A) other things held constant, the lower the current ratio, the lower the interest rate the bank would charge the firm.

B) the lower the company's ebitda coverage ratio, other things held constant, the lower the interest rate the bank would charge the firm.

C) other things held constant, the higher the debt ratio, the lower the interest rate the bank would charge the firm.

D) other things held constant, the lower the debt ratio, the lower the interest rate the bank would charge the firm.

E) the lower the company's tie ratio, other things held constant, the lower the interest rate the bank would charge the firm.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rappaport Corp.'s sales last year were $320,000, and its net income after taxes was $23,000. What was its profit margin on sales?

A) 6.49%

B) 6.83%

C) 7.19%

D) 7.55%

E) 7.92%

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

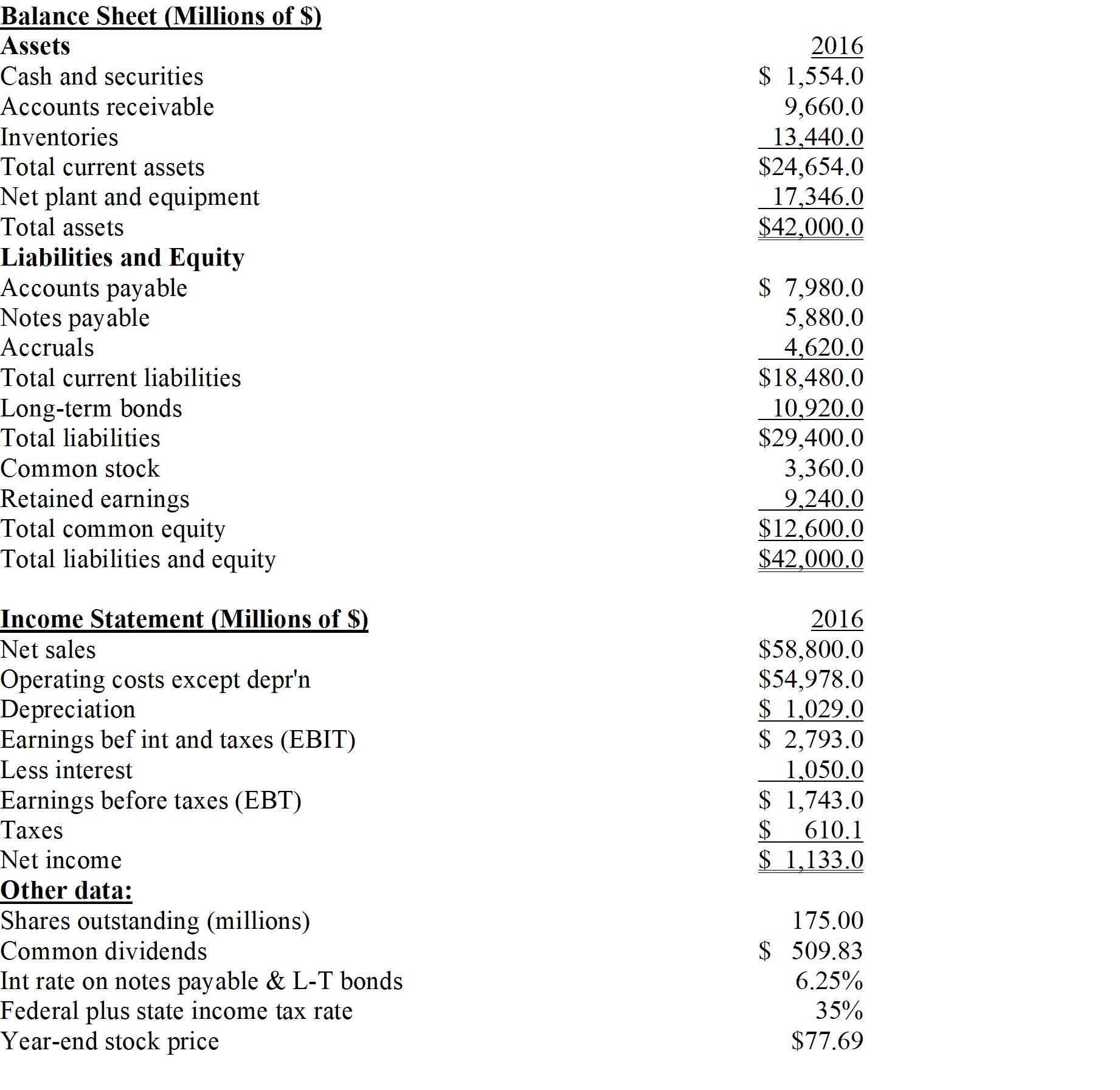

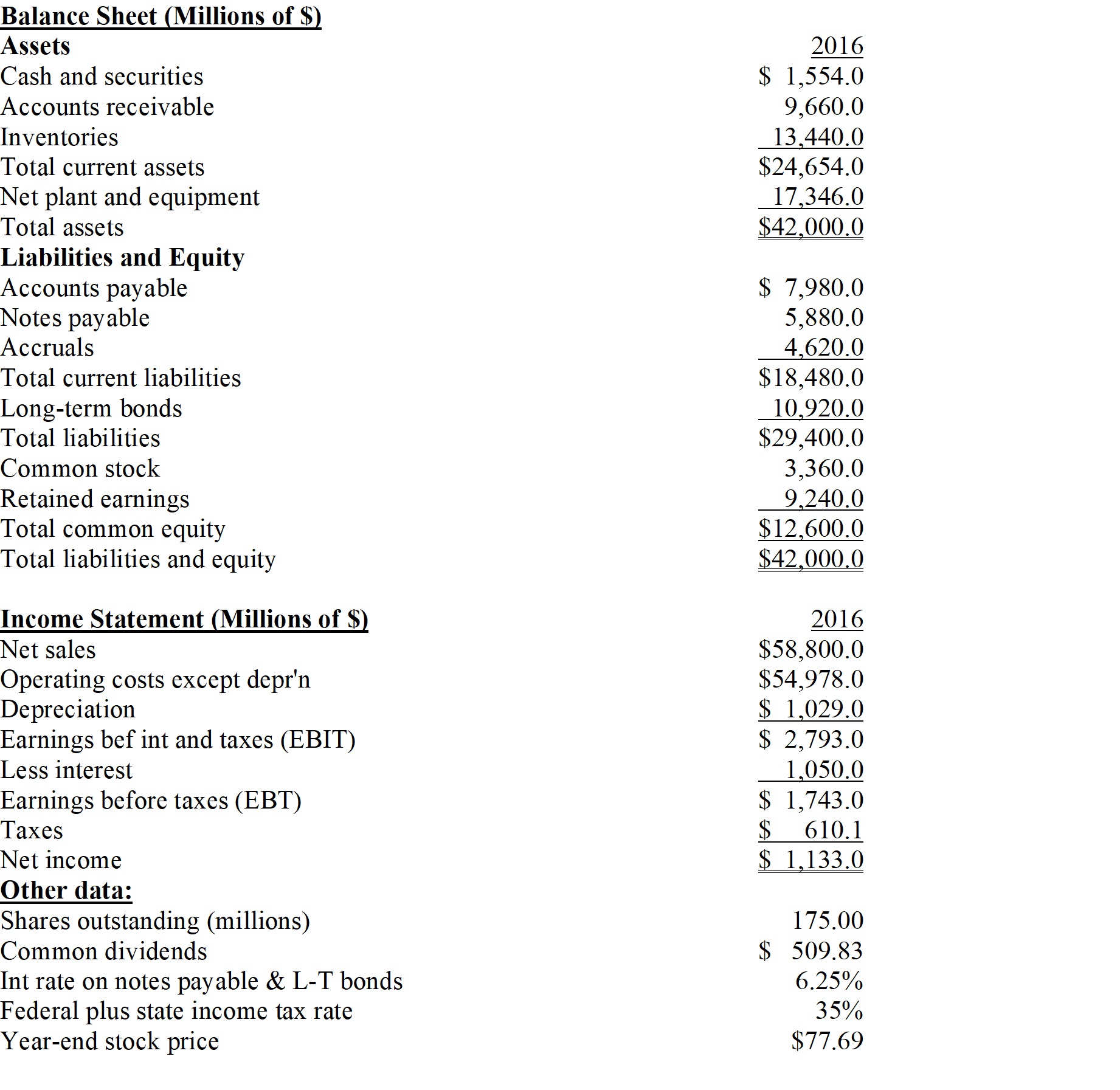

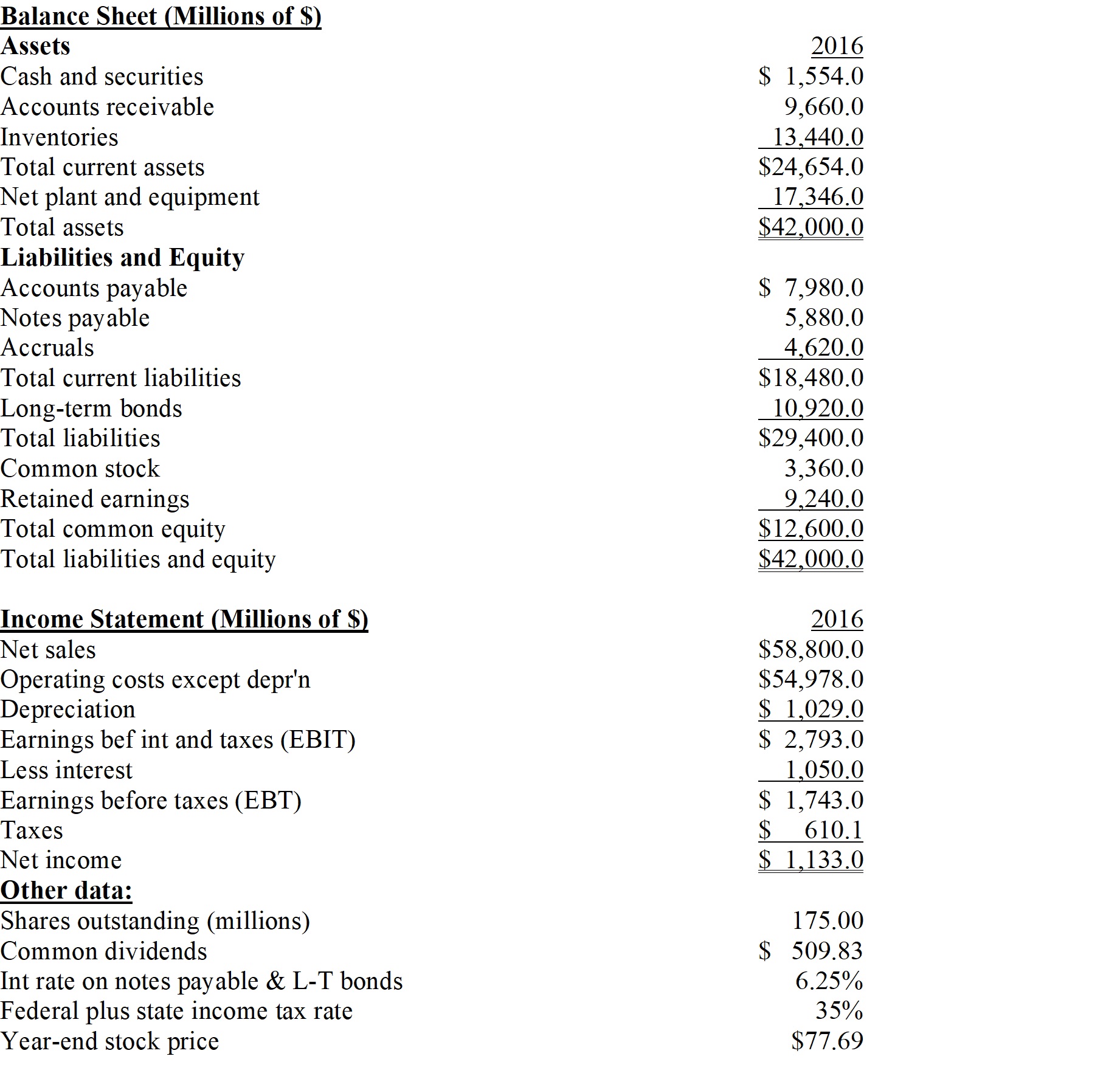

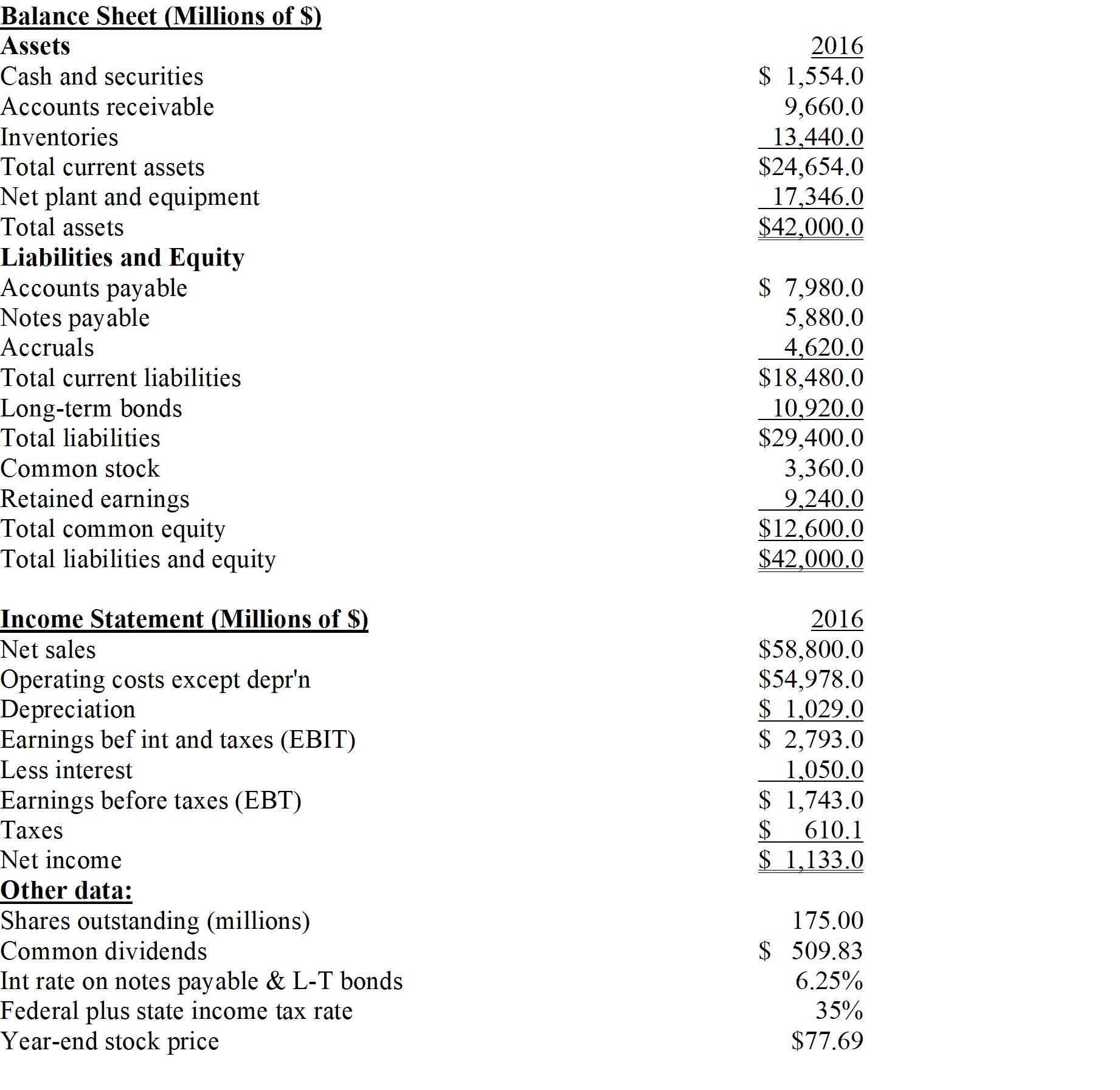

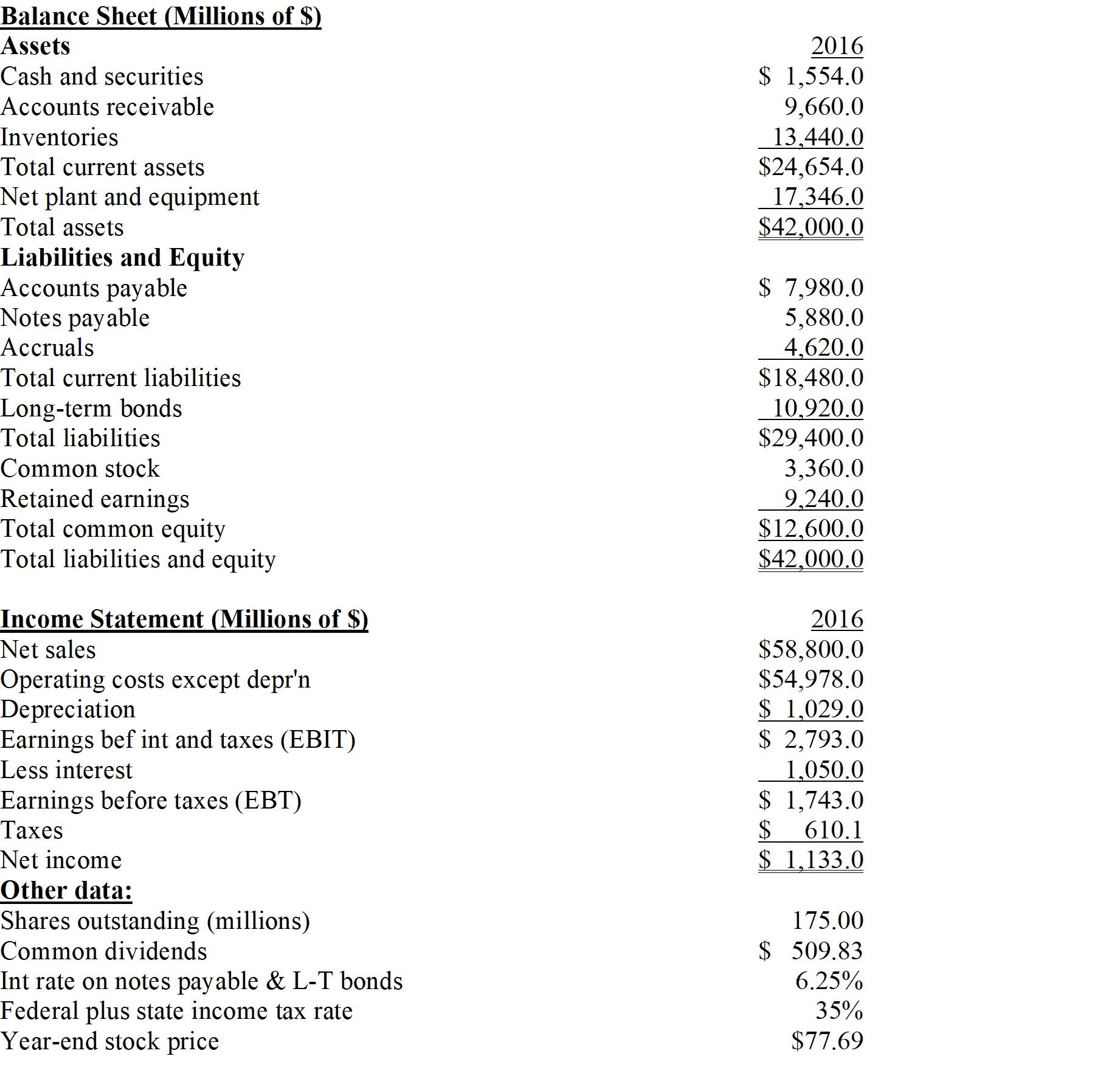

Pettijohn Inc.

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to the data for Pettijohn Inc.What is the firm's market-to-book ratio?

-Refer to the data for Pettijohn Inc.What is the firm's market-to-book ratio?

A) 0.56

B) 0.66

C) 0.78

D) 0.92

E) 1.08

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Branch Corp.'s total assets at the end of last year were $315,000 and its net income after taxes was $22,750. What was its return on total assets?

A) 7.22%

B) 7.58%

C) 7.96%

D) 8.36%

E) 8.78%

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Companies Heidee and Leaudy have the same sales, tax rate, interest rate on their debt, total assets, and basic earning power. Both companies have positive net incomes. Company Heidee has a higher debt ratio and, therefore, a higher interest expense. Which of the following statements is CORRECT?

A) company heidee has more net income.

B) company heidee pays less in taxes.

C) company heidee has a lower equity multiplier.

D) company heidee has a higher roa.

