B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You plan to invest some money in a bank account.Which of the following banks provides you with the highest effective rate of interest?

A) Bank 1;6.1% with annual compounding.

B) Bank 2;6.0% with monthly compounding.

C) Bank 3;6.0% with annual compounding.

D) Bank 4;6.0% with quarterly compounding.

E) Bank 5;6.0% with daily (365-day) compounding.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You plan to borrow $35,000 at a 7.5% annual interest rate.The terms require you to amortize the loan with 7 equal end-of-year payments.How much interest would you be paying in Year 2?

A) $1,994.49

B) $2,099.46

C) $2,209.96

D) $2,326.27

E) $2,442.59

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Time lines cannot be constructed in situations where some of the cash flows occur annually but others occur quarterly.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Southwestern Bank offers to lend you $50,000 at a nominal rate of 6.5%,compounded monthly.The loan (principal plus interest) must be repaid at the end of the year.Woodburn Bank also offers to lend you the $50,000,but it will charge an annual rate of 7.0%,with no interest due until the end of the year.How much higher or lower is the effective annual rate charged by Woodburn versus the rate charged by Southwestern?

A) 0.52%

B) 0.44%

C) 0.36%

D) 0.30%

E) 0.24%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Geraldine was injured in a car accident,and the insurance company has offered her the choice of $25,000 per year for 15 years,with the first payment being made today,or a lump sum.If a fair return is 7.5%,how large must the lump sum be to leave her as well off financially as with the annuity?

A) $225,367

B) $237,229

C) $249,090

D) $261,545

E) $274,622

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

American Express and other credit card issuers must by law print the Annual Percentage Rate (APR) on their monthly statements.If the APR is stated to be 18.00%,with interest paid monthly,what is the card's EFF%?

A) 18.58%

B) 19.56%

C) 20.54%

D) 21.57%

E) 22.65%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A "growing annuity" is a cash flow stream that grows at a constant rate for a specified number of periods.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You just deposited $2,500 in a bank account that pays a 4.0% nominal interest rate,compounded quarterly.If you also add another $5,000 to the account one year (4 quarters) from now and another $7,500 to the account two years (8 quarters) from now,how much will be in the account three years (12 quarters) from now?

A) $15,234.08

B) $16,035.88

C) $16,837.67

D) $17,679.55

E) $18,563.53

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your bank offers a savings account that pays 3.5% interest,compounded annually.How much will $500 invested today be worth at the end of 25 years?

A) $1,122.54

B) $1,181.62

C) $1,240.70

D) $1,302.74

E) $1,367.88

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The store where you bought new home furnishings offers you two alternative payment plans.The first plan requires a $4,000 immediate up-front payment.The second plan requires you to make monthly payments of $137.41,payable at the end of each month for 3 years.What nominal annual interest rate is built into the monthly payment plan?

A) 12.31%

B) 12.96%

C) 13.64%

D) 14.36%

E) 15.08%

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your bank account pays a 5% nominal rate of interest.The interest is compounded quarterly.Which of the following statements is CORRECT?

A) The periodic rate of interest is 5% and the effective rate of interest is also 5%.

B) The periodic rate of interest is 1.25% and the effective rate of interest is 2.5%.

C) The periodic rate of interest is 5% and the effective rate of interest is greater than 5%.

D) The periodic rate of interest is 1.25% and the effective rate of interest is greater than 5%.

E) The periodic rate of interest is 2.5% and the effective rate of interest is 5%.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The going rate of interest on a 5-year treasury bond is 4.25%.You have one that will pay $2,500 five years from now.How much is the bond worth today?

A) $1,928.78

B) $2,030.30

C) $2,131.81

D) $2,238.40

E) $2,350.32

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a State of New Mexico bond will pay $1,000 eight years from now.If the going interest rate on these 8-year bonds is 5.5%,how much is the bond worth today?

A) $651.60

B) $684.18

C) $718.39

D) $754.31

E) $792.02

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The present value of a future sum increases as either the discount rate or the number of periods per year increases,other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ten years ago,Kronan Corporation earned $0.50 per share.Its earnings this year were $2.20.What was the growth rate in earnings per share (EPS) over the 10-year period?

A) 15.17%

B) 15.97%

C) 16.77%

D) 17.61%

E) 18.49%

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding a 20-year (240-month) $225,000,fixed-rate mortgage is CORRECT? (Ignore taxes and transactions costs. )

A) The outstanding balance declines at a slower rate in the later years of the loan's life.

B) The remaining balance after three years will be $225,000 less one third of the interest paid during the first three years.

C) Because it is a fixed-rate mortgage,the monthly loan payments (which include both interest and principal payments) are constant.

D) Interest payments on the mortgage will increase steadily over time,but the total amount of each payment will remain constant.

E) The proportion of the monthly payment that goes towards repayment of principal will be lower 10 years from now than it will be the first year.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What annual payment must you receive in order to earn a 6.5% rate of return on a perpetuity that has a cost of $1,250?

A) $77.19

B) $81.25

C) $85.31

D) $89.58

E) $94.06

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

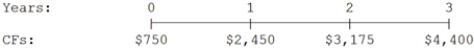

What is the present value of the following cash flow stream at a rate of 8.0%?

A) $7,917

B) $8,333

C) $8,772

D) $9,233

E) $9,695

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Disregarding risk,if money has time value,it is impossible for the present value of a given sum to exceed its future value.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 165

Related Exams