A) The investment timing option would not affect the cash flows and therefore would have no impact on the project's risk.

B) The more uncertainty about the future cash flows, the more logical it is to go ahead with this project today.

C) Since the project has a positive expected NPV today, this means that its expected NPV will be even higher if the firm chooses to wait a year.

D) Since the project has a positive expected NPV today, this means that it should be accepted in order to lock in that NPV.

E) Waiting would probably reduce the project's risk.

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The true expected value of a project with a growth option is the expected NPV of the project (including the value of the option)less the cost of obtaining that option.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lindley Corp.is considering a new product that would require an investment of $10 million now,at t = 0.If the new product is well received,then the project would produce after-tax cash flows of $5 million at the end of each of the next 3 years (t = 1,2,3) ,but if the market did not like the product,then the cash flows would be only $2 million per year.There is a 50% probability that the market will be good.The firm could delay the project for a year while it conducts a test to determine if demand is likely to be strong or weak.The project's cost and expected annual cash flows would be the same whether the project is delayed or not.The project's WACC is 10.0%.What is the value (in thousands) of the project after considering the investment timing option?

A) $ 726

B) $ 807

C) $ 896

D) $ 996

E) $1,106

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

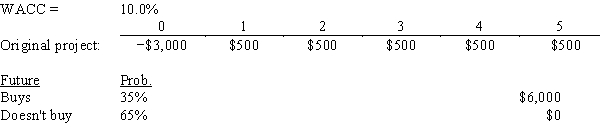

Tutor.com is considering a plan to develop an online finance tutoring package that has the cost and revenue projections shown below.One of Tutor's larger competitors,Online Professor (OP) ,is expected to do one of two things in Year 5: (1) develop its own competing program,which will put Tutor's program out of business,or (2) offer to buy Tutor's program if it decides that this would be less expensive than developing its own program.Tutor thinks there is a 35% probability that its program will be purchased for $6 million and a 65% probability that it won't be bought,and thus the program will simply be closed down with no salvage value.What is the estimated net present value of the project (in thousands) at a WACC = 10%,giving consideration to the potential future purchase?

A) $161.46

B) $179.40

C) $199.33

D) $219.26

E) $241.19

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

High Roller Properties is considering building a new casino at a cost of $10 million at t = 0.The after-tax cash flows the casino generates will depend on whether the state imposes a new income tax,and there is a 50-50 chance the tax will pass.If it passes,after-tax cash flows will be $1.875 million per year for the next 5 years.If it doesn't pass,the after-tax cash flows will be $3.75 million per year for the next 5 years.The project's WACC is 11.0%.If the tax is passed,the firm will have the option to abandon the project 1 year from now,in which case the property could be sold to net $6.5 million after tax at t = 1.What is the value (in thousands) of this abandonment option?

A) $202

B) $224

C) $249

D) $277

E) $308

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gleason Research regularly takes real options into account when evaluating its proposed projects.Specifically,it considers the option to abandon a project whenever it turns out to be unsuccessful (the abandonment option) ,and it evaluates whether it is better to invest in a project today or to wait and collect more information (the investment timing option) .Assume the proposed projects can be abandoned at any time without penalty.Which of the following statements is CORRECT?

A) The abandonment option tends to reduce a project's NPV.

B) The abandonment option tends to reduce a project's risk.

C) If there are important first-mover advantages, this tends to increase the value of waiting a year to collect more information before proceeding with a proposed project.

D) A project can either have an abandonment option or an investment timing option, but never both.

E) Investment timing options always increase the value of a project.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Winters Corp.is considering a new product that would require an investment of $20 million now,at t = 0.If the new product is well received,then the project would produce after-tax cash flows of $10 million at the end of each of the next 3 years (t = 1,2,3) ,but if the market did not like the product,then the cash flows would be only $4 million per year.There is a 50% probability that the market will be good.The firm could delay the project for a year while it conducts a test to determine if demand is likely to be strong or weak,but it would have to incur costs to obtain this timing option.The project's cost and expected annual cash flows would be the same whether the project is delayed or not.The project's WACC is 11.0%.What is the value (in thousands) of the option to delay the project?

A) $1,311

B) $1,457

C) $1,619

D) $1,799

E) $1,999

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Real options are options to buy real assets,especially stocks,rather than interest-bearing assets,like bonds.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Games Unlimited Inc.is considering a new game that would require an investment of $20.0 million.If the new game is well received,then the project would produce cash flows of $9.5 million a year for 3 years.However,if the market does not like the new game,then the cash flows would be only $6.0 million per year.There is a 50% probability of both good and bad market conditions.The firm could delay the project for a year while it conducts a test to determine if demand would be strong or weak.The project's cost and expected annual cash flows would be the same whether the project is delayed or not.If the WACC is 9.0%,what is the value (in thousands) of the investment timing option?

