A) $698.15

B) $734.89

C) $773.57

D) $814.29

E) $857.14

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Heavy use of off-balance-sheet lease financing will tend to

A) make a company appear more risky than it actually is because its stated debt ratio will be increased.

B) make a company appear less risky than it actually is because its stated debt ratio will appear lower.

C) affect a company's cash flows but not its degree of risk.

D) have no effect on either cash flows or risk because the cash flows are already reflected in the income statement.

E) affect the lessee's cash flows but only due to tax effects.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Preferred stock can provide a financing alternative for some firms when market conditions are such that they cannot issue either pure debt or common stock at any reasonable cost.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Assume that a piece of leased equipment has a relatively high expected residual value.From the lessee's viewpoint,it might be better to own the asset rather than lease it because with a high residual value the lessee will likely face a higher lease rate.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about convertibles is most CORRECT?

A) The coupon interest rate on a firm's convertibles is generally set higher than the market yield on its otherwise similar straight debt.

B) One advantage of convertibles over warrants is that the issuer receives additional cash money when convertibles are converted.

C) Investors are willing to accept a lower interest rate on a convertible than on otherwise similar straight debt because convertibles are less risky than straight debt.

D) At the time it is issued, a convertible's conversion (or exercise) price is generally set equal to or below the underlying stock's price.

E) For equilibrium to exist, the expected return on a convertible bond must normally be between the expected return on the firm's otherwise similar straight debt and the expected return on its common stock.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Orient Airlines' common stock currently sells for $33,and its 8% convertible debentures (issued at par,or $1,000) sell for $850.Each debenture can be converted into 25 shares of common stock at any time before 2022.What is the conversion value of the bond?

A) $707.33

B) $744.56

C) $783.75

D) $825.00

E) $866.25

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is most CORRECT?

A) Firms that use "off-balance-sheet" financing, such as leasing, would show lower debt ratios if the effects of their leases were reflected in their financial statements.

B) Capitalizing a lease means that the firm issues equity capital in proportion to its current capital structure, in an amount sufficient to support the lease payment obligation.

C) The fixed charges associated with a lease can be as high as, but never greater than, the fixed payments associated with a loan.

D) Capital, or financial, leases generally provide for maintenance by the lessor.

E) A key difference between a capital lease and an operating lease is that with a capital lease, the lease payments provide the lessor with a return of the funds invested in the asset plus a return on the invested funds, whereas with an operating lease the lessor depends on the residual value to realize a full return of and on the investment.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A warrant holder is not entitled to vote,but he or she does receive any cash dividends paid on the underlying stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Warren Corporation's stock sells for $42 per share.The company wants to sell some 20-year,annual interest,$1,000 par value bonds.Each bond would have 75 warrants attached to it,each exercisable into one share of stock at an exercise price of $47.The firm's straight bonds yield 10%.Each warrant is expected to have a market value of $2.00 given that the stock sells for $42.What coupon interest rate must the company set on the bonds in order to sell the bonds-with-warrants at par?

A) 7.83%

B) 8.24%

C) 8.65%

D) 9.08%

E) 9.54%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Preferred stock typically has a par value,and the dividend is often stated as a percentage of par.The par value is also important in the event of liquidation,as the preferred stockholders are generally entitled to receive the par value before anything is given to the common stockholders.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Curry Corporation is setting the terms on a new issue of bonds with warrants.The bonds will have a 30-year maturity and annual interest payments.Each bond will come with 20 warrants that give the holder the right to purchase one share of stock per warrant.The investment bankers estimate that each warrant will have a value of $10.00.A similar straight-debt issue would require a 10% coupon.What coupon rate should be set on the bonds-with-warrants so that the package would sell for $1,000?

A) 6.75%

B) 7.11%

C) 7.48%

D) 7.88%

E) 8.27%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The owner of a convertible bond owns,in effect,both a bond and a call option.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

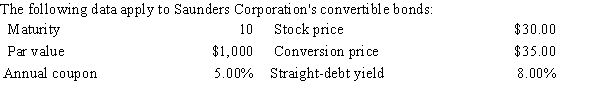

The next 4 problems must be kept together; all use the data in Exhibit 20.1.

Exhibit 20.1

-Refer to Exhibit 20.1.What is the bond's conversion ratio?

-Refer to Exhibit 20.1.What is the bond's conversion ratio?

A) 27.14

B) 28.57

C) 30.00

D) 31.50

E) 33.08

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Preferred stockholders have priority over common stockholders with respect to dividends,because dividends must be paid on preferred stock before they can be paid on common stock.However,preferred and common stockholders normally have equal priority with respect to liquidating proceeds in the event of bankruptcy.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Its investment bankers have told Donner Corporation that it can issue a 25-year,8.1% annual payment bond at par.They also stated that the company can sell an issue of annual payment preferred stock to corporate investors who are in the 40% tax bracket.The corporate investors require an after-tax return on the preferred that exceeds their after-tax return on the bonds by 1.0%,which would represent an after-tax risk premium.What coupon rate must be set on the preferred in order to issue it at par?

A) 6.66%

B) 6.99%

C) 7.34%

D) 7.71%

E) 8.09%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Under a sale and leaseback arrangement,the seller of the leased property is the lessee and the buyer is the lessor.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A convertible debenture can never sell for more than its conversion value or less than its bond value.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The full amount of a lease payment is tax deductible provided the contract qualifies as a true lease under IRS guidelines.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Emerson Electrical Engineering Inc.is issuing new 20-year bonds that have warrants attached.If not for the attached warrants,the bonds would carry an 11% interest rate.However,with the warrants attached the bonds will pay a 9% annual coupon.There are 25 warrants attached to each bond,which have a par value of $1,000.The exercise price of the warrants is $25.00 and the expected stock price 10 years from now (when the warrants may be exercised) is $50.77.What is the investor's expected overall pre-tax rate of return for this bond-with-warrants issue?

A) 10.64%

B) 11.20%

C) 11.79%

D) 12.38%

E) 13.00%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ellis Enterprises is considering whether to lease or buy some necessary equipment it needs for a project that will last the next 3 years.If the firm buys the equipment,it will borrow $4,800,000 at 8% interest.The firm's tax rate is 35% and the firm's before-tax cost of debt is 8%.Annual maintenance costs associated with ownership are estimated to be $300,000 and the equipment will be depreciated on a straight-line basis over 3 years.What is the annual end-of-year lease payment (in thousands of dollars) for a 3-year lease that would make the firm indifferent between buying or leasing the equipment? (Suggestion: Delete 3 zeros from dollars and work in thousands.)

A) $1,950

B) $2,052

C) $2,160

D) $2,268

E) $2,382

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 60

Related Exams