B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Perry Inc.'s bonds currently sell for $1,150. They have a 6-year maturity, an annual coupon of $85, and a par value of $1,000. What is their current yield?

A) 7.39%

B) 7.76%

C) 8.15%

D) 8.56%

E) 8.98%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

"Restrictive covenants" are designed primarily to protect bondholders by constraining the actions of managers. Such covenants are spelled out in bond indentures.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gilligan Co.'s bonds currently sell for $1,150. They have a 6.75% annual coupon rate and a 15-year maturity, and are callable in 6 years at $1,067.50. Assume that no costs other than the call premium would be incurred to call and refund the bonds, and also assume that the yield curve is horizontal, with rates expected to remain at current levels on into the future. Under these conditions, what rate of return should an investor expect to earn if he or she purchases these bonds, the YTC or the YTM?

A) 3.92%

B) 4.12%

C) 4.34%

D) 4.57%

E) 4.81%

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

As a general rule, a company's debentures have higher required interest rates than its mortgage bonds because mortgage bonds are backed by specific assets while debentures are unsecured.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Because short-term interest rates are much more volatile than long-term rates, you would, in the real world, generally be subject to much more interest rate price risk if you purchased a 30-day bond than if you bought a 30-year bond.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Other things equal, a firm will have to pay a higher coupon rate on its subordinated debentures than on its second mortgage bonds.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

The YTMs of three $1,000 face value bonds that mature in 10 years and have the same level of risk are equal. Bond A has an 8% annual coupon, Bond B has a 10% annual coupon, and Bond C has a 12% annual coupon. Bond B sells at par. Assuming interest rates remain constant for the next 10 years, which of the following statements is CORRECT?

A) Since the bonds have the same YTM, they should all have the same price, and since interest rates are not expected to change, their prices should all remain at their current levels until maturity.

B) Bond C sells at a premium (its price is greater than par) , and its price is expected to increase over the next year.

C) Bond A sells at a discount (its price is less than par) , and its price is expected to increase over the next year.

D) Over the next year, Bond A's price is expected to decrease, Bond B's price is expected to stay the same, and Bond C's price is expected to increase.

E) Bond A's current yield will increase each year.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) All else equal, an increase in interest rates will have a greater effect on the prices of short-term than long-term bonds.

B) All else equal, an increase in interest rates will have a greater effect on higher-coupon bonds than it will have on lower-coupon bonds.

C) If a bond's yield to maturity exceeds its coupon rate, the bond's price must be less than its maturity value.

D) If a bond's yield to maturity exceeds its coupon rate, the bond's current yield must be less than its coupon rate.

E) If two bonds have the same maturity, the same yield to maturity, and the same level of risk, the bonds should sell for the same price regardless of the bond's coupon rates.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cornwall Corporation is planning to raise $1,000,000 to finance a new plant. Which of the following statements is CORRECT?

A) If debt is used to raise the million dollars, but $500,000 is raised as first mortgage bonds on the new plant and $500,000 as debentures, the interest rate on the first mortgage bonds would be lower than it would be if the entire $1 million were raised by selling first mortgage bonds.

B) If two tiers of debt are used (with one senior and one subordinated debt class) , the subordinated debt will carry a lower interest rate.

C) If debt is used to raise the million dollars, the cost of the debt would be lower if the debt were in the form of a fixed-rate bond rather than a floating-rate bond.

D) If debt is used to raise the million dollars, the cost of the debt would be higher if the debt were in the form of a mortgage bond rather than an unsecured term loan.

E) The company would be especially eager to have a call provision included in the indenture if its management thinks that interest rates are almost certain to rise in the foreseeable future.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The market value of any real or financial asset, including stocks, bonds, or art work purchased in hope of selling it at a profit, may be estimated by determining future cash flows and then discounting them back to the present.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bonds A and B are 15-year, $1,000 face value bonds. Bond A has a 7% annual coupon, while Bond B has a 9% annual coupon. Both bonds have a yield to maturity of 8%, which is expected to remain constant for the next 15 years. Which of the following statements is CORRECT?

