B) False

Correct Answer

verified

Correct Answer

verified

True/False

A change in the amount of sales can be due to either a change in the units sold or a change in price or both.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

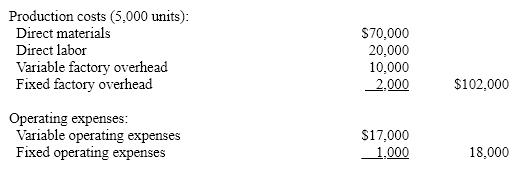

A business operated at 100% of capacity during its first month and incurred the following costs:  If 1,000 units remain unsold at the end of the month and sales total $150,000 for the month, what is the amount of the manufacturing margin that would be reported on the absorption costing income statement?

If 1,000 units remain unsold at the end of the month and sales total $150,000 for the month, what is the amount of the manufacturing margin that would be reported on the absorption costing income statement?

A) $50,000

B) $54,000

C) not reported

D) $70,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not be an appropriate activity base for cost analysis in a service firm?

A) lawns mowed

B) inventory produced

C) customers served

D) haircuts given

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In variable costing, the cost of products manufactured is composed of only those manufacturing costs that increase or decrease as the volume of production rises or falls.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under absorption costing, which of the following costs would not be included in finished goods inventory?

A) hourly wages of assembly worker

B) straight-line depreciation on factory equipment

C) overtime wages paid to factory workers

D) the salaries for salespeople

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

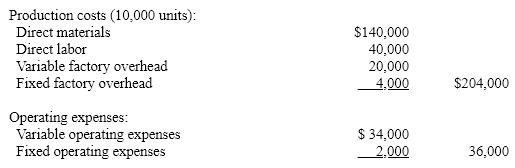

A business operated at 100% of capacity during its first month and incurred the following costs:  If 2,000 units remain unsold at the end of the month and sales total $300,000 for the month, what is the amount of the manufacturing margin that would be reported on the variable costing income statement?

If 2,000 units remain unsold at the end of the month and sales total $300,000 for the month, what is the amount of the manufacturing margin that would be reported on the variable costing income statement?

A) $104,000

B) $106,000

C) $140,000

D) not reported

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the variable selling and administrative expenses totaled $120,000 for the year (80,000 units at $1.50 each) and the planned variable selling and administrative expenses totaled $136,500 (78,000 units at $1.75 each) , the effect of the unit cost factor on the change in contribution margin is:

A) $19,500 decrease

B) $19,500 increase

C) $20,000 decrease

D) $20,000 increase

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which of the following types of firms would it be appropriate to prepare contribution margin reporting and analysis?

A) boat manufacturing

B) a chain of beauty salons

C) home building

D) all of the above

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Contribution margin reporting can be beneficial for analyzing which of the following?

A) sales personnel

B) products

C) sales territory

D) all of the above

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Changes in the quantity of finished goods inventory, caused by differences in the levels of sales and production, directly affect the amount of income from operations reported under absorption costing.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The relative distribution of sales among various products sold is referred to as the:

A) by-product mix

B) joint product mix

C) profit mix

D) sales mix

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Management will use both variable and absorption costing in all of the following activities except:

A) controlling costs

B) product pricing

C) production planning

D) controlling inventory levels

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

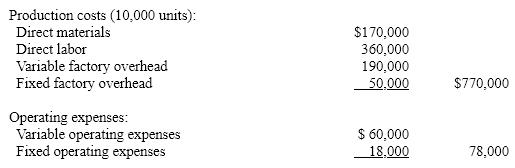

A business operated at 100% of capacity during its first month and incurred the following costs:  If 500 units remain unsold at the end of the month, what is the amount of inventory that would be reported on the variable costing balance sheet?

If 500 units remain unsold at the end of the month, what is the amount of inventory that would be reported on the variable costing balance sheet?

A) $41,500

B) $36,000

C) $42,800

D) $38,500

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Under absorption costing, the cost of finished goods includes direct materials, direct labor, and all factory overhead.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Costs that can be influenced by management at a specific level of management are called:

A) direct costs.

B) variable costs.

C) noncontrollable costs.

D) controllable costs.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

In determining cost of goods sold, two alternate costing concepts can be used: absorption costing and variable costing.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For a period during which the quantity of product manufactured was less than the quantity sold, income from operations reported under absorption costing will be larger than income from operations reported under variable costing.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For a period during which the quantity of inventory at the end was smaller than that at the beginning, income from operations reported under variable costing will be smaller than income from operations reported under absorption costing.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

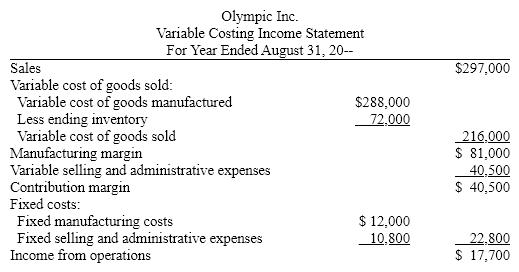

During the first year of operations, 18,000 units were manufactured and 13,500 units were sold. On August 31, Olympic Inc. prepared the following income statement based on the variable costing concept:  Determine the unit cost of goods manufactured, based on (a) the variable costing concept and (b) the absorption costing concept.

Determine the unit cost of goods manufactured, based on (a) the variable costing concept and (b) the absorption costing concept.

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 153

Related Exams