A) The company's debt ratio increased.

B) The company's current ratio increased.

C) The company's times interest earned ratio decreased.

D) The company's basic earning power ratio increased.

E) The company's equity multiplier increased.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

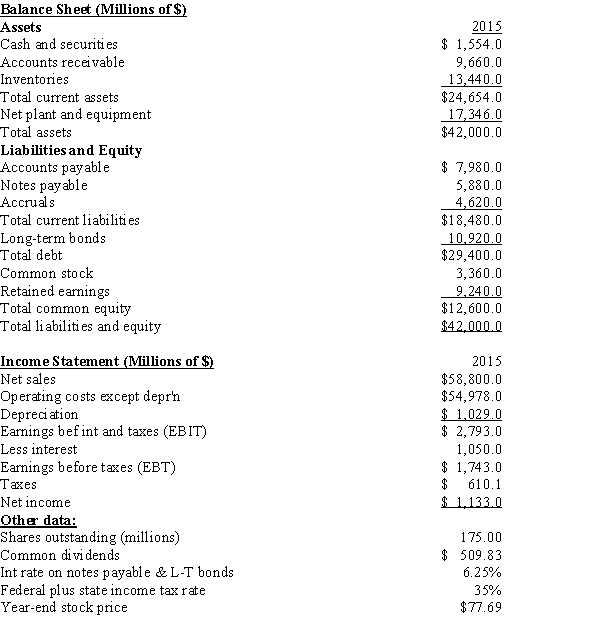

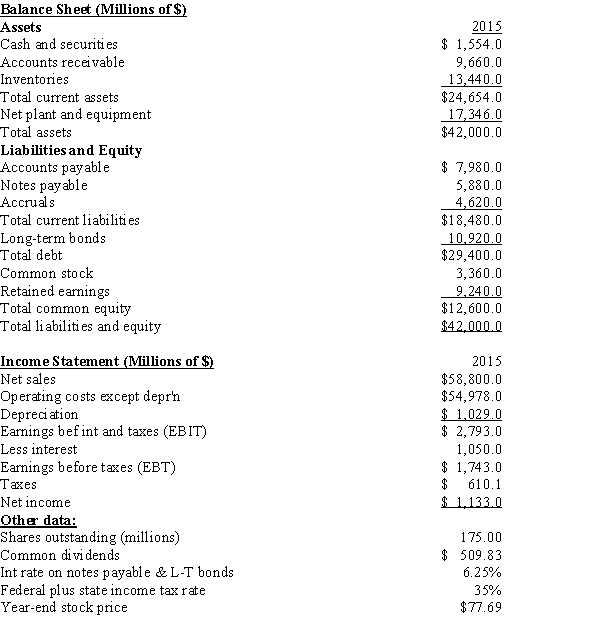

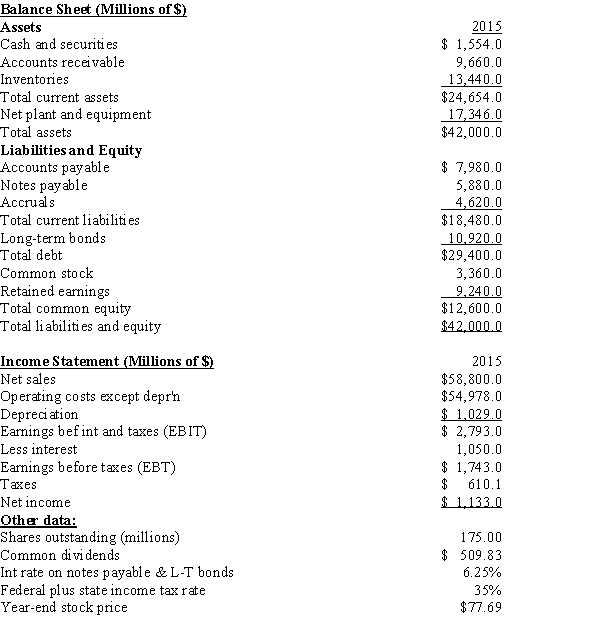

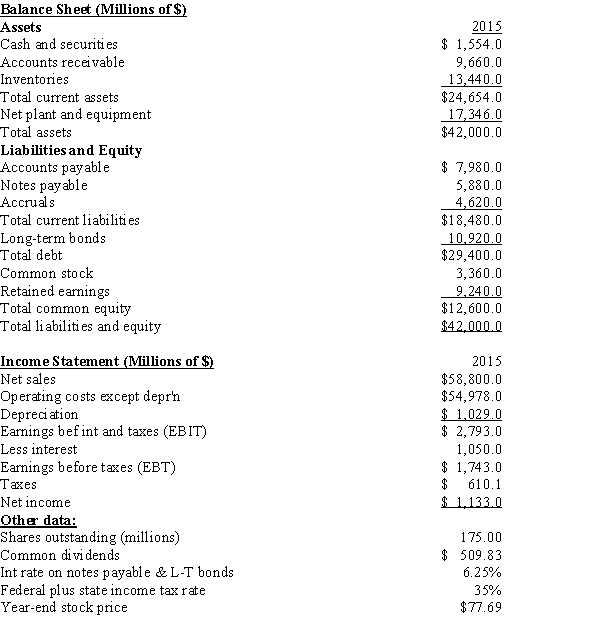

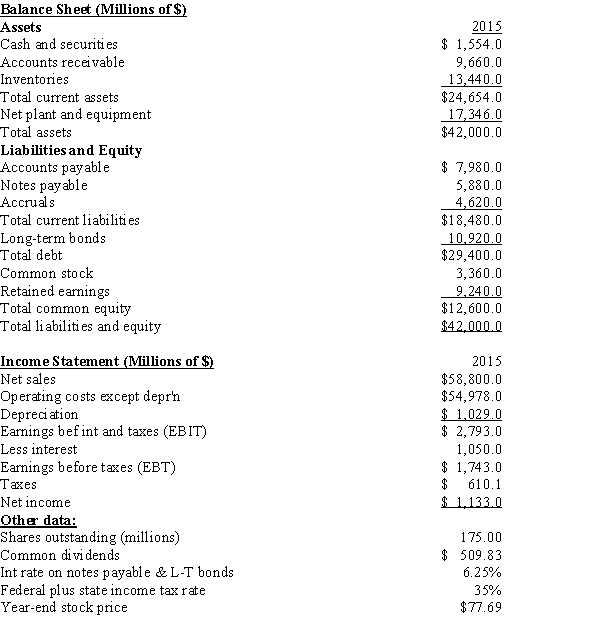

Exhibit 7.1

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.  -Refer to Exhibit 7.1.What is the firm's profit margin?

-Refer to Exhibit 7.1.What is the firm's profit margin?

A) 1.40%

B) 1.56%

C) 1.73%

D) 1.93%

E) 2.12%

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Market value ratios provide management with an indication of how investors view the firm's past performance and especially its future prospects.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Heaton Corp.sells on terms that allow customers 45 days to pay for merchandise.Its sales last year were $425,000,and its year-end receivables were $60,000.If its DSO is less than the 45-day credit period,then customers are paying on time.Otherwise,they are paying late.By how much are customers paying early or late? Base your answer on this equation: DSO − Credit period = days early or late,and use a 365-day year when calculating the DSO.A positive answer indicates late payments,while a negative answer indicates early payments.

A) 6.20

B) 6.53

C) 6.86

D) 7.20

E) 7.56

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 7.1

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.  -Refer to Exhibit 7.1.What is the firm's cash flow per share?

-Refer to Exhibit 7.1.What is the firm's cash flow per share?

A) $10.06

B) $10.59

C) $11.15

D) $11.74

E) $12.35

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) "Window dressing" is any action that improves a firm's fundamental, long-run position and thus increases its intrinsic value.

B) Borrowing by using short-term notes payable and then using the proceeds to retire long-term debt is an example of "window dressing." Offering discounts to customers who pay with cash rather than buy on credit and then using the funds that come in quicker to purchase additional inventories is another example of "window dressing."

C) Borrowing on a long-term basis and using the proceeds to retire short-term debt would improve the current ratio and thus could be considered to be an example of "window dressing."

D) Offering discounts to customers who pay with cash rather than buy on credit and then using the funds that come in quicker to purchase additional inventories is an example of "window dressing."

