B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation issues for cash $9,000,000 of 8%,30-year bonds,interest payable semiannually.The amount received for the bonds will be

A) present value of 60 semiannual interest payments of $360,000,plus present value of $9,000,000 to be repaid in 30 years

B) present value of 30 annual interest payments of $720,000

C) present value of 30 annual interest payments of $360,000,plus present value of $9,000,000 to be repaid in 30 years

D) present value of $9,000,000 to be repaid in 30 years,less present value of 60 semiannual interest payments of $360,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The interest expense recorded on an interest payment date is increased

A) only if the market rate of interest is less than the stated rate of interest on that date

B) by the amortization of premium on bonds payable

C) by the amortization of discount on bonds payable

D) only if the bonds were sold at face value

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

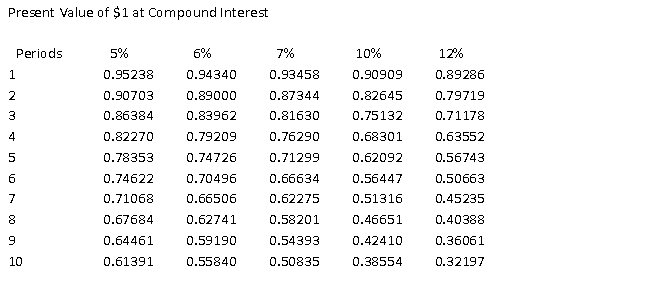

The present value of $40,000 to be received in two years,at 12% compounded annually,is _____ (rounded to nearest dollar) .Use the following table,if needed.

A) $31,888

B) $48,112

C) $8,112

D) $40,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

If the bondholder has the right to exchange a bond for shares of common stock,the bond is called a convertible bond.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Match each description below to the appropriate term (a-g). -On the first day of the fiscal year,a company issues a $1,000,000,7%,5-year bond that pays semiannual interest of $35,000 ($1,000,000 × 7% × 1 / 2),receiving cash of $884,171.Journalize the entry to record the issuance of the bonds.

Correct Answer

verified

Correct Answer

verified

True/False

One reason a dollar today is worth more than a dollar 1 year from today is the time value of money.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

There are two methods of amortizing a bond discount or premium: the straight-line method and the double-declining-balance method.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Both callable and noncallable bonds can be purchased by the issuing corporation in the open market.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Only callable bonds can be purchased by the issuing corporation before maturity.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The effective interest rate method of amortizing a bond discount or premium is the preferred method.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Freeman Corporation issues 2,000,10-year,8%,$1,000 bonds dated January 1 at 96.The journal entry to record the issuance will show a

A) debit to Cash of $2,000,000

B) credit to Discount on Bonds Payable for $80,000

C) credit to Bonds Payable for $1,920,000

D) debit to Cash for $1,920,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If bonds of $1,000,000 with unamortized discount of $10,000 are redeemed at 98,the gain on redemption of bonds is $10,000.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Bondholder claims on the assets of the corporation rank ahead of stockholders.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the corporation issuing the bonds has the right to redeem the bonds prior to the maturity,the bonds are

A) convertible bonds

B) unsecured bonds

C) debenture bonds

D) callable bonds

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

Match each description below to the appropriate term (a-g). -On the first day of the fiscal year,a company issues a $1,000,000,7%,5-year bond that pays semiannual interest of $35,000 ($1,000,000 × 7% × 1 / 2),receiving cash of $884,171.Journalize the first interest payment and the amortization of the related bond discount using the straight-line method.Round answers to the nearest dollar.

Correct Answer

verified

Correct Answer

verified

True/False

Bondholders are creditors of the issuing corporation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each description below to the appropriate term (a-g) . -The principal of the bond issue is paid back in installments

A) carrying amount

B) face value

C) callable bond

D) indenture

E) term bond

F) convertible bond

G) serial bond

![]()

I) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bonds that are subject to retirement prior to maturity at the option of the issuer are called

A) debentures

B) callable bonds

C) early retirement bonds

D) options

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The entry to record the amortization of a premium on bonds payable on an interest payment date would

A) a debit to Premium on Bonds Payable and a credit to Interest Revenue

B) a debit to Interest Expense and a credit to Premium on Bond Payable

C) a debit to Interest Expense and Premium on Bonds Payable and a credit to Cash

D) a debit to Bonds Payable and a credit to Interest Expense

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 154

Related Exams