B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You plan to borrow $35,000 at a 7.5% annual interest rate.The terms require you to amortize the loan with 7 equal end-of-year payments.How much interest would you be paying in Year 2?

A) $1,994.49

B) $2,099.46

C) $2,209.96

D) $2,326.27

E) $2,442.59

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are considering two equally risky annuities,each of which pays $25,000 per year for 10 years.Investment ORD is an ordinary (or deferred) annuity,while Investment DUE is an annuity due.Which of the following statements is CORRECT?

A) If the going rate of interest decreases from 10% to 0%, the difference between the present value of ORD and the present value of DUE would remain constant.

B) A rational investor would be willing to pay more for DUE than for ORD, so their market prices should differ.

C) The present value of DUE exceeds the present value of ORD, while the future value of DUE is less than the future value of ORD.

D) The present value of ORD exceeds the present value of DUE, and the future value of ORD also exceeds the future value of DUE.

E) The present value of ORD exceeds the present value of DUE, while the future value of DUE exceeds the future value of ORD.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

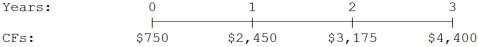

What is the present value of the following cash flow stream at a rate of 8.0%?

A) $7,917

B) $8,333

C) $8,772

D) $9,233

E) $9,695

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A time line is meaningful even if all cash flows do not occur annually.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your older brother turned 35 today,and he is planning to save $7,000 per year for retirement,with the first deposit to be made one year from today.He will invest in a mutual fund that's expected to provide a return of 7.5% per year.He plans to retire 30 years from today,when he turns 65,and he expects to live for 25 years after retirement,to age 90.Under these assumptions,how much can he spend each year after he retires? His first withdrawal will be made at the end of his first retirement year.

A) $58,601

B) $61,686

C) $64,932

D) $68,179

E) $71,588

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a Google.com bond will pay $4,500 ten years from now.If the going interest rate on safe 10-year bonds is 4.25%,how much is the bond worth today?

A) $2,819.52

B) $2,967.92

C) $3,116.31

D) $3,272.13

E) $3,435.74

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your 75-year-old grandmother expects to live for another 15 years.She currently has $1,000,000 of savings,which is invested to earn a guaranteed 5% rate of return.If inflation averages 2% per year,how much can she withdraw (to the nearest dollar) at the beginning of each year and keep the withdrawals constant in real terms,i.e.,growing at the same rate as inflation and thus enabling her to maintain a constant standard of living?

A) $65,632

B) $72,925

C) $81,027

D) $89,130

E) $98,043

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your bank pays 4% interest annually.You have $2,500 invested in the bank.How long will it take for your funds to double?

A) 14.39

B) 15.15

C) 15.95

D) 16.79

E) 17.67

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You borrowed $50,000 which you must repay in 10 years.You plan to make an initial deposit today,then make 9 more deposits at the beginning of each the next 9 years,but with the deposits increasing at the inflation rate.You expect to earn 5% on your funds,and you expect a 3% inflation rate.To the nearest dollar,how large must your initial deposit be to enable you to reach your $50,000 target?

A) $3,008

B) $3,342

C) $3,676

D) $4,044

E) $4,448

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding a 20-year (240-month) $225,000,fixed-rate mortgage is CORRECT? (Ignore taxes and transactions costs.)

A) The outstanding balance declines at a slower rate in the later years of the loan's life.

B) The remaining balance after three years will be $225,000 less one third of the interest paid during the first three years.

C) Because it is a fixed-rate mortgage, the monthly loan payments (which include both interest and principal payments) are constant.

D) Interest payments on the mortgage will increase steadily over time, but the total amount of each payment will remain constant.

E) The proportion of the monthly payment that goes towards repayment of principal will be lower 10 years from now than it will be the first year.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A "growing annuity" is a cash flow stream that grows at a constant rate for a specified number of periods.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have $5,000 invested in a bank that pays 3.8% annually.How long will it take for your funds to triple?

A) 23.99

B) 25.26

C) 26.58

D) 27.98

E) 29.46

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following bank accounts has the highest effective annual return?

A) An account that pays 8% nominal interest with daily (365-day) compounding.

B) An account that pays 8% nominal interest with monthly compounding.

C) An account that pays 8% nominal interest with annual compounding.

D) An account that pays 7% nominal interest with daily (365-day) compounding.

E) An account that pays 7% nominal interest with monthly compounding.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

If the discount (or interest)rate is positive,the present value of an expected series of payments will always exceed the future value of the same series.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a bank compounds savings accounts quarterly,the nominal rate will exceed the effective annual rate.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Midway through the life of an amortized loan,the percentage of the payment that represents interest must be equal to the percentage that represents repayment of principal.This is true regardless of the original life of the loan or the interest rate on the loan.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How much would Roderick have after 6 years if he has $500 now and leaves it invested at 5.5% with annual compounding?

A) $591.09

B) $622.20

C) $654.95

D) $689.42

E) $723.89

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your Aunt Elsa has $500,000 invested at 6.5%,and she plans to retire.She wants to withdraw $40,000 at the beginning of each year,starting immediately.What is the maximum number of whole payments that can be withdrawn before the account is exhausted,i.e.,before the account balance would become negative? (Hint: Round down to the nearest whole number.)

A) 18

B) 19

C) 20

D) 21

E) 22

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you just won the state lottery,and you have a choice between receiving $2,550,000 today or a 20-year annuity of $250,000,with the first payment coming one year from today.What rate of return is built into the annuity? Disregard taxes.

A) 7.12%

B) 7.49%

C) 7.87%

D) 8.26%

E) 8.67%

G) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 168

Related Exams