A) 333 contracts short

B) 333 contracts long

C) 348 contracts short

D) 348 contracts long

E) 300 contracts long

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The basis (Bt,T) at time t between the spot price (St) and a futures contract expiring at time T (Ft,T) is St - Ft,T.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S) As a portfolio manager, you are responsible for a $150 million portfolio, 90 percent of which is invested in equities, with a portfolio beta of 1.25. You are utilizing the S&P 500 as your passive benchmark. Currently the S&P 500 is valued at 1202. The value of the S&P 500 futures contract is equal to $250 times the value of the index. The beta of the futures contract is 1.0. -Refer to Exhibit 15.11. How many contracts should you buy or sell in order to reduce the portfolio beta to 0.80 (rounded to the nearest integer) ?

A) sell 162 contracts

B) buy 162 contracts

C) sell 324 contracts

D) buy 324 contracts

E) buy 234 contracts

G) A) and C)

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S) An international investment firm buys an interest rate swap that pays the difference between LIBOR and 6 percent if LIBOR exceeds 6 percent. Current LIBOR is 5 percent. The amount of the option is $1,500,000, and the settlement is every three months. Assume a 360-day year. -Refer to Exhibit 15.20. Find the payoff if LIBOR closes at 6.3 percent.

A) -$45,000

B) -$11,250

C) $0

D) $11,250

E) $45,000

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Margin accounts are adjusted, or marked to market, at the end of each trading day.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S) The Skalmory Corporation has entered into a three-year interest rate swap, with semiannual settlement, to pay a fixed rate of 7.5 percent per year and receive six-month LIBOR. The notional principal is $10,000,000. -Refer to Exhibit 15.17. Assuming that one year after the swap was initiated the fixed rate on a new two-year receive fixed pay floating LIBOR swap has fallen to 7 percent per year, calculate the market value of the 7.5 percent fixed rate bond based on a $100 face value. Settlement is on a semiannual basis.

A) $101.33

B) $100.92

C) $100.00

D) $98.67

E) $95.83

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As a contract approaches maturity, the spot price and forward price

A) increase.

B) diverge.

C) maintain a fixed price differential.

D) have a random relationship.

E) converge.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

As a relationship officer for a money-center commercial bank, one of your corporate accounts has just approached you about a one-year loan for $3,000,000. The customer would pay a quarterly interest expense based on the prevailing level of LIBOR at the beginning of each quarter. As is the bank's convention on all such loans, the amount of the interest payment would then be paid at the end of the quarterly cycle when the new rate for the next cycle is determined. You observe the following LIBOR yield curve in the cash market:

-Refer to Exhibit 15.3. Assuming the yields inferred from the Eurodollar futures contract prices for the next three settlement periods are equal to the implied forward rates, calculate, in annual (360-day) percentage terms, the annuity that would leave the bank indifferent between making the floating-rate loan and hedging it in the futures market and making a one-year fixed-rate loan.

-Refer to Exhibit 15.3. Assuming the yields inferred from the Eurodollar futures contract prices for the next three settlement periods are equal to the implied forward rates, calculate, in annual (360-day) percentage terms, the annuity that would leave the bank indifferent between making the floating-rate loan and hedging it in the futures market and making a one-year fixed-rate loan.

A) 20.86%

B) 5.10%

C) 4.91%

D) 5.20%

E) 0%

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S) The Skalmory Corporation has entered into a three-year interest rate swap, with semiannual settlement, to pay a fixed rate of 7.5 percent per year and receive six-month LIBOR. The notional principal is $10,000,000. -Refer to Exhibit 15.17. Assume that one year later the fixed rate on a new two-year receive fixed pay floating LIBOR swap has fallen to 7 percent per year. Settlement is on a semiannual basis. Calculate the market value of the FRN based on $100 face value.

A) $101.33

B) $100.58

C) $100.00

D) $98.67

E) $95.83

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The major difference between valuing futures versus forward contracts stems from the fact that future contracts are

A) traded on exchange.

B) backed by a clearinghouse.

C) marked-to-market daily.

D) less risky.

E) relatively inflexible.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S) Consider a portfolio manager with a $10,000,000 equity portfolio under management. The manager wishes to hedge against a decline in share values using stock index futures. Currently a stock index future is priced at 1350 and has a multiplier of 250. The portfolio beta is 1.50. -Refer to Exhibit 15.13. Calculate the number of contract required to hedge the risk exposure and indicate whether the manager should be short or long.

