B) False

Correct Answer

verified

Correct Answer

verified

True/False

Typically, a project will have a higher NPV if the firm uses accelerated rather than straight-line depreciation. This is because the total cash flows over the project's life will be higher if accelerated depreciation is used, other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The use of accelerated versus straight-line depreciation causes net income reported to stockholders to be lower, and cash flows higher, during every year of a project's life, other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

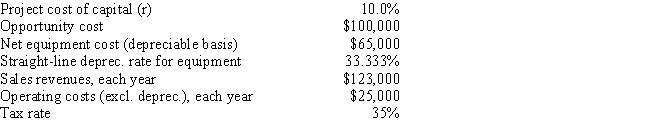

Century Roofing is thinking of opening a new warehouse, and the key data are shown below. The company owns the building that would be used, and it could sell it for $100,000 after taxes if it decides not to open the new warehouse. The equipment for the project would be depreciated by the straight-line method over the project's 3-year life, after which it would be worth nothing and thus it would have a zero salvage value. No new working capital would be required, and revenues and other operating costs would be constant over the project's 3-year life. What is the project's NPV? (Hint: Cash flows are constant in Years 1-3.)

A) $10,521

B) $11,075

C) $11,658

D) $12,271

E) $12,885

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

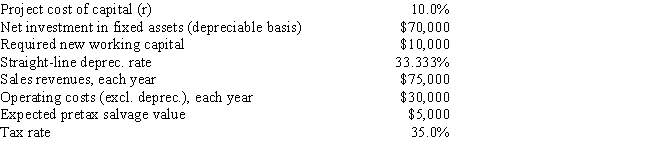

In your first job with TBL Inc. your task is to consider a new project whose data are shown below. What is the project's Year 1 cash flow?

A) $8,903

B) $9,179

C) $9,463

D) $9,746

E) $10,039

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) One advantage of sensitivity analysis relative to scenario analysis is that it explicitly takes into account the probability of specific effects occurring, whereas scenario analysis cannot account for probabilities.

B) Well-diversified stockholders do not need to consider market risk when determining required rates of return.

C) Market risk is important, but it does not have a direct effect on stock prices because it only affects beta.

D) Simulation analysis is a computerized version of scenario analysis where input variables are selected randomly on the basis of their probability distributions.

E) Sensitivity analysis is a good way to measure market risk because it explicitly takes into account diversification effects.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To increase productive capacity, a company is considering a proposed new plant. Which of the following statements is CORRECT?

A) Since depreciation is a non-cash expense, the firm does not need to deal with depreciation when calculating the operating cash flows.

B) When estimating the project's operating cash flows, it is important to include both opportunity costs and sunk costs, but the firm should ignore the cash flow effects of externalities since they are accounted for in the discounting process.

C) Capital budgeting decisions should be based on before-tax cash flows.

D) The cost of capital used to discount cash flows in a capital budgeting analysis should be calculated on a before-tax basis.

E) In calculating the project's operating cash flows, the firm should not deduct financing costs such as interest expense, because financing costs are accounted for by discounting at the cost of capital. If interest were deducted when estimating cash flows, this would, in effect, "double count" it.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following procedures does the text say is used most frequently by businesses when they do capital budgeting analyses?

A) Differential project risk cannot be accounted for by using "risk-adjusted discount rates" because it is highly subjective and difficult to justify. It is better to not risk adjust at all.

B) Other things held constant, if returns on a project are thought to be positively correlated with the returns on other firms in the economy, then the project's NPV will be found using a lower discount rate than would be appropriate if the project's returns were negatively correlated.

C) Monte Carlo simulation uses a computer to generate random sets of inputs, those inputs are then used to determine a trial NPV, and a number of trial NPVs are averaged to find the project's expected NPV. Sensitivity and scenario analyses, on the other hand, require much more information regarding the input variables, including probability distributions and correlations among those variables. This makes it easier to implement a simulation analysis than a scenario or a sensitivity analysis, hence simulation is the most frequently used procedure.

D) DCF techniques were originally developed to value passive investments (stocks and bonds) . However, capital budgeting projects are not passive investments⎯managers can often take positive actions after the investment has been made that alter the cash flow stream. Opportunities for such actions are called real options. Real options are valuable, but this value is not captured by conventional NPV analysis. Therefore, a project's real options must be considered separately.

E) The firm's corporate, or overall, WACC is used to discount all project cash flows to find the projects' NPVs. Then, depending on how risky different projects are judged to be, the calculated NPVs are scaled up or down to adjust for differential risk.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

McPherson Company must purchase a new milling machine. The purchase price is $50,000, including installation. The machine has a tax life of 5 years, and it can be depreciated according to the following rates. The firm expects to operate the machine for 4 years and then to sell it for $12,500. If the marginal tax rate is 40%, what will the after-tax salvage value be when the machine is sold at the end of Year 4?

A) $8,878

B) $9,345

C) $9,837

D) $10,355

E) $10,900

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following factors should be included in the cash flows used to estimate a project's NPV?

