B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Precision Aviation had a profit margin of 6.25%,a total assets turnover of 1.5,and an equity multiplier of 1.8.What was the firm's ROE?

A) 15.23%

B) 16.03%

C) 16.88%

D) 17.72%

E) 18.60%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Firms A and B have the same current ratio,0.75,the same amount of sales,and the same amount of current liabilities.However,Firm A has a higher inventory turnover ratio than B.Therefore,we can conclude that A's quick ratio must be smaller than B's.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

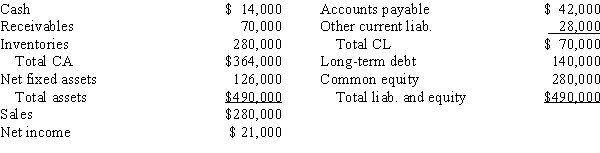

Jordan Inc has the following balance sheet and income statement data:

The new CFO thinks that inventories are excessive and could be lowered sufficiently to cause the current ratio to equal the industry average,2.75,without affecting either sales or net income.Assuming that inventories are sold off and not replaced to get the current ratio to the target level,and that the funds generated are used to buy back common stock at book value,by how much would the ROE change?

The new CFO thinks that inventories are excessive and could be lowered sufficiently to cause the current ratio to equal the industry average,2.75,without affecting either sales or net income.Assuming that inventories are sold off and not replaced to get the current ratio to the target level,and that the funds generated are used to buy back common stock at book value,by how much would the ROE change?

A) 11.26%

B) 11.85%

C) 12.45%

D) 13.07%

E) 13.72%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm's new president wants to strengthen the company's financial position.Which of the following actions would make it financially stronger?

A) Increase accounts receivable while holding sales constant.

B) Increase EBIT while holding sales and assets constant.

C) Increase accounts payable while holding sales constant.

D) Increase notes payable while holding sales constant.

E) Increase inventories while holding sales constant.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

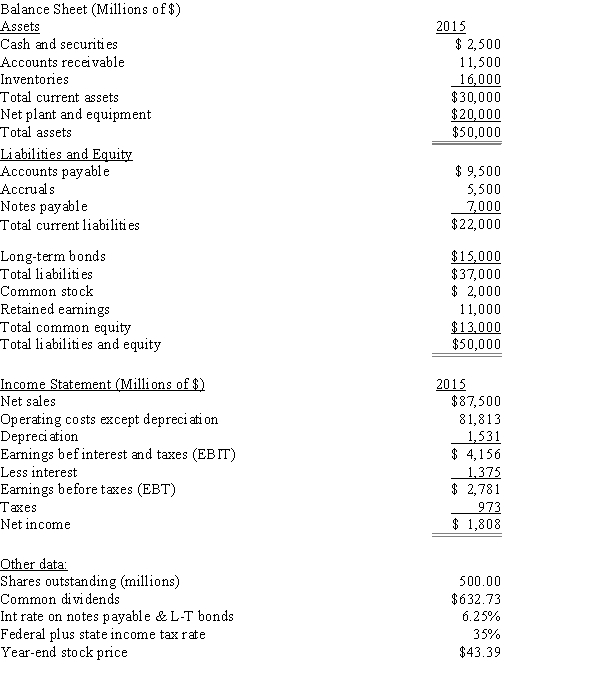

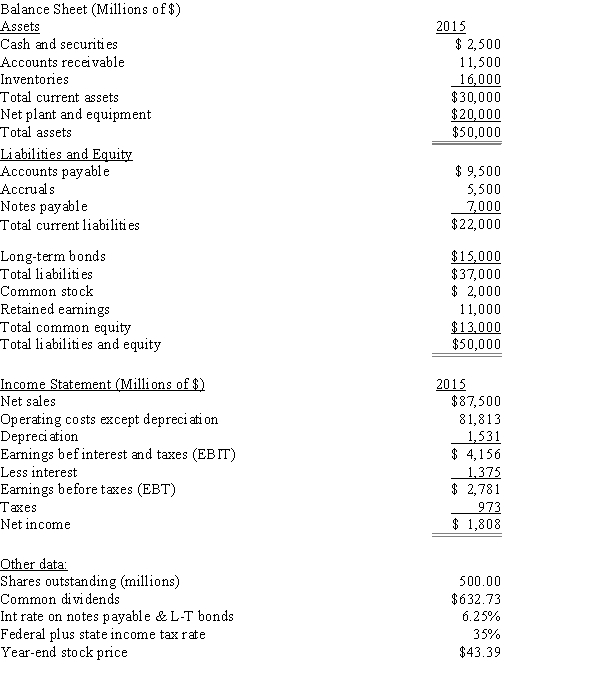

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to Exhibit 4.1.What is the firm's operating margin?