A) 100 contracts long

B) 44 contracts long

C) 44 contracts short

D) 100 contracts short

E) 75 contracts short

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

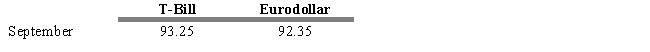

Assume that you observe the following prices in the T-Bill and Eurodollar futures markets

-Refer to Exhibit 15.5. If you expected the TED spread to widen over the next month, then an appropriate strategy would be to

-Refer to Exhibit 15.5. If you expected the TED spread to widen over the next month, then an appropriate strategy would be to

A) go long T-Bill futures and long Eurodollar futures.

B) go short T-Bill futures and short Eurodollar futures.

C) go long T-Bill futures and short Eurodollar futures.

D) go short T-Bill futures and long Eurodollar futures.

E) None of these are correct.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The pure expectations hypothesis suggests futures prices serve as unbiased forecasts of future spot prices.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following are all advantages of having an equity swap market EXCEPT:

A) These agreements allow investors to take advantage of overall price movements in a specific country's stock market.

B) Creating a direct equity investment in a foreign country may be difficult for some investors where it is prohibited by law.

C) These agreements eliminate the need for a counterparty because they are traded on the NYSE.

D) An investment fund wanting to accumulate foreign index returns denominated in their domestic currency may not be legally permitted to obtain sufficient exchange-traded derivative contracts to hedge a direct equity investment.

E) Equity swaps can reduce both the transaction costs and the tracking error.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that you manage an equity portfolio. The portfolio beta is 1.15. You anticipate a rise in equity values and wish to increase equity exposure on $500 million of the portfolio. Calculate the number of contracts you would need to hedge your position and indicate whether you would go short or long. Assume that the price of the S&P 500 futures contract is 1105 and the multiplier is 250.

A) 2500 contracts short

B) 1810 contracts short

C) 1810 contracts long

D) 2081 contracts short

E) 2081 contracts long

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Some forward contracts, particularly in the foreign exchange market, are quite standard and liquid.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT true about interest rate swaps?

A) Payments are based on a notional principal.

B) Floating rate payers profit if interest rates fall.

C) Payments can be quarterly as well as semi-annually.

D) Parities exchange debt obligations.

E) Default risk is a possibility in the swaps market.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S) Darden Industries has decided to borrow $25,000,000.00 for six months in two three-month issues. As the Treasurer, you are concerned that interest rates will rise over the next three months and the rate upon which the second payment will be based will be undesirable. (The amount of Darden's first payment will be known at origination.) To reduce the company's interest rate exposure, you decide to purchase a 3 * 6 FRA whereby you pay the dealer's quoted fixed rate of 4.5 percent in exchange for receiving three-month LIBOR at the settlement date. In order to hedge her exposure, the dealer buys LIBOR from McIntire Industries at its bid rate of 4 percent. (Assume a notional principal of $25,000,000.00 and that there are 60 days between month 3 and month 6.) -Refer to Exhibit 15.15. Assuming that three-month LIBOR is 5.00 percent on the rate determination day, and the contract specified settlement in arrears at month 6, describe the transaction that occurs between the dealer and McIntire.

A) The dealer is obligated to pay McIntire $62,500.

B) The dealer is obligated to pay McIntire $57,500.

C) McIntire is obligated to pay the dealer $62,500.

D) McIntire is obligated to pay the dealer $57,500.

E) McIntire is obligated to pay the dealer $55,700.

G) None of the above

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

The cost of carry includes all of the following EXCEPT

A) storage costs.

B) insurance.

C) current price.

D) financing costs.

E) risk-free rate.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the exchange rate is GBP 1.35/USD, the US risk-free rate is 3.0 percent, and the UK risk-free rate is 6.5 percent. What is the implied one-year forward rate?

A) GBP 1.40/USD

B) GBP 1.35/USD

C) GBP 1.30/USD

D) GBP 1.25/USD

E) GBP 1.20/USD

G) B) and C)

Correct Answer

verified

A

Correct Answer

verified

Showing 1 - 20 of 148

Related Exams