B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The WACC for two mutually exclusive projects that are being considered is 12%.Project K has an IRR of 20% while Project R's IRR is 15%.The projects have the same NPV at the 12% current WACC.Interest rates are currently high.However,you believe that money costs and thus your WACC will soon decline.You also think that the projects will not be funded until the WACC has decreased,and their cash flows will not be affected by the change in economic conditions.Under these conditions,which of the following statements is CORRECT?

A) You should delay a decision until you have more information on the projects, even if this means that a competitor might come in and capture this market.

B) You should recommend Project R, because at the new WACC it will have the higher NPV.

C) You should recommend Project K, because at the new WACC it will have the higher NPV.

D) You should recommend Project R because it will have both a higher IRR and a higher NPV under the new conditions.

E) You should reject both projects because they will both have negative NPVs under the new conditions.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

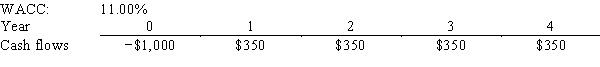

Scott Enterprises is considering a project that has the following cash flow and WACC data.What is the project's NPV? Note that if a project's expected NPV is negative,it should be rejected.

A) $77.49

B) $81.56

C) $85.86

D) $90.15

E) $94.66

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

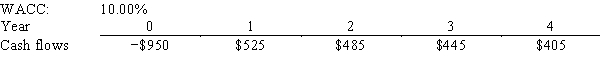

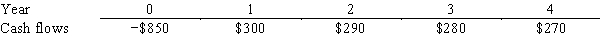

Shannon Co.is considering a project that has the following cash flow and WACC data.What is the project's discounted payback?

A) 1.61 years

B) 1.79 years

C) 1.99 years

D) 2.22 years

E) 2.44 years

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are on the staff of O'Hara Inc.The CFO believes project acceptance should be based on the NPV,but Andrew O'Hara,the president,insists that no project should be accepted unless its IRR exceeds the project's risk-adjusted WACC.Now you must make a recommendation on a project that has a cost of $15,000 and two cash flows: $110,000 at the end of Year 1 and −$100,000 at the end of Year 2.The president and the CFO both agree that the appropriate WACC for this project is 10%.At 10%,the NPV is $2,355.37,but you find two IRRs,one at 6.33% and one at 527%,and a MIRR of 11.32%.Which of the following statements best describes your optimal recommendation,i.e.,the analysis and recommendation that is best for the company and least likely to get you in trouble with either the CFO or the president?

A) You should recommend that the project be rejected because, although its NPV is positive, it has an IRR that is less than the WACC.

B) You should recommend that the project be accepted because (1) its NPV is positive and (2) although it has two IRRs, in this case it would be better to focus on the MIRR, which exceeds the WACC. You should explain this to the president and tell him that the firm's value will increase if the project is accepted.

C) You should recommend that the project be rejected. Although its NPV is positive it has two IRRs, one of which is less than the WACC, which indicates that the firm's value will decline if the project is accepted.

D) You should recommend that the project be rejected because, although its NPV is positive, its MIRR is less than the WACC, and that indicates that the firm's value will decline if it is accepted.

E) You should recommend that the project be rejected because its NPV is negative and its IRR is less than the WACC.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

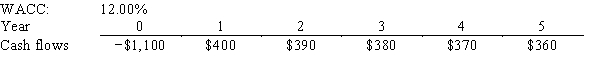

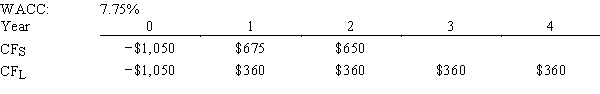

Dickson Co.is considering a project that has the following cash flow and WACC data.What is the project's NPV? Note that a project's expected NPV can be negative,in which case it will be rejected.