A) One year from now, Bond A's price will be higher than it is today.

B) Bond A's current yield is greater than 8%.

C) Bond A has a higher price than Bond B today, but one year from now the bonds will have the same price.

D) Both bonds have the same price today, and the price of each bond is expected to remain constant until the bonds mature.

E) Bond B has a higher price than Bond A today, but one year from now the bonds will have the same price.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Other things held constant, a callable bond should have a lower yield to maturity than a noncallable bond.

B) Once a firm declares bankruptcy, it must then be liquidated by the trustee, who uses the proceeds to pay bondholders, unpaid wages, taxes, and lawyer fees.

C) Income bonds must pay interest only if the company earns the interest. Thus, these securities cannot bankrupt a company prior to their maturity, and this makes them safer to the issuing corporation than "regular" bonds.

D) A firm with a sinking fund that gave it the choice of calling the required bonds at par or buying the bonds in the open market would generally choose the open market purchase if the coupon rate exceeded the going interest rate.

E) One disadvantage of zero coupon bonds is that the issuing firm cannot realize any tax savings from the debt until the bonds mature.

G) A) and D)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Assume that all interest rates in the economy decline from 10% to 9%. Which of the following bonds would have the largest percentage increase in price?

A) A 1-year bond with a 15% coupon.

B) A 3-year bond with a 10% coupon.

C) A 10-year zero coupon bond.

D) A 10-year bond with a 10% coupon.

E) An 8-year bond with a 9% coupon.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a bond's yield to maturity exceeds its coupon rate, the bond will sell at par.

B) All else equal, if a bond's yield to maturity increases, its price will fall.

C) If a bond's yield to maturity exceeds its coupon rate, the bond will sell at a premium over par.

D) All else equal, if a bond's yield to maturity increases, its current yield will fall.

E) A zero coupon bond's current yield is equal to its yield to maturity.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

There is an inverse relationship between bonds' quality ratings and their required rates of return. Thus, the required return is lowest for AAA-rated bonds, and required returns increase as the ratings get lower.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sentry Corp. bonds have an annual coupon payment of 7.25%. The bonds have a par value of $1,000, a current price of $1,125, and they will mature in 13 years. What is the yield to maturity on these bonds?

A) 5.56%

B) 5.85%

C) 6.14%

D) 6.45%

E) 6.77%

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

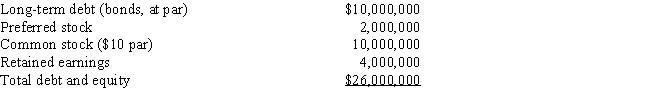

CMS Corporation's balance sheet as of today is as follows: The bonds have a 4.0% coupon rate, payable semiannually, and a par value of $1,000. They mature exactly 10 years from today. The yield to maturity is 12%, so the bonds now sell below par. What is the current market value of the firm's debt?

A) $5,276,731

B) $5,412,032

C) $5,547,332

D) $7,706,000

E) $7,898,650

G) C) and E)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Nicholas Industries can issue a 20-year bond with a 6% annual coupon. This bond is not convertible, is not callable, and has no sinking fund. Alternatively, Nicholas could issue a 20-year bond that is convertible into common equity, may be called, and has a sinking fund. Which of the following most accurately describes the coupon rate that Nicholas would have to pay on the convertible, callable bond?

A) It could be less than, equal to, or greater than 6%.

B) Greater than 6%.

C) Exactly equal to 8%.

D) Less than 6%.

E) Exactly equal to 6%.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jerome Corporation's bonds have 15 years to maturity, an 8.75% coupon paid semiannually, and a $1,000 par value. The bond has a 6.50% nominal yield to maturity, but it can be called in 6 years at a price of $1,050. What is the bond's nominal yield to call?

A) 5.01%

B) 5.27%

C) 5.54%

D) 5.81%

E) 6.10%

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 101

Related Exams