E) Using some of the firm's cash to reduce long-term debt is an example of "window dressing."

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Emerson Inc.'s would like to undertake a policy of paying out 45% of its income.Its latest net income was $1,250,000,and it had 225,000 shares outstanding.What dividend per share should it declare?

A) $2.14

B) $2.26

C) $2.38

D) $2.50

E) $2.63

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Orono Corp.'s sales last year were $435,000,its operating costs were $362,500,and its interest charges were $12,500.What was the firm's times interest earned (TIE) ratio?

A) 4.72

B) 4.97

C) 5.23

D) 5.51

E) 5.80

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 7.1

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.  -Refer to Exhibit 7.1.What is the firm's book value per share?

-Refer to Exhibit 7.1.What is the firm's book value per share?

A) $61.73

B) $64.98

C) $68.40

D) $72.00

E) $75.60

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Companies Heidee and Leaudy have the same total assets,sales,operating costs,and tax rates,and they pay the same interest rate on their debt.However,company Heidee has a higher debt ratio.Which of the following statements is CORRECT?

A) If the interest rate the companies pay on their debt is less than their basic earning power (BEP) , then Company Heidee will have the higher ROE.

B) Given this information, Leaudy must have the higher ROE.

C) Company Leaudy has a higher basic earning power ratio (BEP) .

D) Company Heidee has a higher basic earning power ratio (BEP) .

E) If the interest rate the companies pay on their debt is more than their basic earning power (BEP) , then Company Heidee will have the higher ROE.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 7.1

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.  -Refer to Exhibit 7.1.What is the firm's BEP?

-Refer to Exhibit 7.1.What is the firm's BEP?

A) 6.00%

B) 6.32%

C) 6.65%

D) 6.98%

E) 7.33%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investor is considering starting a new business.The company would require $475,000 of assets,and it would be financed entirely with common stock.The investor will go forward only if she thinks the firm can provide a 13.5% return on the invested capital,which means that the firm must have an ROE of 13.5%.How much net income must be expected to warrant starting the business?

A) $52,230

B) $54,979

C) $57,873

D) $60,919

E) $64,125

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 7.1

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.  -Refer to Exhibit 7.1.What is the firm's total assets turnover?

-Refer to Exhibit 7.1.What is the firm's total assets turnover?

A) 0.90

B) 1.12

C) 1.40

D) 1.68

E) 2.02

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would indicate an improvement in a company's financial position,holding other things constant?

A) The current and quick ratios both increase.

B) The inventory and total assets turnover ratios both decline.

C) The debt ratio increases.

D) The profit margin declines.

E) The EBITDA coverage ratio declines.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A decline in a firm's inventory turnover ratio suggests that it is managing its inventory more efficiently and also that its liquidity position is improving,i.e.,it is becoming more liquid.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

High current and quick ratios always indicate that a firm is managing its liquidity position well.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The inventory turnover and current ratio are related.The combination of a high current ratio and a low inventory turnover ratio,relative to industry norms,suggests that the firm has an above-average inventory level and/or that part of the inventory is obsolete or damaged.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Urbana Corp.had $197,500 of assets,$307,500 of sales,$19,575 of net income,and a debt-to-total-assets ratio of 37.5%.The new CFO believes a new computer program will enable it to reduce costs and thus raise net income to $33,000.Assets,sales,and the debt ratio would not be affected.By how much would the cost reduction improve the ROE?

A) 9.32%

B) 9.82%

C) 10.33%

D) 10.88%

E) 11.42%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm wants to strengthen its financial position.Which of the following actions would increase its quick ratio?

A) Issue new common stock and use the proceeds to acquire additional fixed assets.

B) Offer price reductions along with generous credit terms that would (1) enable the firm to sell some of its excess inventory and (2) lead to an increase in accounts receivable.

C) Issue new common stock and use the proceeds to increase inventories.

D) Speed up the collection of receivables and use the cash generated to increase inventories.

E) Use some of its cash to purchase additional inventories.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Firms A and B have the same current ratio,0.75,the same amount of sales and cost of goods sold,and the same amount of current liabilities.However,Firm A has a higher inventory turnover ratio than B.Therefore,we can conclude that A's quick ratio must be smaller than B's.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 104

Related Exams