.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Hill Co.can further process Product O to produce Product P.Product O is currently selling for $65 per pound and costs $42 per pound to produce.Product P would sell for $82 per pound and would require an additional cost of $13 per pound to produce. The differential cost of producing Product P is $56 per pound.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The unit selling price for the company's product is

A) $19.70.

B) $17.50.

C) $24.50.

D) $22.00.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When evaluating whether to lease or sell equipment,book value is considered to be a cost of selling the equipment.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What pricing method may be used if there are several providers in the same market and there is sufficient demand for your product?

A) Demand-based method

B) Total cost method

C) Cost-plus method

D) Competition-based method

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Whiteville Co.can further process Product B to produce Product C.Product B is currently selling for $45 per pound and costs $30 per pound to produce.Product C would sell for $80 per pound and would require an additional cost of $18 per pound to produce.What is the differential cost of producing Product C?

A) $30 per pound

B) $18 per pound

C) $17 per pound

D) $12 per pound

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A practical approach that is frequently used by managers when setting normal long-run prices is the

A) cost-plus approach.

B) economic theory approach.

C) price graph approach.

D) market price approach.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

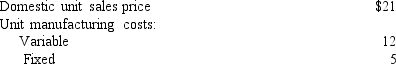

A business received an offer from an exporter for 10,000 units of product at $13.50 per unit.The acceptance of the offer will not affect normal production or domestic sales prices.

The following data are available:

What is the amount of the gain or loss from acceptance of the offer?

What is the amount of the gain or loss from acceptance of the offer?

A) $75,000 loss

B) $40,000 gain

C) $15,000 gain

D) $85,000 gain

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Hill Co.can further process Product O to produce Product P.Product O is currently selling for $60 per pound and costs $42 per pound to produce.Product P would sell for $82 per pound and would require an additional cost of $13 per pound to produce. The differential cost of producing Product P is $13 per pound.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Product J is one of the many products manufactured and sold by Gooble Company.An income statement by product line for the past year indicated a net loss for Product J of $7,250.This net loss resulted from sales of $265,000,cost of goods sold of $186,500,and operating expenses of $85,750.It is estimated that 30% of the cost of goods sold represents fixed factory overhead costs and that 40% of the operating expense is fixed.If Product J is retained,the revenue,costs,and expenses are not expected to change significantly from those of the current year.However,because of the net loss,management is considering the elimination of the unprofitable endeavor.Because of the large number of products manufactured,the total fixed costs and expenses are not expected to decline significantly if Product J is discontinued. Prepare a differential analysis report,dated February 8 of the current year,on the proposal to discontinue Product J.

Correct Answer

verified

Correct Answer

verified

True/False

Eliminating a product or segment may have the long-term effect of reducing fixed costs.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 102

Related Exams