B) False

Correct Answer

verified

Correct Answer

verified

True/False

One advantage of the payback method for evaluating potential investments is that it provides information about a project's liquidity and risk.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If two projects are mutually exclusive, then they are likely to have multiple IRRs.

B) If a project is independent, then it cannot have multiple IRRs.

C) Multiple IRRs can occur only if the signs of the cash flows change more than once.

D) If a project has two IRRs, then the smaller one is the one that is most relevant, and it should be accepted and relied upon.

E) For a project to have more than one IRR, then both IRRs must be greater than the cost of capital.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) One advantage of the NPV over the IRR is that NPV assumes that cash flows will be reinvested at the cost of capital, whereas IRR assumes that cash flows are reinvested at the IRR. The NPV assumption is generally more appropriate.

B) One advantage of the NPV over the MIRR method is that NPV takes account of cash flows over a project's full life whereas MIRR does not.

C) One advantage of the NPV over the MIRR method is that NPV discounts cash flows whereas the MIRR is based on undiscounted cash flows.

D) Since cash flows under the IRR and MIRR are both discounted at the same rate (the cost of capital) , these two methods always rank mutually exclusive projects in the same order.

E) One advantage of the NPV over the IRR is that NPV takes account of cash flows over a project's full life whereas IRR does not.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) One defect of the IRR method versus the NPV is that the IRR does not take account of the time value of money.

B) One defect of the IRR method versus the NPV is that the IRR does not take account of the cost of capital.

C) One defect of the IRR method versus the NPV is that the IRR values a dollar received today the same as a dollar that will not be received until sometime in the future.

D) One defect of the IRR method versus the NPV is that the IRR does not take proper account of differences in the sizes of projects.

E) One defect of the IRR method versus the NPV is that the IRR does not take account of cash flows over a project's full life.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Both the regular and the modified IRR (MIRR) methods have wide appeal to professors, but most business executives prefer the NPV method to either of the IRR methods.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

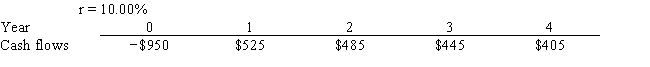

Last month, Standard Systems analyzed the project whose cash flows are shown below. However, before the decision to accept or reject the project took place, the Federal Reserve changed interest rates and therefore the firm's cost of capital (r) . The Fed's action did not affect the forecasted cash flows. By how much did the change in the r affect the project's forecasted NPV? Note that a project's expected NPV can be negative, in which case it should be rejected.

A) −$18.89

B) −$19.88

C) −$20.93

D) −$22.03

E) −$23.13

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

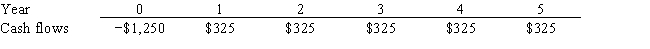

Murray Inc. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. The CEO wants to use the IRR criterion, while the CFO favors the NPV method. You were hired to advise Murray on the best procedure. If the wrong decision criterion is used, how much potential value would Murray lose?

A) $188.68

B) $198.61

C) $209.07

D) $219.52

E) $230.49

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The payback method is generally regarded by academics as being the best single method for evaluating capital budgeting projects.

B) The discounted payback method is generally regarded by academics as being the best single method for evaluating capital budgeting projects.

C) The net present value method (NPV) is generally regarded by academics as being the best single method for evaluating capital budgeting projects.

D) The modified internal rate of return method (MIRR) is generally regarded by academics as being the best single method for evaluating capital budgeting projects.

E) The internal rate of return method (IRR) is generally regarded by academics as being the best single method for evaluating capital budgeting projects.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If Project A's IRR exceeds Project B's, then A must have the higher NPV.

B) A project's MIRR can never exceed its IRR.

C) If a project with normal cash flows has an IRR less than the cost of capital, the project must have a positive NPV.

D) If the NPV is negative, the IRR must also be negative.

E) If a project with normal cash flows has an IRR greater than the cost of capital, the project must also have a positive NPV.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The primary reason that the NPV method is conceptually superior to the IRR method for evaluating mutually exclusive investments is that multiple IRRs may exist, and when that happens, we don't know which IRR is relevant.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Because "present value" refers to the value of cash flows that occur at different points in time, a series of present values of cash flows should not be summed to determine the value of a capital budgeting project.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Shannon Co. is considering a project that has the following cash flow and cost of capital (r) data. What is the project's discounted payback?

A) 1.61 years

B) 1.79 years

C) 1.99 years

D) 2.22 years

E) 2.44 years

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In theory, capital budgeting decisions should depend solely on forecasted cash flows and the opportunity cost of capital. The decision criterion should not be affected by managers' tastes, choice of accounting method, or the profitability of other independent projects.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The IRR method can never be subject to the multiple IRR problem, while the MIRR method can be.

B) One reason some people prefer the MIRR to the regular IRR is that the MIRR is based on a generally more reasonable reinvestment rate assumption.

C) The higher the cost of capital, the shorter the discounted payback period.

D) The MIRR method assumes that cash flows are reinvested at the crossover rate.

E) The MIRR and NPV decision criteria can never conflict.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Other things held constant, an increase in the cost of capital will result in a decrease in a project's IRR.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider two projects, X and Y. Project X's IRR is 19% and Project Y's IRR is 17%. The projects have the same risk and the same lives, and each has constant cash flows during each year of their lives. If the cost of capital is 10%, Project Y has a higher NPV than X. Given this information, which of the following statements is CORRECT?

A) The crossover rate must be greater than 10%.

B) If the cost of capital is 8%, Project X will have the higher NPV.

C) If the cost of capital is 18%, Project Y will have the higher NPV.

D) Project X is larger in the sense that it has the higher initial cost.

E) The crossover rate must be less than 10%.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nichols Inc. is considering a project that has the following cash flow data. What is the project's IRR? Note that a project's IRR can be less than the cost of capital or negative, in both cases it will be rejected.

A) 9.43%

B) 9.91%

C) 10.40%

D) 10.92%

E) 11.47%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows.

A) One drawback of the regular payback for evaluating projects is that this method does not properly account for the time value of money.

B) If a project's payback is positive, then the project should be rejected because it must have a negative NPV.

C) The regular payback ignores cash flows beyond the payback period, but the discounted payback method overcomes this problem.

D) If a company uses the same payback requirement to evaluate all projects, say it requires a payback of 4 years or less, then the company will tend to reject projects with relatively short lives and accept long-lived projects, and this will cause its risk to increase over time.

E) The longer a project's payback period, the more desirable the project is normally considered to be by this criterion.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When considering two mutually exclusive projects, the firm should always select the project whose internal rate of return is the highest, provided the projects have the same initial cost. This statement is true regardless of whether the projects can be repeated or not.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 108

Related Exams