B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is (are) the proper time period(s) to record the effects of a change in accounting estimate?

A) Current period and prospectively

B) Current period and retrospectively

C) Retrospectively only

D) Current period only

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a particular transaction is not specifically addressed by IFRS, where should an accountant turn to find a hierarchy of guidance to be considered in the selection of an accounting policy?

A) accounting standards from other countries

B) IAS 8

C) the company's board of directors

D) the company's external auditors

F) All of the above

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Which of the following is accounted for as a change in accounting policy?

A) A change in the estimated useful life of plant assets.

B) A change from the cash basis of accounting to the accrual basis of accounting.

C) A change from expensing immaterial expenditures to deferring and amortizing them as they become material.

D) A change in inventory valuation from average cost to FIFO.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Why does IASB prohibit retrospective treatment of changes in accounting estimates?

A) The IASB view changes in estimates as normal recurring corrections and adjustments, which are the natural result of the accounting process.

B) The IASB does not allow the retrospective treatment for any type of presentation.

C) The IASB prohibits retrospective treatment of changes in accounting estimates because IFRS requires it.

D) IASB does not prohibit retrospective treatment of changes in accounting estimates, but is silent on this issue

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Accounting changes are often made and the monetary impact is reflected in the financial statements of a company even though, in theory, this may be a violation of the accounting concept of

A) materiality.

B) consistency.

C) prudence.

D) objectivity.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Counterbalancing errors are those that will be offset and that take longer than two periods to correct themselves.

B) False

Correct Answer

verified

False

Correct Answer

verified

True/False

One of the disclosure requirements for a change in accounting policy is to show the cumulative effect of the change on retained earnings as of the beginning of the earliest period presented.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The accounting for change in estimates differs between U.S.GAAP and IFRS.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Counterbalancing errors do not include

A) errors that correct themselves in two years.

B) errors that correct themselves in three years.

C) an understatement of purchases.

D) an overstatement of unearned revenue.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following statements are true regarding IASB's guideline that companies must demonstrate change in accounting policy as preferable or as an improvement, except

A) Diversity in situations and characteristics of the items encountered in practice require the use of professional judgment.

B) Changes in accounting policy are appropriate only when a company demonstrates that the newly adopted generally accepted accounting policy is more relevant and reliable than the existing one.

C) Changes in accounting policy are appropriate only when a company demonstrates an improved income tax effect alone.

D) All of these statements are true.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The IASB has declared, as part of its conceptual framework, that it will assess the merits of proposed standards

A) from a position of neutrality.

B) from a position of materiality.

C) based on the possible impact on behavior.

D) based on lobbyist arguments.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under IFRS, when a company prepares financial statements on a new basis, how many years of comparative data are reported?

A) One

B) Two

C) Three

D) Five

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When a company changes an accounting policy, it should report the change by reporting the cumulative effect of the change in the current year's income statement.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Accounting errors include changes in estimates that occur because a company acquires more experience, or as it obtains additional information.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Which of the following is true regarding whether IFRS specifically addresses the accounting and reporting for effects of changes in accounting policies?

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

The estimated life of a building that has been depreciated 30 years of an originally estimated life of 50 years has been revised to a remaining life of 10 years.Based on this information, the accountant should

A) continue to depreciate the building over the original 50-year life.

B) depreciate the remaining book value over the remaining life of the asset.

C) adjust accumulated depreciation to its appropriate balance, through net income, based on a 40-year life, and then depreciate the adjusted book value as though the estimated life had always been 40 years.

D) adjust accumulated depreciation to its appropriate balance through retained earnings, based on a 40-year life, and then depreciate the adjusted book value as though the estimated life had always been 40 years.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Retrospective application refers to the application of a different accounting policy to recast previously issued financial statements-as if the new policy had always been used.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

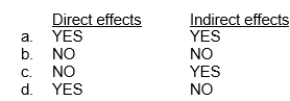

The IASB is silent on the application of the direct effects of a change in accounting policy.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) Changes in accounting policy are always handled in the current or prospective period.

B) Prior statements should be restated for changes in accounting estimates.

C) A change from expensing certain costs to capitalizing these costs due to a change in the period benefited, should be handled as a change in accounting estimate.

D) Correction of an error related to a prior period should be considered as an adjustment to current year net income.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 53

Related Exams