A) Interest on funds borrowed to help finance the project.

B) The end-of-project recovery of any working capital required to operate the project.

C) Cannibalization effects, but only if those effects increase the project's projected cash flows.

D) Expenditures to date on research and development related to the project, provided those costs have already been expensed for tax purposes.

E) All costs associated with the project that have been incurred prior to the time the analysis is being conducted.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) In comparing two projects using sensitivity analysis, the one with the steeper lines would be considered less risky, because a small error in estimating a variable such as unit sales would produce only a small error in the project's NPV.

B) The primary advantage of simulation analysis over scenario analysis is that scenario analysis requires a relatively powerful computer, coupled with an efficient financial planning software package, whereas simulation analysis can be done efficiently using a PC with a spreadsheet program or even with just a calculator.

C) Sensitivity analysis is a type of risk analysis that considers both the sensitivity of NPV to changes in key input variables and the probability of occurrence of these variables' values.

D) As computer technology advances, simulation analysis becomes increasingly obsolete and thus less likely to be used as compared to sensitivity analysis.

E) Sensitivity analysis as it is generally employed is incomplete in that it fails to consider the probability of occurrence of the key input variables.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Superior analytical techniques, such as NPV, used in combination with risk-adjusted cost of capital estimates, can overcome the problem of poor cash flow estimation and lead to generally correct accept/reject decisions.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kasper Film Co. is selling off some old equipment it no longer needs because its associated project has come to an end. The equipment originally cost $22,500, of which 75% has been depreciated. The firm can sell the used equipment today for $6,000, and its tax rate is 40%. What is the equipment's after-tax salvage value for use in a capital budgeting analysis? Note that if the equipment's final market value is less than its book value, the firm will receive a tax credit as a result of the sale.

A) $5,558

B) $5,850

C) $6,143

D) $6,450

E) $6,772

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Because of improvements in forecasting techniques, estimating the cash flows associated with a project has become the easiest step in the capital budgeting process.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sheridan Films is considering some new equipment whose data are shown below. The equipment has a 3-year tax life and would be fully depreciated by the straight-line method over 3 years, but it would have a positive pre-tax salvage value at the end of Year 3, when the project would be closed down. Also, some new working capital would be required, but it would be recovered at the end of the project's life. Revenues and other operating costs are expected to be constant over the project's 3-year life. What is the project's NPV?

A) $20,762

B) $21,854

C) $23,005

D) $24,155

E) $25,363

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The primary advantage to using accelerated rather than straight-line depreciation is that with accelerated depreciation the present value of the tax savings provided by depreciation will be higher, other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Puckett Inc. risk-adjusts its WACC to account for project risk. It uses a risk-adjusted project cost of capital of 8% for below-average risk projects, 10% for average-risk projects, and 12% for above-average risk projects. Which of the following independent projects should Puckett accept, assuming that the company uses the NPV method when choosing projects?

A) Project B, which has below-average risk and an IRR = 8.5%.

B) Project C, which has above-average risk and an IRR = 11%.

C) Without information about the projects' NPVs we cannot determine which project(s) should be accepted.

D) All of these projects should be accepted.

E) Project A, which has average risk and an IRR = 9%.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following should be considered when a company estimates the cash flows used to analyze a proposed project?

A) Since the firm's director of capital budgeting spent some of her time last year to evaluate the new project, a portion of her salary for that year should be charged to the project's initial cost.

B) The company has spent and expensed $1 million on R&D associated with the new project.

C) The company spent and expensed $10 million on a marketing study before its current analysis regarding whether to accept or reject the project.

D) The firm would borrow all the money used to finance the new project, and the interest on this debt would be $1.5 million per year.

E) The new project is expected to reduce sales of one of the company's existing products by 5%.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) An example of an externality is a situation where a bank opens a new office, and that new office causes deposits in the bank's other offices to increase.

B) The NPV method automatically deals correctly with externalities, even if the externalities are not specifically identified, but the IRR method does not. This is another reason to favor the NPV.

C) Both the NPV and IRR methods deal correctly with externalities, even if the externalities are not specifically identified. However, the payback method does not.

D) Identifying an externality can never lead to an increase in the calculated NPV.

E) An externality is a situation where a project would have an adverse effect on some other part of the firm's overall operations. If the project would have a favorable effect on other operations, then this is not an externality.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wansley Enterprises is considering a new project. The company has a beta of 1.0, and its sales and profits are positively correlated with the overall economy. The company estimates that the proposed new project would have a higher standard deviation and coefficient of variation than an average company project. Also, the new project's sales would be countercyclical in the sense that they would be high when the overall economy is down and low when the overall economy is strong. On the basis of this information, which of the following statements is CORRECT?

A) The proposed new project would increase the firm's corporate risk.

B) The proposed new project would increase the firm's market risk.

C) The proposed new project would not affect the firm's risk at all.

D) The proposed new project would have less stand-alone risk than the firm's typical project.

E) The proposed new project would have more stand-alone risk than the firm's typical project.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 78

Related Exams