A) $250.15

B) $277.94

C) $305.73

D) $336.31

E) $369.94

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The IRR method is based on the assumption that projects' cash flows are reinvested at the project's risk-adjusted cost of capital.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The NPV and IRR methods,when used to evaluate two equally risky but mutually exclusive projects,will lead to different accept/reject decisions and thus capital budgets if the cost of capital at which the projects' NPV profiles cross is less than the projects' cost of capital.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A project's IRR is independent of the firm's cost of capital.In other words,a project's IRR doesn't change with a change in the firm's cost of capital.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

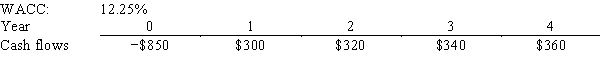

Westwood Painting Co.is considering a project that has the following cash flow and WACC data.What is the project's MIRR? Note that a project's MIRR can be less than the WACC (and even negative) ,in which case it will be rejected.

A) 13.42%

B) 14.91%

C) 16.56%

D) 18.22%

E) 20.04%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The NPV method's assumption that cash inflows are reinvested at the cost of capital is generally more reasonable than the IRR's assumption that cash flows are reinvested at the IRR.This is an important reason why the NPV method is generally preferred over the IRR method.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Modern Refurbishing Inc.is considering a project that has the following cash flow data.What is the project's IRR? Note that a project's IRR can be less than the WACC (and even negative) ,in which case it will be rejected.

A) 13.13%

B) 14.44%

C) 15.89%

D) 17.48%

E) 19.22%

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lancaster Corp.is considering two equally risky,mutually exclusive projects,both of which have normal cash flows.Project A has an IRR of 11%,while Project B's IRR is 14%.When the WACC is 8%,the projects have the same NPV.Given this information,which of the following statements is CORRECT?

A) If the WACC is 9%, Project A's NPV will be higher than Project B's.

B) If the WACC is 6%, Project B's NPV will be higher than Project A's.

C) If the WACC is greater than 14%, Project A's IRR will exceed Project B's.

D) If the WACC is 9%, Project B's NPV will be higher than Project A's.

E) If the WACC is 13%, Project A's NPV will be higher than Project B's.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Carolina Company is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and are not repeatable.If the decision is made by choosing the project with the higher IRR,how much value will be forgone? Note that under some conditions choosing projects on the basis of the IRR will cause $0.00 value to be lost.

A) $11.45

B) $12.72

C) $14.63

D) $16.82

E) $19.35

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

For a project with one initial cash outflow followed by a series of positive cash inflows,the modified IRR (MIRR)method involves compounding the cash inflows out to the end of the project's life,summing those compounded cash flows to form a terminal value (TV),and then finding the discount rate that causes the PV of the TV to equal the project's cost.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Other things held constant,an increase in the cost of capital will result in a decrease in a project's IRR.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In theory,capital budgeting decisions should depend solely on forecasted cash flows and the opportunity cost of capital.The decision criterion should not be affected by managers' tastes,choice of accounting method,or the profitability of other independent projects.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The NPV profile graph for a normal project will generally have a positive (upward) slope as the life of the project increases.

B) An NPV profile graph is designed to give decision makers an idea about how a project's risk varies with its life.

C) An NPV profile graph is designed to give decision makers an idea about how a project's contribution to the firm's value varies with the cost of capital.

D) We cannot draw a project's NPV profile unless we know the appropriate WACC for use in evaluating the project's NPV.

E) An NPV profile graph shows how a project's payback varies as the cost of capital changes.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

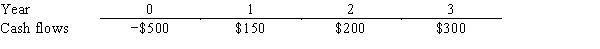

Worthington Inc.is considering a project that has the following cash flow data.What is the project's payback?

A) 2.03 years

B) 2.25 years

C) 2.50 years

D) 2.75 years

E) 3.03 years

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) To find the MIRR, we first compound cash flows at the regular IRR to find the TV, and then we discount the TV at the WACC to find the PV.

B) The NPV and IRR methods both assume that cash flows can be reinvested at the WACC. However, the MIRR method assumes reinvestment at the MIRR itself.

C) If two projects have the same cost, and if their NPV profiles cross in the upper right quadrant, then the project with the higher IRR probably has more of its cash flows coming in the later years.

D) If two projects have the same cost, and if their NPV profiles cross in the upper right quadrant, then the project with the lower IRR probably has more of its cash flows coming in the later years.

E) For a project with normal cash flows, any change in the WACC will change both the NPV and the IRR.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 107

Related Exams