-Refer to Exhibit 4.1.What is the firm's operating margin?

A) 3.12%

B) 3.46%

C) 3.85%

D) 4.28%

E) 4.75%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Casey Communications recently issued new common stock and used the proceeds to pay off some of its short-term notes payable.This action had no effect on the company's total assets or operating income.Which of the following effects would occur as a result of this action?

A) The company's current ratio increased.

B) The company's times interest earned ratio decreased.

C) The company's basic earning power ratio increased.

D) The company's equity multiplier increased.

E) The company's total debt to total capital ratio increased.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Even though Firm A's current ratio exceeds that of Firm B, Firm B's quick ratio might exceed that of A. However, if A's quick ratio exceeds B's, then we can be certain that A's current ratio is also larger than B's.

B) Suppose a firm wants to maintain a specific TIE ratio. It knows the amount of its debt, the interest rate on that debt, the applicable tax rate, and its operating costs. With this information, the firm can calculate the amount of sales required to achieve its target TIE ratio.

C) Since the ROA measures the firm's effective utilization of assets without considering how these assets are financed, two firms with the same EBIT must have the same ROA.

D) Suppose all firms follow similar financing policies, face similar risks, have equal access to capital, and operate in competitive product and capital markets. However, firms face different operating conditions because, for example, the grocery store industry is different from the airline industry. Under these conditions, firms with high profit margins will tend to have high asset turnover ratios, and firms with low profit margins will tend to have low turnover ratios.

E) Klein Cosmetics has a profit margin of 5.0%, a total assets turnover ratio of 1.5 times, no debt and therefore an equity multiplier of 1.0, and an ROE of 7.5%. The CFO recommends that the firm borrow funds using long-term debt, use the funds to buy back stock, and raise the equity multiplier to 2.0. The size of the firm (assets) would not change. She thinks that operations would not be affected, but interest on the new debt would lower the profit margin to 4.5%. This would probably not be a good move, as it would decrease the ROE from 7.5% to 6.5%.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to Exhibit 4.1.What is the firm's BEP?

-Refer to Exhibit 4.1.What is the firm's BEP?

A) 7.50%

B) 7.90%

C) 8.31%

D) 8.73%

E) 9.16%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Market value ratios provide management with an indication of how investors view the firm's past performance and especially its future prospects.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Companies HD and LD have the same tax rate,sales,total assets,and basic earning power.Both companies have positive net incomes.Both firms finance using only debt and common equity and total assets equal total invested capital.Company HD has a higher total debt to total invested capital ratio and,therefore,a higher interest expense.Which of the following statements is CORRECT?

A) Company HD has a lower equity multiplier.

B) Company HD has more net income.

C) Company HD pays more in taxes.

D) Company HD has a lower ROE.

E) Company HD has a lower times-interest-earned (TIE) ratio.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Companies HD and LD have the same total assets,sales,operating costs,and tax rates,and they pay the same interest rate on their debt.Both firms finance using only debt and common equity and total assets equal total invested capital.However,company HD has a higher total debt to total capital ratio.Which of the following statements is CORRECT?

A) Given this information, LD must have the higher ROE.

B) Company LD has a higher basic earning power ratio (BEP) .

C) Company HD has a higher basic earning power ratio (BEP) .

D) If the interest rate the companies pay on their debt is more than their basic earning power (BEP) , then Company HD will have the higher ROE.

E) If the interest rate the companies pay on their debt is less than their basic earning power (BEP) , then Company HD will have the higher ROE.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The more conservative a firm's management is,the higher its total debt to total capital ratio [measured as (Short-term debt + Long-term debt)/(Debt + Preferred stock + Common equity)] is likely to be.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 121 - 133 of 133

Related Exams