B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) A reduction in inventories would have no effect on the current ratio.

B) An increase in inventories would have no effect on the current ratio.

C) If a firm increases its sales while holding its inventories constant, then, other things held constant, its inventory turnover ratio will increase.

D) A reduction in the inventory turnover ratio will generally lead to an increase in the ROE.

E) If a firm increases its sales while holding its inventories constant, then, other things held constant, its fixed assets turnover ratio will decline.

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The return on invested capital measures the total return that a company has provided for its investors.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Other things held constant,a decline in sales accompanied by an increase in financial leverage must result in a lower profit margin.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Amram Company's current ratio is 2.0.Considered alone,which of the following actions would lower the current ratio?

A) Borrow using short-term notes payable and use the proceeds to reduce accruals.

B) Borrow using short-term notes payable and use the proceeds to reduce long-term debt.

C) Use cash to reduce accruals.

D) Use cash to reduce short-term notes payable.

E) Use cash to reduce accounts payable.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

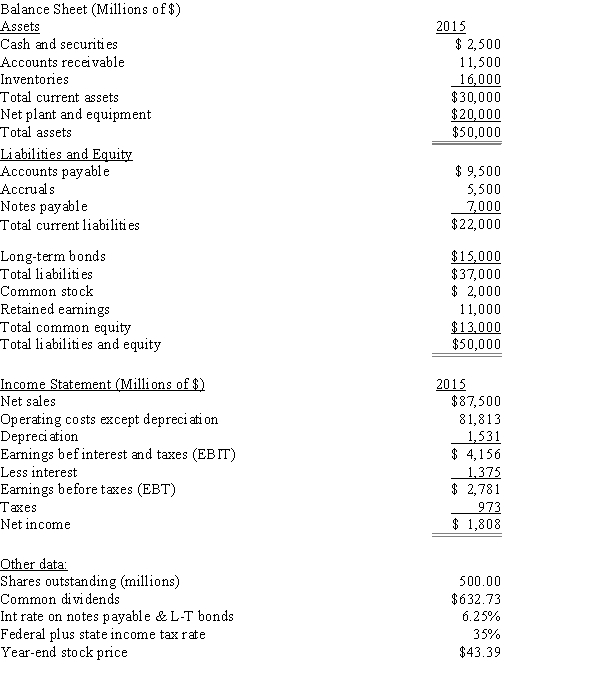

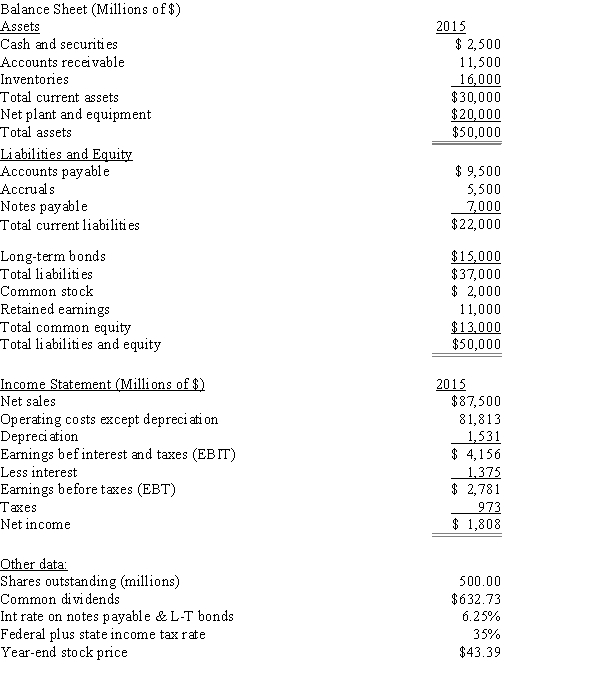

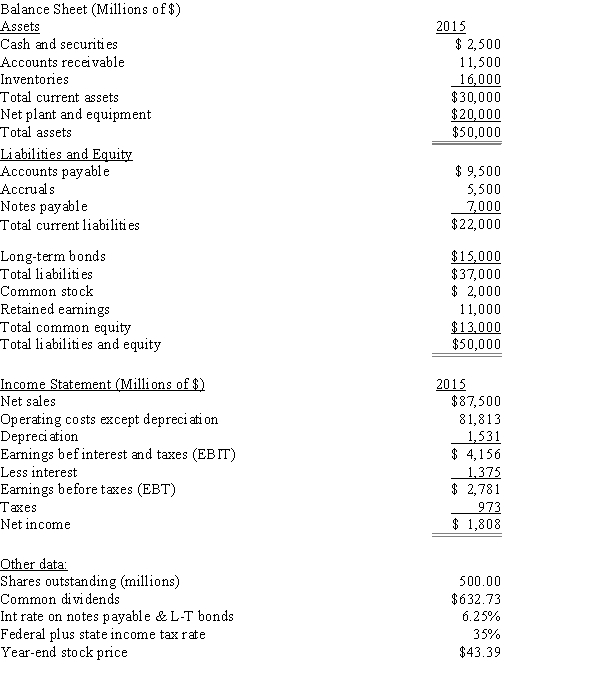

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to Exhibit 4.1.What is the firm's P/E ratio?

-Refer to Exhibit 4.1.What is the firm's P/E ratio?

A) 12.0

B) 12.6

C) 13.2

D) 13.9

E) 14.6

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

If a firm sold some inventory on credit,its current ratio would probably not change much,but its quick ratio would increase.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to Exhibit 4.1.What is the firm's TIE?

-Refer to Exhibit 4.1.What is the firm's TIE?

A) 2.20

B) 2.45

C) 2.72

D) 3.02

E) 3.33

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Although a full liquidity analysis requires the use of a cash budget,the current and quick ratios provide fast and easy-to-use estimates of a firm's liquidity position.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your sister is thinking about starting a new business.The company would require $375,000 of assets,and it would be financed entirely with common stock.She will go forward only if she thinks the firm can provide a 13.5% return on the invested capital,which means that the firm must have an ROE of 13.5%.How much net income must be expected to warrant starting the business?

A) $41,234

B) $43,405

C) $45,689

D) $48,094

E) $50,625

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The return on common equity (ROE)is generally regarded as being less significant,from a stockholder's viewpoint,than the return on total assets (ROA).

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