A) $1,857

B) $2,042

C) $2,246

D) $2,471

E) $2,718

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The option to abandon a project is a real option,but a call option on a stock is not a real option.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements is most CORRECT?

A) Real options change the size, but not the risk, of projects' expected NPVs.

B) Real options change the risk, but not the size, of projects' expected NPVs.

C) Real options can reduce the cost of capital that should be used to discount a project's expected cash flows.

D) Very few projects actually have real options. They are theoretically interesting but of little practical importance.

E) Real options are more valuable when there is very little uncertainty about the true values of future sales and costs.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

If a firm practices capital rationing,this means that it is accepting fewer projects than would be theoretically optimal; hence,it is not maximizing its theoretical value.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Traditionally,an NPV analysis assumes that projects will be accepted or rejected,which implies that they will be undertaken now or never.However,in practice,companies sometimes have a third choice--delay the decision until later,when more information will be available.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

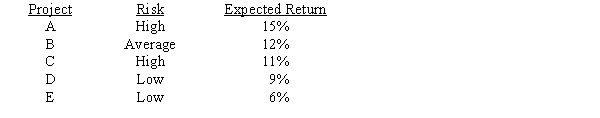

Langston Labs has an overall (composite) WACC of 10%,which reflects the cost of capital for its average asset.Its assets vary widely in risk,and Langston evaluates low-risk projects with a WACC of 8%,average-risk projects at 10%,and high-risk projects at 12%.The company is considering the following projects:

Which set of projects would maximize shareholder wealth?

Which set of projects would maximize shareholder wealth?

A) A and B.

B) A, B, and C.

C) A, B, and D.

D) A, B, C, and D.

E) A, B, C, D, and E.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) In general, the more uncertainty there is about market conditions, the more attractive it may be to wait before making an investment.

B) In general, the greater the strategic advantages of being the first competitor to enter a given market, the more attractive it probably is to wait before making an investment.

C) In general, the higher the discount rate, the more attractive it probably is to wait before making an investment.

D) In general, investment timing options are more valuable than abandonment options.

E) In general, abandonment options are rarely seen in the real world.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The following are all examples of real options that are discussed in the text: (1)growth options,(2)flexibility options,(3)timing options,and (4)abandonment options.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Real options are valuable,and that value is correctly captured by a traditional NPV analysis.Therefore,there is no reason to consider real options separately from the NPV analysis.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wahal Corporation uses the NPV method when selecting projects,and it does a reasonably good job of estimating projects' sales and costs.However,it never considers any real options that might be associated with projects.Which of the following statements is most likely to describe its situation?

A) Its estimated capital budget is probably too small, because projects' NPVs are often larger when real options are taken into account.

B) Its estimated capital budget is probably too large due to its failure to consider abandonment and growth options.

C) Failing to consider abandonment and flexibility options probably makes the optimal capital budget too large, but failing to consider growth and timing options probably makes the optimal capital budget too small, so it is unclear what impact the failure to consider real options has on the overall capital budget.

D) Failing to consider abandonment and flexibility options probably makes the optimal capital budget too small, but failing to consider growth and timing options probably makes the optimal capital budget too large, so it is unclear what impact not considering real options has on the overall capital budget.

E) Real options should not have any effect on the size of the optimal capital budget.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Norris Production Company (NPC) is considering a project that has an up-front cost at t = 0 of $2,500.(All dollars in this problem are in thousands.) The project's subsequent cash flows are critically dependent on whether a competitor's product is approved by the Food and Drug Administration.If the FDA rejects the competitive product,NPC's product will have high sales and cash flows,but if the competitive product is approved,that will negatively impact NPC.There is a 75% chance that the competitive product will be rejected,in which case NPC's expected cash flows will be $750 at the end of each of the next seven years (t = 1 to 7) .There is a 25% chance that the competitor's product will be approved,in which case the expected cash flows will be only $50 at the end of each of the next seven years (t = 1 to 7) .NPC will know for sure one year from today whether the competitor's product has been approved. NPC is considering whether to make the investment today or to wait a year to find out about the FDA's decision.If it waits a year,the project's up-front cost at t = 1 will remain at $2,500,the subsequent cash flows will remain at $750 per year if the competitor's product is rejected and $50 per year if the alternative product is approved.However,if NPC decides to wait,the subsequent cash flows will be received only for six years (t = 2 ...7) .In addition,once NPC knows the outcome of the FDA's decision,it will not take on the project if its NPV is negative. This is a risky project,so a WACC of 16.0% is to be used.If NPC chooses to wait a year before proceeding,what is the value of the timing option today?

A) $124.22

B) $138.02

C) $153.36

D) $170.40

E) $187.44

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Traditional discounted cash flow (DCF)analysis--where a project's cash flows are estimated and then discounted to obtain an expected NPV--has been the cornerstone of capital budgeting since the 1950s.However,in recent years,it has been demonstrated that DCF techniques do not always lead to proper capital budgeting decisions due to the existence of real options.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 41

Related Exams