E) company heidee has a higher times interest earned (tie) ratio.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Companies Heidee and Leaudy are virtually identical in that they are both profitable, and they have the same total assets (TA) , Sales (S) , return on assets (ROA) , and profit margin (PM) . However, Company Heidee has the higher debt ratio. Which of the following statements is CORRECT?

A) company heidee has a lower operating income (ebit) than company ld.

B) company heidee has a lower total assets turnover than company leaudy.

C) company heidee has a lower equity multiplier than company leaudy.

D) company heidee has a higher fixed assets turnover than company leaudy.

E) company heidee has a higher roe than company leaudy.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The basic earning power ratio (BEP) reflects the earning power of a firm's assets after giving consideration to financial leverage and tax effects.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Significant variations in accounting methods among firms make meaningful ratio comparisons between firms more difficult than if all firms used similar accounting methods.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Suppose Firms A and B have the same amount of assets, pay the same interest rate on their debt, have the same basic earning power (BEP), and have the same tax rate. However, Firm A has a higher debt ratio. If BEP is greater than the interest rate on debt, Firm A will have a higher ROE as a result of its higher debt ratio.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pettijohn Inc.

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to the data for Pettijohn Inc.What is the firm's total assets turnover?

-Refer to the data for Pettijohn Inc.What is the firm's total assets turnover?

A) 0.90

B) 1.12

C) 1.40

D) 1.68

E) 2.02

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm wants to strengthen its financial position. Which of the following actions would increase its quick ratio?

A) issue new common stock and use the proceeds to acquire additional fixed assets.

B) offer price reductions along with generous credit terms that would (1) enable the firm to sell some of its excess inventory and (2) lead to an increase in accounts receivable.

C) issue new common stock and use the proceeds to increase inventories.

D) speed up the collection of receivables and use the cash generated to increase inventories.

E) use some of its cash to purchase additional inventories.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pettijohn Inc.

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to the data for Pettijohn Inc.What is the firm's EBITDA coverage?

-Refer to the data for Pettijohn Inc.What is the firm's EBITDA coverage?

A) 3.29

B) 3.46

C) 3.64

D) 3.82

E) 4.01

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pettijohn Inc.

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to the data for Pettijohn Inc.What is the firm's EPS?

-Refer to the data for Pettijohn Inc.What is the firm's EPS?

A) $5.84

B) $6.15

C) $6.47

D) $6.80

E) $7.14

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Firms A and B have the same current ratio, 0.75, the same amount of sales and cost of goods sold, and the same amount of current liabilities. However, Firm A has a higher inventory turnover ratio than B. Therefore, we can conclude that A's quick ratio must be smaller than B's.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Aziz Industries has sales of $100,000 and accounts receivable of $11,500, and it gives its customers 30 days to pay. The industry average DSO is 27 days, based on a 365-day year. If the company changes its credit and collection policy sufficiently to cause its DSO to fall to the industry average, and if it earns 8.0% on any cash freed-up by this change, how would that affect its net income, assuming other things are held constant?

A) $267.34

B) $281.41

C) $296.22

D) $311.81

E) $328.22

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would, generally, indicate an improvement in a company's financial position, holding other things constant?

A) the total assets turnover decreases.

B) the tie declines.

C) the dso increases.

D) the ebitda coverage ratio increases.

E) the current and quick ratios both decline.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You observe that a firm's ROE is above the industry average, but its profit margin and debt ratio are both below the industry average. Which of the following statements is CORRECT?

A) its total assets turnover must equal the industry average.

B) its total assets turnover must be above the industry average.

C) its return on assets must equal the industry average.

D) its tie ratio must be below the industry average.

E) its total assets turnover must be below the industry average.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Vang Corp.'s stock price at the end of last year was $33.50 and its earnings per share for the year were $2.30. What was its P/E ratio?

A) 13.84

B) 14.57

C) 15.29

D) 16.06

E) 16.86

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Chambliss Corp.'s total assets at the end of last year were $305,000 and its EBIT was 62,500. What was its basic earning power (BEP) ?

A) 18.49%

B) 19.47%

C) 20.49%

D) 21.52%

E) 22.59%

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pettijohn Inc.

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to the data for Pettijohn Inc.What is the firm's cash flow per share?

-Refer to the data for Pettijohn Inc.What is the firm's cash flow per share?

A) $10.06

B) $10.59

C) $11.15

D) $11.74

E) $12.35

G) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 104

Related Exams