River Corp's total assets at the end of last year were $415,000 and its net income was $32,750.What was its return on total assets?

A) 7.89%

B) 8.29%

C) 8.70%

D) 9.14%

E) 9.59%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

HD Corp and LD Corp have identical assets,sales,interest rates paid on their debt,tax rates,and EBIT.Both firms finance using only debt and common equity and total assets equal total invested capital.However,HD uses more debt than LD.Which of the following statements is CORRECT?

A) Without more information, we cannot tell if HD or LD would have a higher or lower net income.

B) HD would have the lower equity multiplier for use in the DuPont equation.

C) HD would have to pay more in income taxes.

D) HD would have the lower net income as shown on the income statement.

E) HD would have the higher operating margin.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The times-interest-earned ratio measures the extent to which operating income can decline before the firm is unable to meet its annual interest costs.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The ratio of long-term debt to total capital is more likely to experience seasonal fluctuations than is either the DSO or the inventory turnover ratio.

B) If two firms have the same ROA, the firm with the most debt can be expected to have the lower ROE.

C) An increase in the DSO, other things held constant, could be expected to increase the total assets turnover ratio.

D) An increase in the DSO, other things held constant, could be expected to increase the ROE.

E) An increase in a firm's total debt to total capital ratio, with no changes in its sales or operating costs, could be expected to lower its profit margin.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Harrington Inc.had sales of $325,000 and a net income of $19,000,and its year-end assets were $250,000.The firm's total-debt-to-total-capital ratio was 45.0%.The firm finances using only debt and common equity and its total assets equal total invested capital.Based on the DuPont equation,what was the ROE?

A) 13.82%

B) 14.51%

C) 15.23%

D) 16.00%

E) 16.80%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to Exhibit 4.1.What is the firm's profit margin?

-Refer to Exhibit 4.1.What is the firm's profit margin?

A) 1.51%

B) 1.67%

C) 1.86%

D) 2.07%

E) 2.27%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would,generally,indicate an improvement in a company's financial position,holding other things constant?

A) The TIE declines.

B) The DSO increases.

C) The quick ratio increases.

D) The current ratio declines.

E) The total assets turnover decreases.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In general,if investors regard a company as being relatively risky and/or having relatively poor growth prospects,then it will have relatively high P/E and M/B ratios.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The operating margin measures operating income per dollar of assets.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 133

Related Exams